Key Takeaways

- Expansion in global markets, technology upgrades, and industry partnerships are set to drive stronger growth, improved margins, and long-term earnings stability.

- Increased outsourcing trends and customer diversification protect against risk and create reliable revenue streams for future financial performance.

- Expansion into Western markets, aggressive pricing, and reliance on milestone payments elevate risk, while heavy investment and reduced Legend Biotech consolidation threaten profitability and stability.

Catalysts

About Genscript Biotech- An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, Mainland China, Europe, Asia Pacific, and internationally.

- Strong rebound and sustained growth in the global demand for biologics, cell & gene therapies, and protein engineering-including AI-driven applications-are expected to drive higher future service volumes and revenue growth for Genscript, particularly in its Life Sciences and CDMO segments.

- Rising R&D spending among pharmaceutical and biotech companies, along with an expanding customer base outside of China (notably in Europe and the U.S.), positions Genscript to benefit from ongoing industry outsourcing trends, supporting stable order pipelines and revenue visibility.

- Expansion and integration of proprietary technology platforms, automation, and intelligent production systems are enabling significant cost savings and higher delivery speed, supporting both increased market share and future improvements in gross and net margins as efficiency gains compound.

- Genscript's aggressive global capacity expansion (notably in the U.S., Singapore, and European markets) and diversified revenue streams (including Bestzyme and the LaNova licensing payments) are expected to improve scale, mitigate geopolitical risk, and support further revenue and earnings growth.

- Enhanced long-term licensing and milestone revenue potential through deals like the LaNova-Merck collaboration and continued innovation in synthetic biology and CDMO pipelines position Genscript for sustained cash flow generation and long-term earnings accretion.

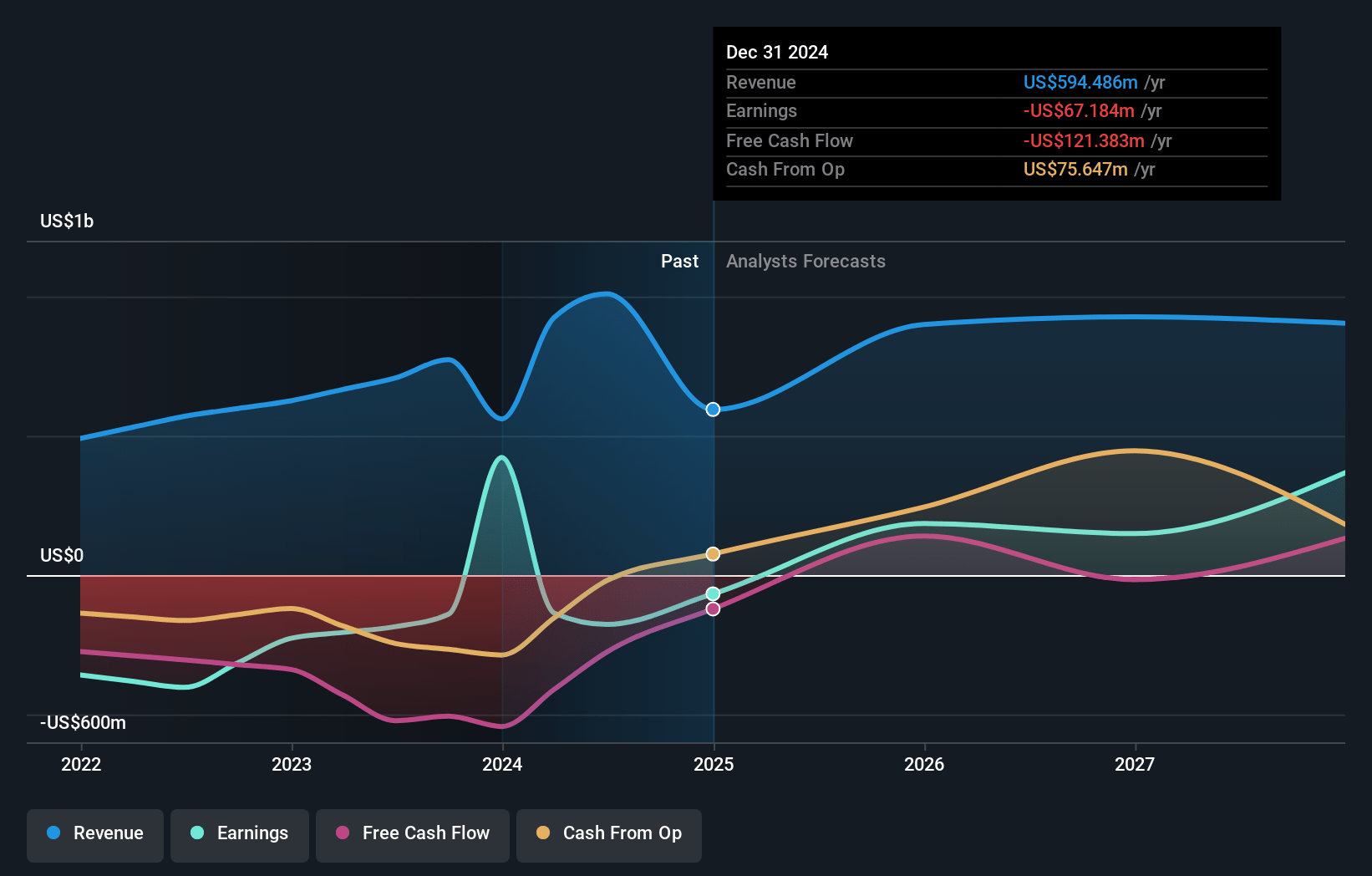

Genscript Biotech Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Genscript Biotech's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.3% today to 40.7% in 3 years time.

