Key Takeaways

- Xiaomi's successful premiumization strategy and international expansion efforts indicate strong potential for future revenue growth and improved profitability across its market segments.

- Diversification in home appliances, IoT, and the automobile sector, along with strategic offline retail expansion, suggests increased brand visibility and earnings potential.

- Xiaomi faces potential risks due to intense competition in home appliances, heavy R&D investment in automobiles, geopolitical tensions, market saturation, and high retail costs.

Catalysts

About Xiaomi- An investment holding company, provides hardware and software services in Mainland China and internationally.

- Xiaomi's premiumization strategy in the handset market has shown strong results, with increased market share and successful sales of the Xiaomi 15 series, suggesting future potential for revenue growth and improved net margins due to higher price points.

- The expansion of Xiaomi's home appliance and IoT business with strong growth in sales and gross margins indicates potential for further revenue growth and enhanced profitability through innovation and market differentiation.

- Xiaomi's international market expansion, as evidenced by their growing presence in 52 countries and the success of their localized operations, implies future revenue growth and increased global market share.

- The development and scaling of Xiaomi's automobile business, reflected in increasing delivery volumes and enhanced gross margins, suggests potential for significant revenue diversification and improved earnings.

- Xiaomi's investment in offline retail expansion and the synergy between their handset, IoT, and automobile businesses could drive enhanced brand visibility and sales growth, contributing to future revenue and earnings expansion.

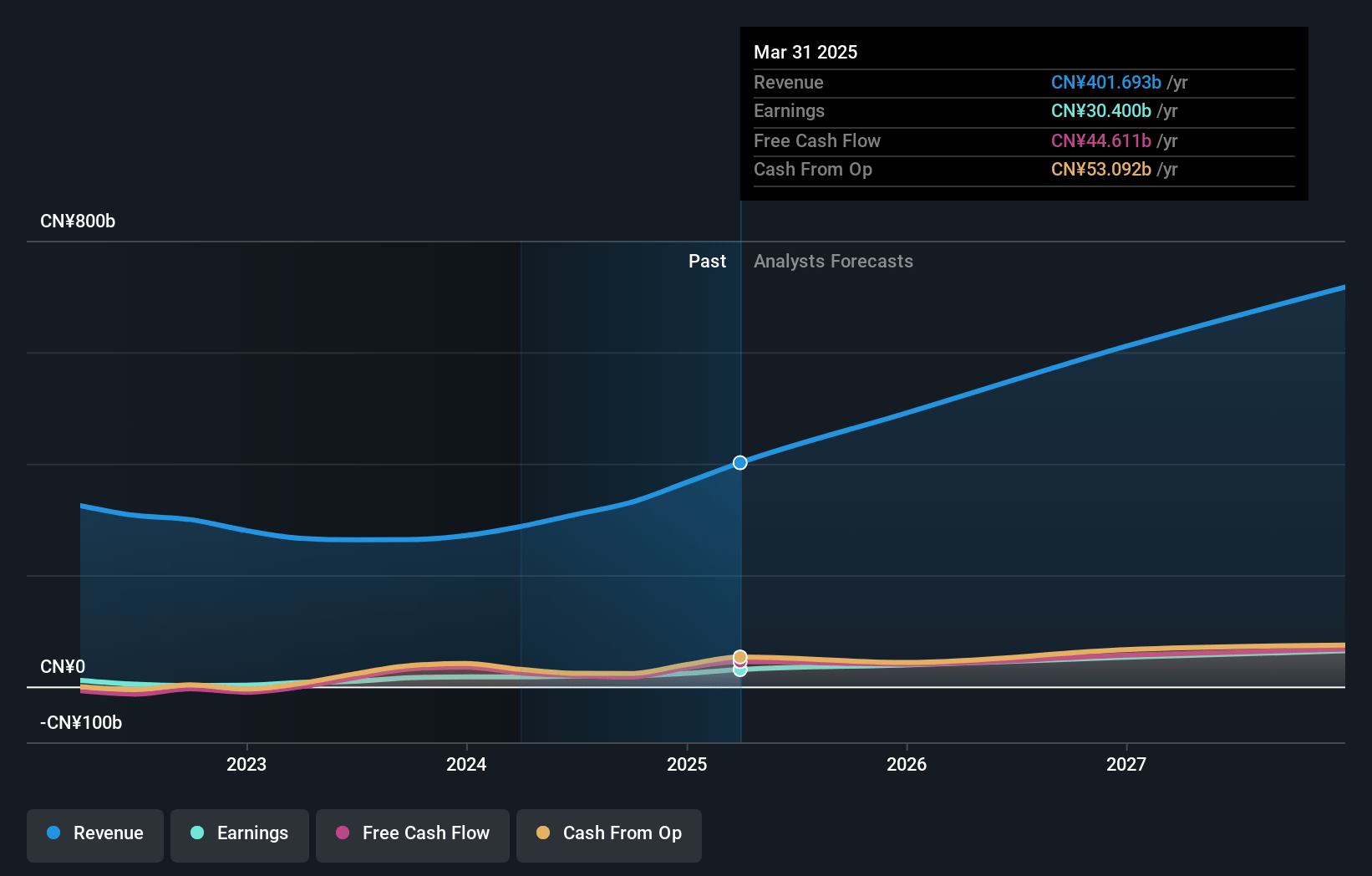

Xiaomi Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Xiaomi's revenue will grow by 18.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.9% today to 7.6% in 3 years time.

