Key Takeaways

- Strategic growth initiatives, including partnerships and ecosystem expansions, aim to bolster revenue across key banking segments and enhance customer acquisitions.

- Investments in digital transformation and improved loan risk metrics indicate potential for increased revenue, operational efficiency, and strong future earnings.

- Pressure on Net Interest Margin from lending and funding gaps, along with economic challenges, poses risks to revenue, profit stability, and overall financial performance.

Catalysts

About Bank Danamon Indonesia- Provides banking services for retail, small and medium enterprises (SMEs), and corporate customers in Indonesia.

- Bank Danamon's three-year midterm business plan aims to grow the company as a financial group, driving revenue by including multifinance partners such as Adira Finance, with a focus on four key segments: enterprise banking, SME banking, consumer banking, and partnerships with non-bank partners like Zurich Insurance.

- The expansion into targeted ecosystems, including automotive, real estate, Hajj and Umrah, and education sectors, shows promise for revenue growth. The 213% year-on-year growth in customer acquisitions from the Hajj and Umrah ecosystem can significantly impact funding and fee-based income.

- Enhancing the MUFG value proposition through synergy loans with MUFG and Adira Finance has already shown a 13% growth. Continuous collaboration efforts, such as joint events and synergy deals in the automotive segment, could enhance revenue and CASA, positively impacting net margins and earnings.

- Investments in digital transformation, including the D-Bank PRO mobile banking application and Danamon Cash Connect, have led to increased customer engagement and double-digit transaction growth. These enhancements are likely to improve revenue and operational efficiency.

- Despite a decrease in NPAT due to increased operational expenses and credit costs, the significant increase in NPL coverage to 287% and improvements in loan risk metrics suggest a stronger balance sheet that could support future earnings growth as the cost of credit stabilizes.

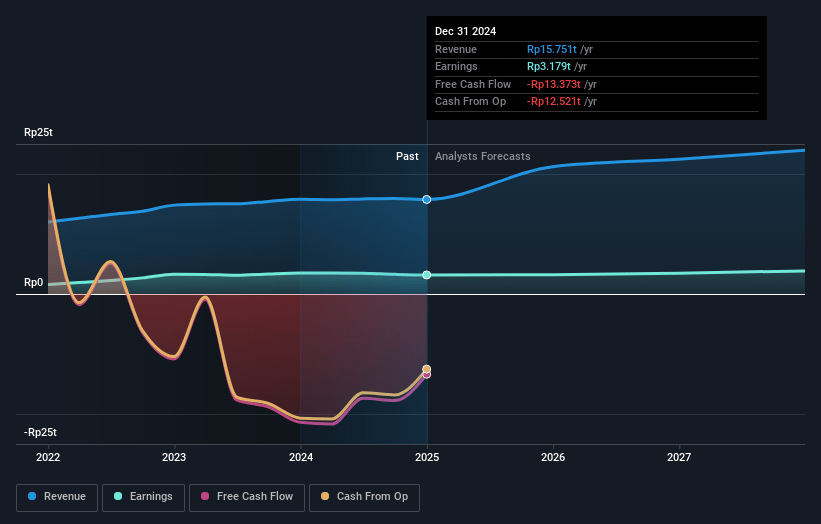

Bank Danamon Indonesia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bank Danamon Indonesia's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 20.2% today to 16.1% in 3 years time.

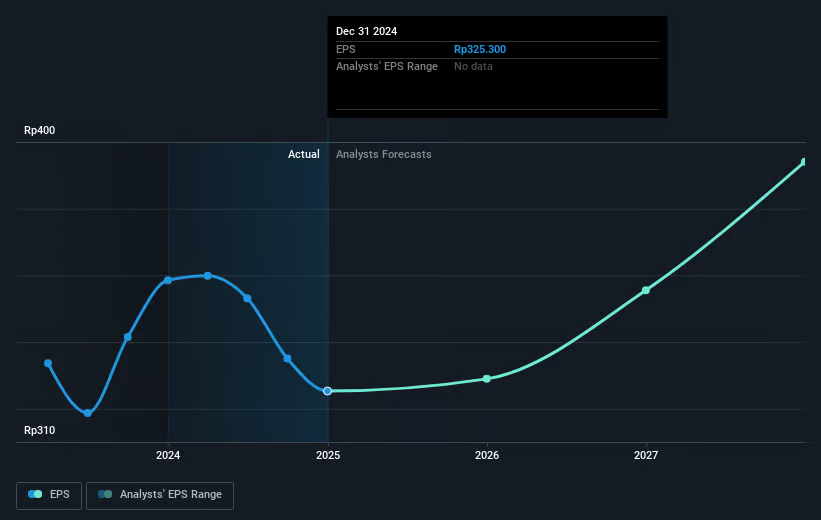

- Analysts expect earnings to reach IDR 3852.0 billion (and earnings per share of IDR 394.11) by about May 2028, up from IDR 3179.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, up from 7.4x today. This future PE is lower than the current PE for the ID Banks industry at 19.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 13.67%, as per the Simply Wall St company report.

Bank Danamon Indonesia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Mounting pressure on the banking Net Interest Margin (NIM) due to a gap between lending and funding growth, as well as uncertainty and higher inflation expectations impacting U.S. dollar interest rates, could potentially suppress revenue and net interest income.

- Multifinance areas, especially in the 4-wheelers sector, experienced significant decline during the first half of the previous year. Although recovery was observed particularly in the 2-wheelers segment, existing weaknesses in such key market areas could impact the bank's overall revenue and margin performance moving forward.

- The 9% year-on-year decrease in Net Profit After Tax (NPAT), attributed to increased operational expenses (OpEx) and credit costs, presents a concern for future earnings stability. Further increases in these factors could put additional pressure on the bank's net margins.

- Decline in Current Account Savings Account (CASA) deposits by 13% due to a shift to higher-rate alternatives like Term Deposits (TD) and wealth management products under a high interest rate environment, could impact funding costs and subsequently, net margins.

- Adira Finance, a subsidiary of Bank Danamon, saw a 12% decline in new financing due to a weakening automotive sector and challenging economic conditions. Continued economic uncertainties and potential sluggish growth in this segment could impact loan portfolio growth and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of IDR2750.0 for Bank Danamon Indonesia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be IDR23949.0 billion, earnings will come to IDR3852.0 billion, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 13.7%.

- Given the current share price of IDR2410.0, the analyst price target of IDR2750.0 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.