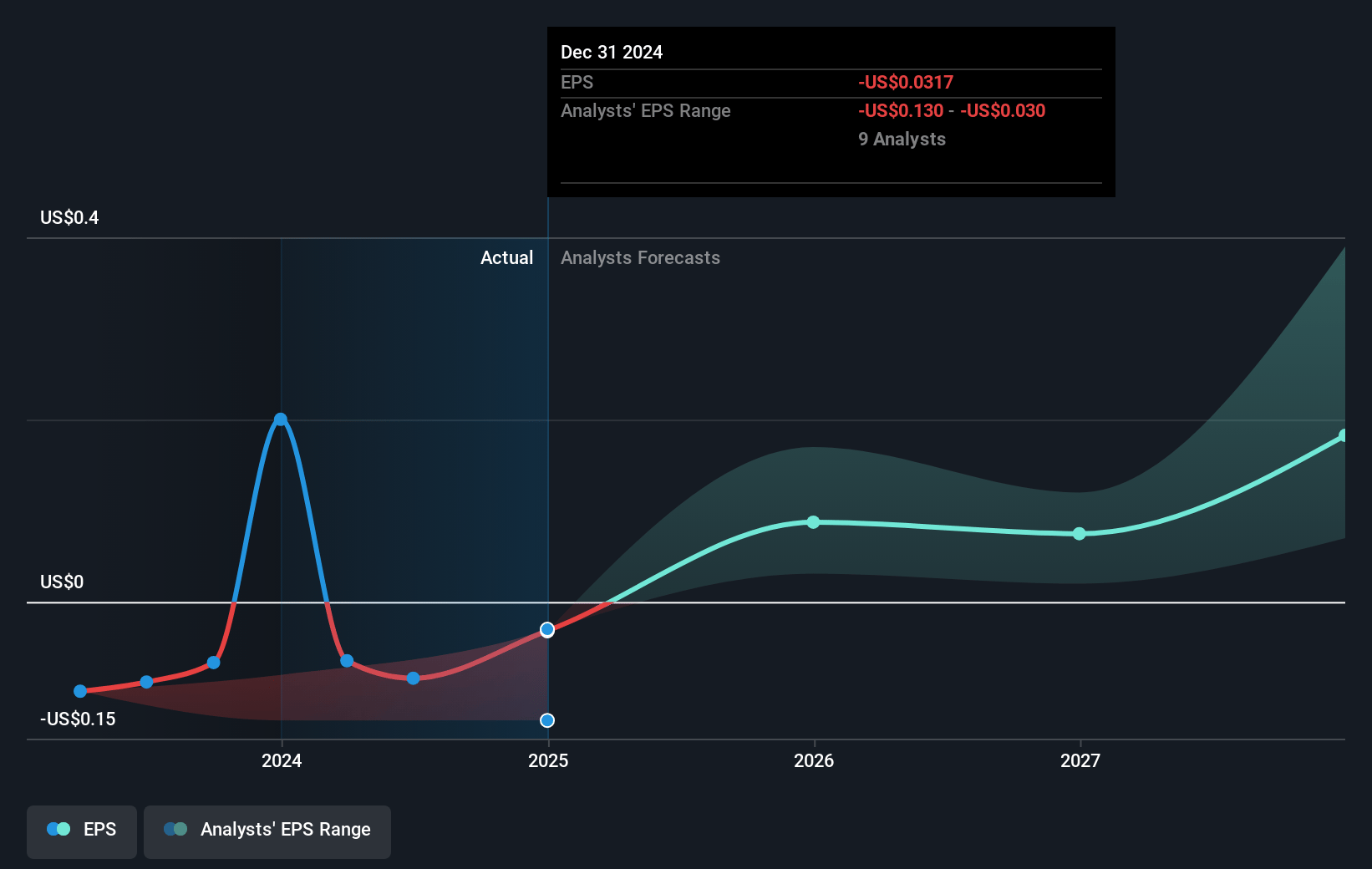

- Analysts expect earnings to reach $367.9 million (and earnings per share of $0.18) by about July 2028, up from $-67.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $849.7 million in earnings, and the most bearish expecting $151 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from -68.8x today. This future PE is lower than the current PE for the HK Life Sciences industry at 50.2x.

- Analysts expect the number of shares outstanding to grow by 1.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.63%, as per the Simply Wall St company report.

Genscript Biotech Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expansion outside China, especially into the US and Europe, exposes Genscript to heightened geopolitical risks, including tariffs and trade restrictions, which could limit global market access, disrupt operations, and create revenue volatility.

- Aggressive pricing strategies in key business segments to gain market share (e.g., offering services at 50% below market price and 3x cost savings) suggest ongoing and intensifying global competition that could drive long-term gross margin compression, impacting net earnings growth.

- Heavy CapEx and ongoing R&D investments, particularly in new facilities and expanding capacity (e.g., new Bestzyme plant, expanded US/Singapore presence), risk outpacing near-term demand if market conditions weaken, thus depressing return on investment and constraining free cash flow.

- Continued dependence on one-time and milestone payments (e.g., LaNova/Merck deal) and licensing revenues introduces volatility; if such deals do not recur or expected milestones are missed, recurring revenues and operating income could weaken.

- The loss of consolidation of Legend Biotech reduces Genscript's reported operating scale and introduces potential variability and downside risk to equity income, as Legend's future performance-especially in CAR-T-faces regulatory uncertainty and increasing industry competition, which may negatively impact Genscript's net profits.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$21.609 for Genscript Biotech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$27.34, and the most bearish reporting a price target of just HK$16.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $904.1 million, earnings will come to $367.9 million, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 7.6%.

- Given the current share price of HK$16.64, the analyst price target of HK$21.61 is 23.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.