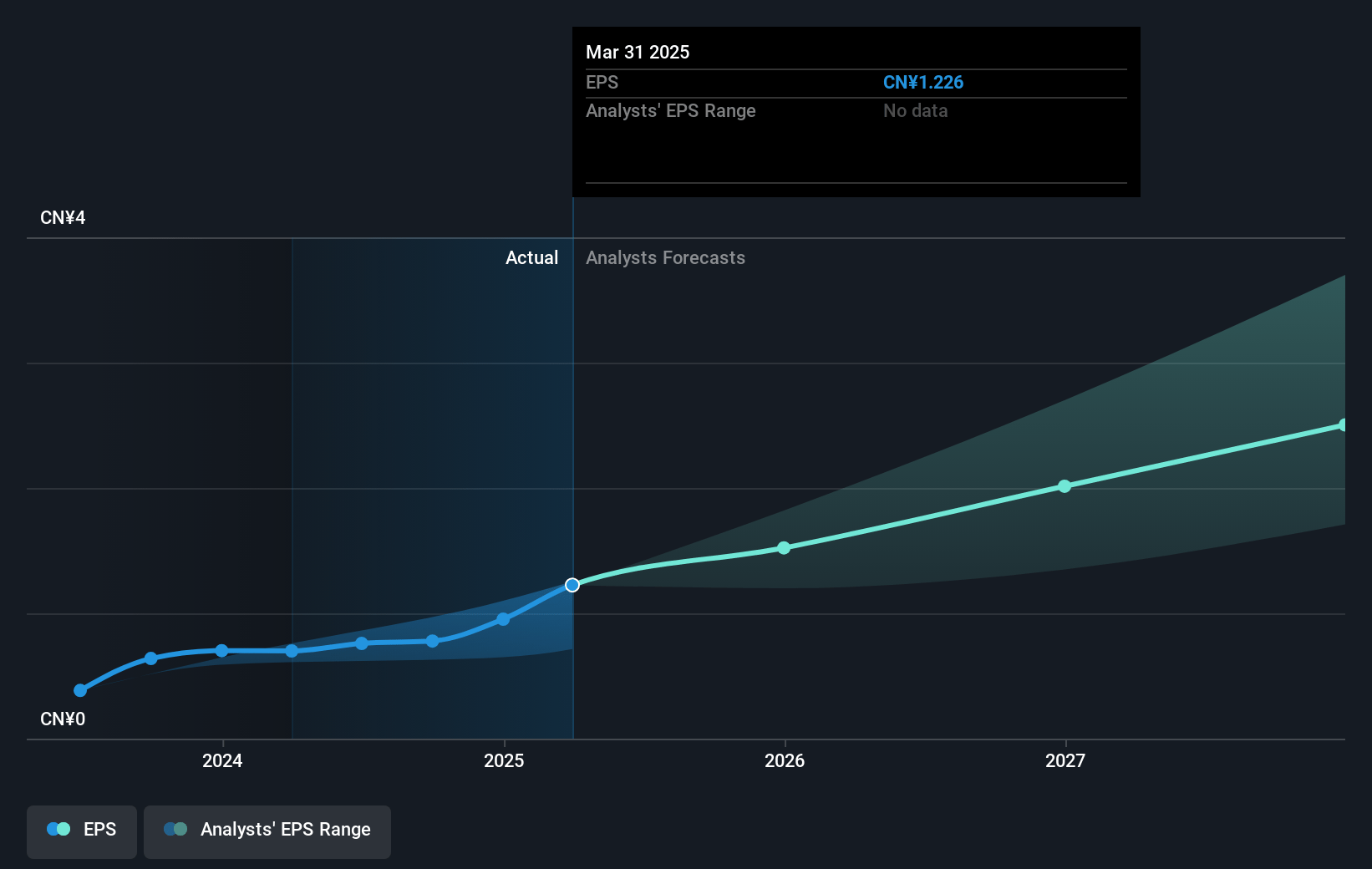

- Analysts expect earnings to reach CN¥41.7 billion (and earnings per share of CN¥1.65) by about January 2028, up from CN¥19.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥51.2 billion in earnings, and the most bearish expecting CN¥20.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, down from 42.6x today. This future PE is greater than the current PE for the HK Tech industry at 12.7x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.99%, as per the Simply Wall St company report.

Xiaomi Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite Xiaomi's strong performance in the home appliance sector, the traditional nature of these products could lead to intense competition, potentially putting pressure on revenue and margins as other companies might enter the market with similar innovations, thus impacting long-term earnings.

- The automobile business, although growing rapidly, is still in its early stages and requires heavy investment in R&D and production capabilities, which could affect net profit margins if economies of scale are not achieved as quickly as anticipated.

- Global expansion and premiumization strategies, while promising, pose potential risks related to geopolitical tensions and trade barriers, which could hinder revenue growth in overseas markets and affect overall profitability.

- Xiaomi's reliance on premiumization of its handsets and the wider distribution network for IoT and smart devices present risks, as market saturation or shifts in consumer preferences might affect revenue growth, putting pressure on sustained earnings improvements.

- The substantial growth in physical retail outlets, although strategically beneficial, entails significant fixed costs and investment in infrastructure, which could reduce net margins if sales do not meet projections or if market conditions change unfavorably.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$33.0 for Xiaomi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$43.06, and the most bearish reporting a price target of just HK$20.95.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥546.9 billion, earnings will come to CN¥41.7 billion, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of HK$35.3, the analyst's price target of HK$33.0 is 7.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

PA

Panayiotis

Community Contributor

Xiaomi to Surge with 15% Revenue Growth and IoT Expansion

Catalysts Xiaomi's growth and success can be attributed to several strategic catalysts, which can be categorized as follows: 1. Disruptive Pricing and Value Proposition High-Spec, Low-Cost Smartphones : Xiaomi disrupted markets by offering feature-rich devices at competitive prices, undercutting rivals like Samsung and Apple.

View narrativeHK$51.83

FV

0.3% undervalued intrinsic discount15.00%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

1users have followed this narrative

3 days ago author updated this narrative