Key Takeaways

- Partnerships with major digital players and the premium subscription tier are expected to drive user base growth and increase subscription revenue and ARPU.

- Event business expansion and content initiatives in Southeast Asia could significantly boost revenue and profitability through higher subscriber acquisition and advertising.

- Soft retail markets and increased expenses challenge PCCW's revenue growth and net margins, with potential financial impact from reliance on HKT dividends.

Catalysts

About PCCW- Provides telecommunications and related services in Hong Kong, Mainland and other parts of China, Singapore, and internationally.

- PCCW's strategic expansion with partnerships involving leading digital players like Grab, Trip.com, and Zalora is expected to broaden its user base and boost subscription revenue and ARPU across its OTT platform, impacting future revenue growth.

- The company's introduction of a premium plus subscription tier aims to enhance ARPU by offering consumers exclusive access to content, which is likely to drive higher subscription revenue and improve overall profitability.

- As demand for live events rebounds, PCCW's artiste management and event business has demonstrated success, doubling concert revenues. The continuation and expansion of such events, particularly into international markets, could significantly increase revenue and enhance net earnings.

- PCCW's commitment to content expansion, particularly Chinese content, along with its Viu Originals, should capitalize on rising content consumption trends in Southeast Asia, potentially boosting subscriber acquisition and advertising revenue.

- Cost optimization measures, such as AI automation and platform rationalization, are helping improve operating efficiencies and margins, which could lead to better net earnings as revenue streams continue to develop.

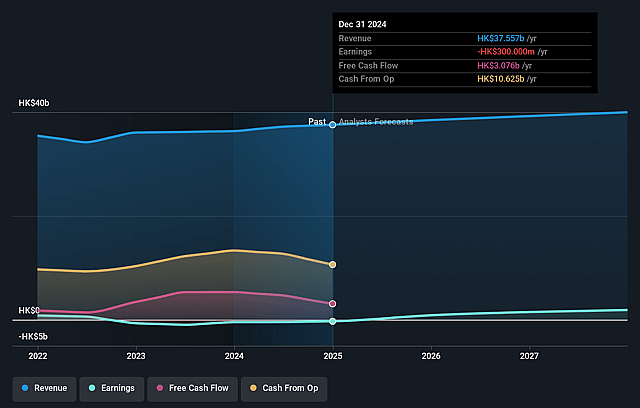

PCCW Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PCCW's revenue will grow by 2.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.8% today to 4.7% in 3 years time.

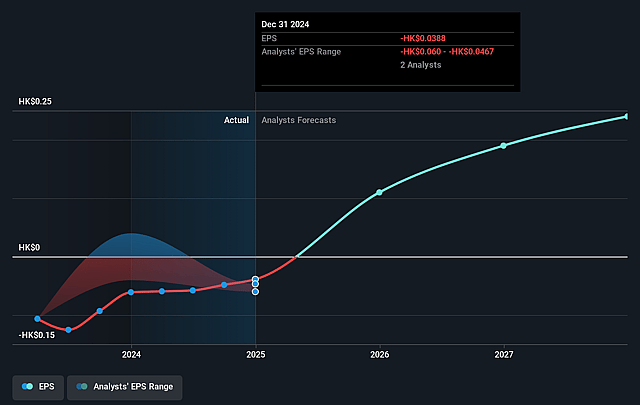

- Analysts expect earnings to reach HK$1.9 billion (and earnings per share of HK$0.24) by about July 2028, up from HK$-300.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.5x on those 2028 earnings, up from -146.4x today. This future PE is greater than the current PE for the HK Telecom industry at 14.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.99%, as per the Simply Wall St company report.

PCCW Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The subdued retail backdrop in Hong Kong and relatively softer advertising spend can impact revenue growth, particularly in the Free TV and entertainment segment.

- PCCW's core growth in Viu was diluted by lower content syndication and event revenues in the second half of the year, which could affect overall earnings.

- Increased operational expenses driven by higher publicity and promotion costs in the OTT business might pressure net margins despite revenue growth.

- The economic and retail environments in Hong Kong could impact the company’s advertising revenue and net margins if they remain sluggish.

- Despite stable revenues, the reliance on HKT for dividend income means any performance issues at HKT could impact PCCW's earnings and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$5.3 for PCCW based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$40.0 billion, earnings will come to HK$1.9 billion, and it would be trading on a PE ratio of 26.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of HK$5.68, the analyst price target of HK$5.3 is 7.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.