Key Takeaways

- Digital transformation and workforce optimization are expected to drive efficiency gains, cost savings, and support improved margins and earnings.

- Strong economic conditions and diversified lending should fuel loan growth, stable asset quality, and open new revenue streams through digital channels.

- Heavy reliance on the domestic market, high operational costs, regulatory risks, and compressed net interest margins threaten future revenue growth and long-term profitability.

Catalysts

About Israel Discount Bank- Provides various banking and financial services in Israel, Europe, and North America.

- Ongoing implementation of digital transformation and workflow automation projects (e.g., moving activities from branches to back office, use of AI in customer service) is expected to drive sustained efficiency gains, lower operating expenses, and improve net margins in upcoming quarters.

- Demographic and economic growth in Israel, highlighted by strong GDP rebound forecasts and a resilient low unemployment rate, is projected to fuel further demand for business lending and fee-based services, supporting healthy loan book expansion and revenue growth.

- Successful renegotiation of the collective labor agreement increases organizational flexibility and will allow workforce optimization, resulting in significant cost savings and supporting long-term improvement in the cost-to-income ratio, which should positively impact net margins and earnings.

- Expansion in corporate and middle-market lending, backed by strong credit growth in these segments and prudent risk management, is set to further diversify the loan portfolio and drive top-line revenue growth while maintaining high asset quality and stable provisions.

- Ongoing integration of digital channels-reflected in high customer satisfaction ratings for mobile and web platforms-positions the bank to capture younger, tech-savvy customers, opening new revenue streams and supporting higher fee and commission income.

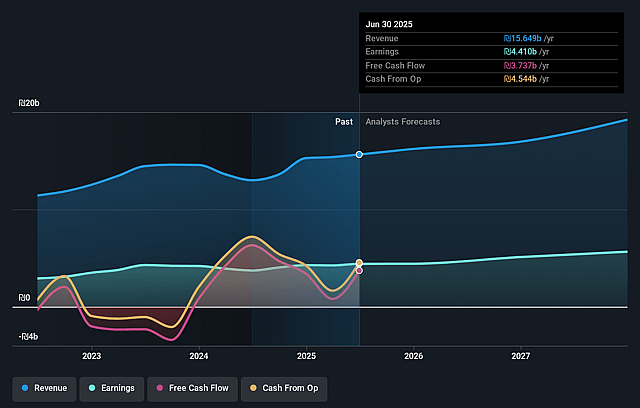

Israel Discount Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Israel Discount Bank's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 28.2% today to 30.6% in 3 years time.

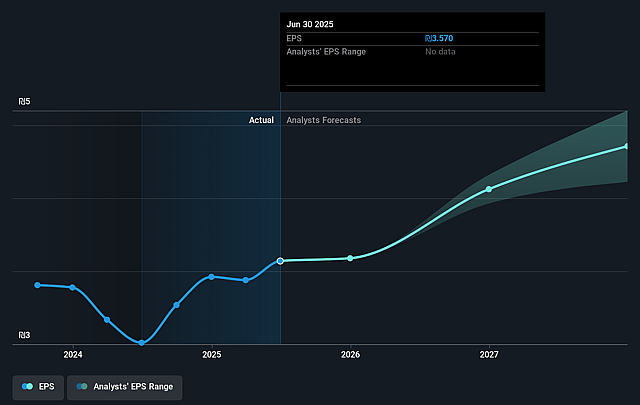

- Analysts expect earnings to reach ₪6.0 billion (and earnings per share of ₪4.36) by about September 2028, up from ₪4.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, up from 8.8x today. This future PE is greater than the current PE for the IL Banks industry at 9.6x.

- Analysts expect the number of shares outstanding to decline by 0.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.08%, as per the Simply Wall St company report.

Israel Discount Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing military conflict and regional geopolitical instability in Israel create uncertain macroeconomic conditions that could result in elevated risk premiums, potentially dampening foreign capital flows and increasing the bank's funding costs, which can negatively impact net interest margins and profitability.

- Discount Bank's loan growth strategy is heavily concentrated in the domestic Israeli market, with slower growth observed in retail and mortgage segments and stagnant household lending, leaving it vulnerable to domestic economic downturns or sector-specific shocks, which can adversely affect future revenue growth and loan book quality.

- The recent sale of CAL (credit card subsidiary) and the outcome of related legal and regulatory issues, such as the unfavorable VAT court ruling and provisioning for potential liabilities, introduce earnings volatility and remove a potential source of fee and commission income, thereby impacting non-interest revenue streams.

- Despite cost-saving initiatives and a new labor agreement, the bank continues to face high operational expenses due to legacy systems and dependence on unionized labor, which could constrain future improvements in net margins compared to more digitally agile banking competitors.

- Discount Bank's net interest margin (NIM) has experienced significant compression over the past year, primarily due to competition-driven declines in lending rates and the migration of non-interest-bearing deposits, which, if persistent, may reduce the bank's profitability and earnings sustainability over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ₪36.55 for Israel Discount Bank based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ₪19.5 billion, earnings will come to ₪6.0 billion, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 10.1%.

- Given the current share price of ₪31.74, the analyst price target of ₪36.55 is 13.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.