Last Update 25 Sep 25

Fair value Increased 1.17%China Mobile’s consensus price target was only slightly raised, as a higher future P/E multiple was offset by lower revenue growth expectations.

What's in the News

- China Mobile announced an interim cash dividend of HKD 2.75 per share for the first half of 2025, payable on 17 September.

- Board meeting held to discuss interim results and consider payment of the interim dividend.

Valuation Changes

Summary of Valuation Changes for China Mobile

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from HK$100.97 to HK$102.15.

- The Future P/E for China Mobile has significantly risen from 15.61x to 17.25x.

- The Consensus Revenue Growth forecasts for China Mobile has fallen from 3.2% per annum to 3.0% per annum.

Key Takeaways

- Rapid expansion in digital and AI-driven services, alongside leadership in next-gen networks, positions the company for higher-margin growth and broader market opportunities.

- Focus on cloud, operational efficiency, and shareholder payouts supports resilient earnings and enhances overall returns.

- Saturated domestic demand, intense competition, high transformation costs, and macroeconomic and regulatory challenges threaten sustainable growth, profitability, and successful diversification.

Catalysts

About China Mobile- Provides telecommunications and information related services in Mainland China and Hong Kong.

- Strong expansion in digital transformation and AI-powered products, as evidenced by nearly 10% year-on-year growth in digital transformation revenues and significant growth in AI+ applications, positions China Mobile to capture rising enterprise and sector demand for intelligent and connected solutions-likely supporting faster revenue and higher-margin growth versus legacy telecom services.

- Ongoing rollout and upgrades of 5G/5G-A and imminent preparation for 6G infrastructure, backed by sustained government support and industry leadership in standards and patents, secures China Mobile's lead in next-generation network services and new connectivity use cases-supporting long-term ARPU expansion and an increase in addressable markets.

- The pivot towards cloud computing, data centers (China Mobile Cloud revenue up over 20% YoY), and value-added digital ecosystem offerings (e.g., video, fintech, smart home) is increasing the share of recurring, higher-margin service revenues and cross-sell opportunities, directly improving net margins and underpinning future earnings resilience.

- Steadily declining CapEx-to-revenue ratio (expected to fall further in 2025) and emphasis on operational efficiency, precise management, and platformization are enabling better cost control and higher EBITDA margins, translating into improved free cash flow and sustained profit growth.

- Commitment to increasing dividend payout ratio above 75% over the next three years, underpinned by robust free cash flow growth and stable balance sheet, suggests upside potential for total shareholder returns as financial performance benefits from these long-term growth catalysts.

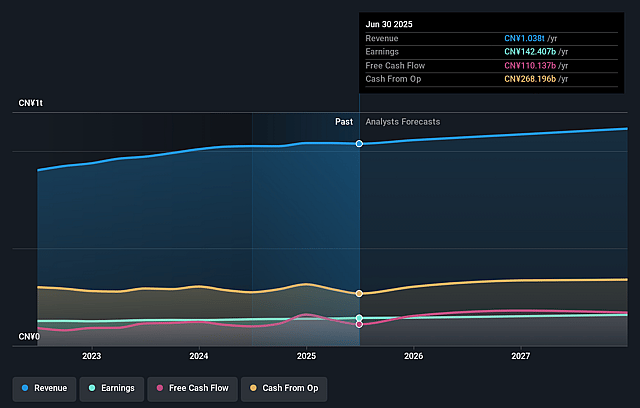

China Mobile Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming China Mobile's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.7% today to 14.1% in 3 years time.

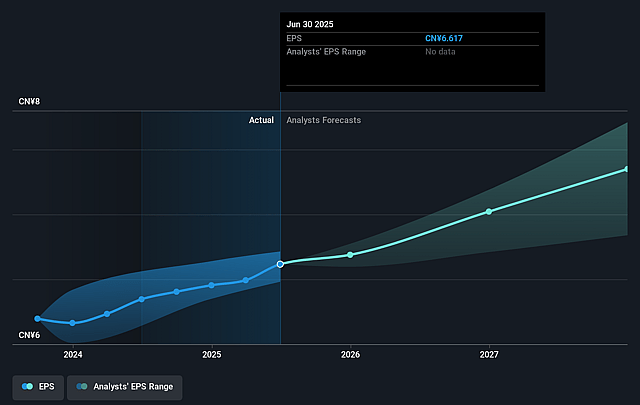

- Analysts expect earnings to reach CN¥160.9 billion (and earnings per share of CN¥7.5) by about September 2028, up from CN¥142.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from 11.9x today. This future PE is lower than the current PE for the US Wireless Telecom industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.89%, as per the Simply Wall St company report.

China Mobile Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying homogenous competition within the traditional telecom industry, coupled with cross-disciplinary entrants, may exert downward pressure on pricing and ARPU, limiting overall revenue growth and long-term earnings potential.

- Management notes that traditional communications demand is becoming saturated, suggesting that core connectivity and mobile subscriber growth rates may plateau, making it difficult to sustain historical revenue and profit growth rates.

- Rapid business transformation toward digital, AI, and emerging markets requires ongoing significant capital expenditure and increased operating expenses, which, if not matched by sufficiently profitable growth, could compress net margins and constrain free cash flow available for dividends or reinvestment.

- Heightened macroeconomic uncertainties, including weak effective demand, fragile recovery, and consumption weakness in China, could lead to reduced customer spending on new telecom and digital services, potentially dampening both top-line revenue and earnings growth.

- Increasing complexity in international expansion and escalating costs in international business settlement, together with potential regulatory headwinds, could limit China Mobile's ability to diversify revenue streams and negatively impact net profit through rising compliance costs and operational risks.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$100.97 for China Mobile based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$114.58, and the most bearish reporting a price target of just HK$81.96.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥1141.0 billion, earnings will come to CN¥160.9 billion, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 6.9%.

- Given the current share price of HK$85.7, the analyst price target of HK$100.97 is 15.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.