Key Takeaways

- Strategic mergers and acquisitions strengthen XL Axiata's market position and align with its convergence strategy to boost revenue from expanded broadband and subscriber base.

- Digitalization and cost optimization enhance profitability and user engagement, driving ARPU growth and positioning the company for future connectivity advancements.

- Intense price competition and regulatory uncertainties threaten XL Axiata's revenue growth, margins, and competitive advantage amid market and economic challenges.

Catalysts

About XL Axiata- Provides telecommunication, telecommunications network, and multimedia services for consumers and businesses in Indonesia.

- XL Axiata's strategic merger with Smartfren is expected to create significant synergies by expanding the subscriber base and enhancing network infrastructure. This merger could lead to increased market share, potentially driving revenue growth in the coming years.

- The acquisition of fixed broadband customers from Link Net and the integration of First Media into XL Axiata's ecosystem positions the company as a leading ISP in Indonesia. This strategic move reinforces its convergence strategy, likely boosting future revenue by expanding the fixed broadband segment.

- Digitalization and personalization through the MyXL and AXISNet applications have increased subscriber engagement, with over 56% of users engaging on these platforms. This digital focus is driving increased ARPU and revenue growth from app channels, which should support sustained future revenue streams.

- Cost optimization initiatives, such as improved sales and marketing efficiencies and network infrastructure cost reductions, have led to a 3 percentage point expansion in EBITDA margin and a 45% increase in profit after tax. These ongoing efficiency measures are likely to enhance net margins and profitability moving forward.

- The fiberization of 63% of XL Axiata's sites and strategic initiatives aimed at network optimization and capacity enhancement lay a strong foundation for future connectivity upgrades, such as 5G. These technological advancements can provide long-term revenue growth opportunities through improved service offerings and customer experience.

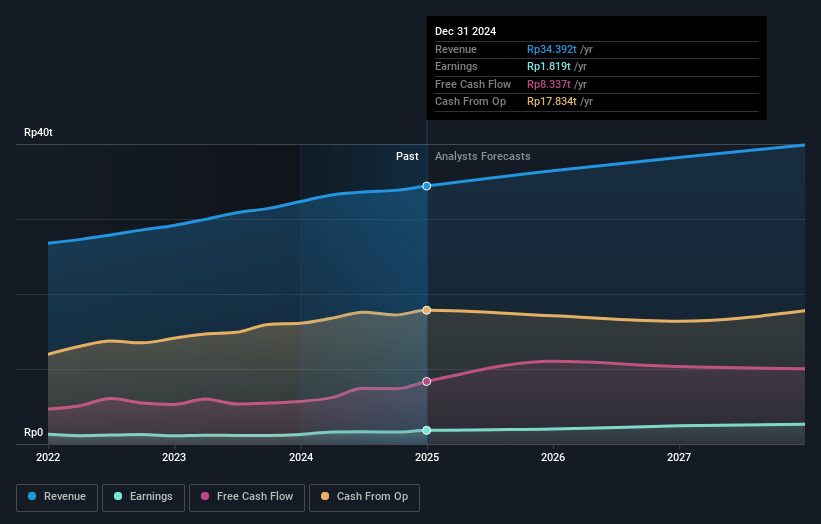

XL Axiata Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming XLSMART Telecom Sejahtera's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 7.1% in 3 years time.

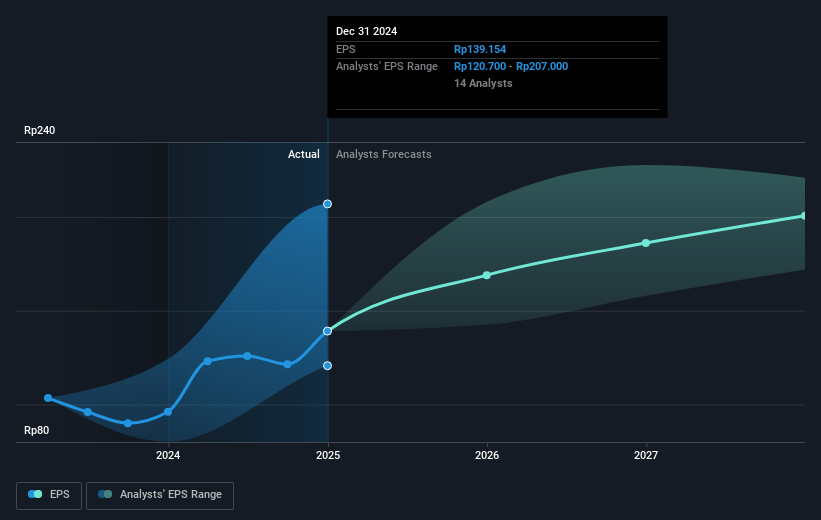

- Analysts expect earnings to reach IDR 2810.2 billion (and earnings per share of IDR 200.66) by about May 2028, up from IDR 1819.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting IDR3518.0 billion in earnings, and the most bearish expecting IDR2261.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.1x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the ID Wireless Telecom industry at 17.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.03%, as per the Simply Wall St company report.

XL Axiata Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense price competition in the fixed broadband and mobile sectors, with aggressive undercutting by incumbents and new entrants offering unsustainably low prices, could lead to pressure on revenue and margins for XL Axiata.

- The uncertainty surrounding the completion of the merger with Smartfren and the possible requirement to return spectrum could impact network expansion and competitive advantage, affecting future earnings potential.

- Continued aggressive pricing strategies from competitors, particularly in the mobile segment, may challenge XL Axiata's ability to increase ARPU and could adversely impact revenue growth.

- The unclear regulatory environment regarding spectrum allocation and pricing, including the introduction of the 1.4 GHz spectrum for fixed wireless, adds potential cost and competitive risks that could affect profitability.

- Economic factors such as weak purchasing power and increased competition from Wi-Fi providers could limit growth in customer spending and subscriber additions, potentially hindering revenue growth and net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR2904.5 for XLSMART Telecom Sejahtera based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of IDR5000.0, and the most bearish reporting a price target of just IDR2070.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be IDR39604.9 billion, earnings will come to IDR2810.2 billion, and it would be trading on a PE ratio of 27.1x, assuming you use a discount rate of 13.0%.

- Given the current share price of IDR2150.0, the analyst price target of IDR2904.5 is 26.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.