Last Update 19 Aug 25

Fair value Increased 19%Despite a reduction in consensus revenue growth forecasts, CITIC Telecom International Holdings’ valuation has expanded, as reflected in a higher Future P/E, driving a notable increase in the consensus analyst price target from HK$2.60 to HK$3.10.

What's in the News

- Board meeting scheduled to approve interim results for the first half of 2025 and consider the declaration of an interim dividend.

- Mr. Wu Jun appointed as Chief Executive Officer, bringing significant experience in banking technology and business innovation.

- Messrs. KPMG appointed as auditor until the next annual general meeting, with remuneration to be set by the Board.

Valuation Changes

Summary of Valuation Changes for CITIC Telecom International Holdings

- The Consensus Analyst Price Target has significantly risen from HK$2.60 to HK$3.10.

- The Future P/E for CITIC Telecom International Holdings has significantly risen from 10.36x to 13.91x.

- The Consensus Revenue Growth forecasts for CITIC Telecom International Holdings has significantly fallen from 5.7% per annum to 4.2% per annum.

Key Takeaways

- Expansion in cloud, AI, and data center services positions CITIC Telecom to benefit from digitalization trends, supporting recurring revenue and profitability growth.

- Strategic network upgrades and partnerships strengthen regional presence, enabling capture of rising demand for enterprise connectivity and cross-border digital services in emerging Asian markets.

- Declining revenues, intense competition, and innovation investment challenges threaten sustainable profit growth and long-term returns for CITIC Telecom International Holdings.

Catalysts

About CITIC Telecom International Holdings- An investment holding company, engages in the provision of international telecommunications services in Hong Kong, China, Macau, Singapore, and internationally.

- The rapid growth in data consumption, cloud computing, and AI-driven applications is driving increased demand for high-capacity, secure, and reliable telecom infrastructure. CITIC Telecom is actively expanding its cloud, AI, and data center capabilities (highlighted by the development of 10-gigabit broadband, F5.5G services, and AI-powered enterprise offerings), which is expected to support higher recurring revenues and margin expansion as enterprises require more integrated digital solutions.

- Cross-border commerce in Asia and the ongoing support of initiatives like the Belt and Road are boosting demand for international connectivity and managed enterprise services. CITIC Telecom is strengthening its regional presence through network upgrades (Southeast Asia, Hong Kong/Mainland China), strategic partnerships, and expanded international project wins-positioning itself to capture future top-line growth from emerging markets and increased network interconnection volumes.

- The company's accelerated investment in digital transformation-deploying automation, AI-enhanced customer service, and workflow optimization internally-is anticipated to drive improved operational efficiencies and cost reductions, supporting long-term improvements to net margins and overall profitability.

- The successful migration of legacy networks (completion of 3G retirement and focus on migrating customers to 5G/5.5G) is expected to lead to better spectrum utilization and reduced maintenance costs, freeing up resources for next-gen services and enhancing return on capital and future net income.

- CITIC Telecom's ongoing integration and cross-selling of advanced ICT and security offerings across CITIC Group's ecosystem, along with proactive R&D in AI and network security, is likely to strengthen recurring enterprise business and elevate average revenue per user (ARPU), driving sustained earnings growth.

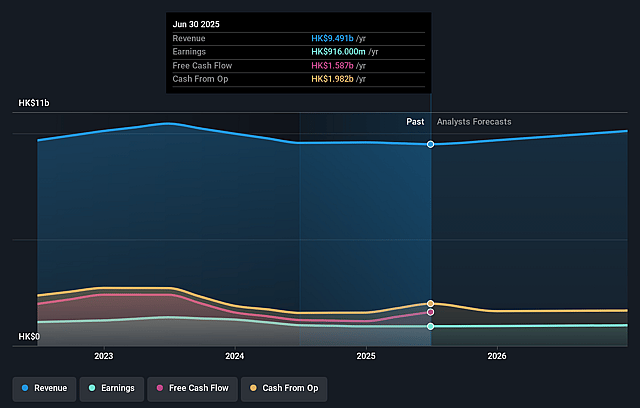

CITIC Telecom International Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CITIC Telecom International Holdings's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.7% today to 9.3% in 3 years time.

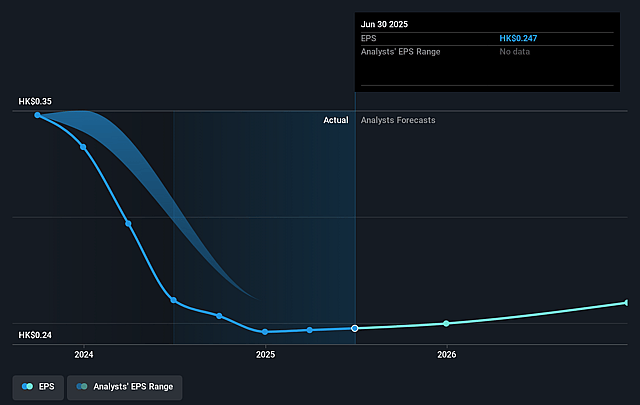

- Analysts expect earnings to reach HK$1.0 billion (and earnings per share of HK$0.27) by about September 2028, up from HK$916.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 10.3x today. This future PE is lower than the current PE for the HK Telecom industry at 14.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.77%, as per the Simply Wall St company report.

CITIC Telecom International Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- CITIC Telecom's enterprise solutions segment, especially in key international markets like Singapore, experienced significant year-on-year revenue decline (over 50%), reflecting execution risks and heightened "red ocean" competition; sustained weakness here is likely to exert pressure on group revenue and net profit in the mid/long term.

- Management acknowledged a global, irreversible secular decline in traditional fixed-line business, which experienced another 7.4% drop in H1 2025; this ongoing erosion structurally lowers recurring revenues and puts continued pressure on overall revenue growth rates and operating margins.

- Group total revenue continues to drop (down 1.7% YoY in H1 2025, following a larger prior-period decline), with profit growth derived mainly from cost management and financing structure adjustments rather than operating momentum-raising concerns about future earnings sustainability if top-line performance does not recover.

- There is explicit recognition of intense, escalating competition in core segments (enterprise solutions, international telecom, mobile), described as "red ocean," where global and regional players are aggressively deploying similar AI, cloud, and digital offerings-this increases margin pressure and the risk of market share loss, likely impacting net margins and earnings consistency.

- Despite expanding into Southeast Asia and developing new AI/cloud products, the company's ability to capture long-term growth may be hindered by potentially inadequate or inconsistent innovation investment, as management has to balance rising CapEx needs (AI, 5G, data centers) against volatile revenue streams-this could negatively affect free cash flow and returns on capital if topline growth fails to support ongoing investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$3.1 for CITIC Telecom International Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be HK$10.8 billion, earnings will come to HK$1.0 billion, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of HK$2.54, the analyst price target of HK$3.1 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CITIC Telecom International Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.