Last Update 11 Dec 25

Fair value Increased 0.64%2899: Lithium Project Ramp Will Drive Long Term Upside Potential

Analysts have slightly raised their price target on Zijin Mining Group to reflect modestly stronger long term revenue growth expectations and a marginally higher valuation multiple, lifting fair value from RMB 37.22 to RMB 37.46 per share, despite a small downward tweak to forecast profit margins.

What's in the News

- Start of production at the Tres Quebradas lithium project in Catamarca, Argentina, positioning Zijin as a growing player in the global battery supply chain, with Phase 1 targeting 20,000 tonnes per annum of lithium carbonate equivalent and a planned expansion to 60,000 to 80,000 tonnes per annum across both phases (Lithium Royalty Corp. press release).

- An extraordinary general meeting on November 28, 2025 approved amendments to the Articles of Association, including changes to registered capital and the abolishment of the Supervisory Committee, aligning governance with updated CSRC and stock exchange rules.

- A board meeting on November 28, 2025 nominated candidates for both independent and non independent directors for the ninth term of the Board and considered appointing Mr. Chen Jinghe as lifetime honorary chairman.

- A board meeting on October 17, 2025 approved third quarter 2025 results, assessed the satisfaction of exercise conditions for the first exercise period of the 2023 share option incentive scheme and canceled certain share options.

- A special or extraordinary shareholders meeting is scheduled for December 31, 2025, where investors are expected to vote on recent governance and capital structure proposals.

Valuation Changes

- Fair Value per Share has risen slightly, moving from RMB 37.22 to about RMB 37.46, reflecting a modest uplift in long term expectations.

- Discount Rate has edged higher, increasing from roughly 8.80 percent to about 8.87 percent, implying a marginally higher required return.

- Revenue Growth has been revised up slightly, from around 11.32 percent to about 11.49 percent per annum, indicating a modestly stronger top line outlook.

- Net Profit Margin has been trimmed marginally, easing from roughly 16.07 percent to about 16.03 percent, pointing to slightly higher cost or mix assumptions.

- Future P/E has inched up, rising from about 16.32x to roughly 16.37x, suggesting a small increase in the valuation multiple applied to forecast earnings.

Key Takeaways

- Strategic focus on cost control, AI, and M&A activities aims to improve efficiency, expand resource base, and boost long-term revenue and profitability.

- Emphasis on sustainability initiatives and clean energy positions Zijin for favorable market perception and potential regulatory benefits.

- Rising geopolitical risks, increased costs, and uncertain market conditions could pressure Zijin Mining's margins and profitability despite ambitious expansion and investment strategies.

Catalysts

About Zijin Mining Group- A mining company, engages in the exploration, mining, processing, refining, and sale of gold, non-ferrous metals, and other mineral resources in Mainland China and internationally.

- The company is accelerating the construction of incremental copper, gold, and lithium projects, including Phase 2 expansion for Julong Copper and debuting new projects like the lithium extraction, which is expected to enhance output and contribute to revenue growth.

- Zijin Mining is strategically focusing on cost control measures, particularly in overseas mines, which could potentially improve net margins and enhance profitability despite challenges such as degrading ore grades.

- The company is committed to leveraging AI and improving its global operations management, which could drive efficiency and optimize earnings by reducing operational costs and enhancing output quality.

- Zijin's robust pipeline of M&A activity, including potential acquisitions and strategic investments, aims to expand its resource base and output capacity, likely boosting long-term revenue and earnings growth.

- Their focus on sustainability and ESG improvements, alongside advances in low-carbon and clean energy development, positions Zijin for favorable market perception and potential regulatory advantages, supporting stable financial performance and future profitability.

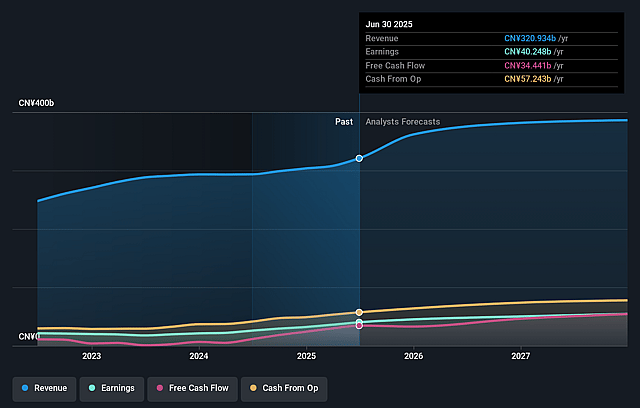

Zijin Mining Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zijin Mining Group's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.5% today to 14.3% in 3 years time.

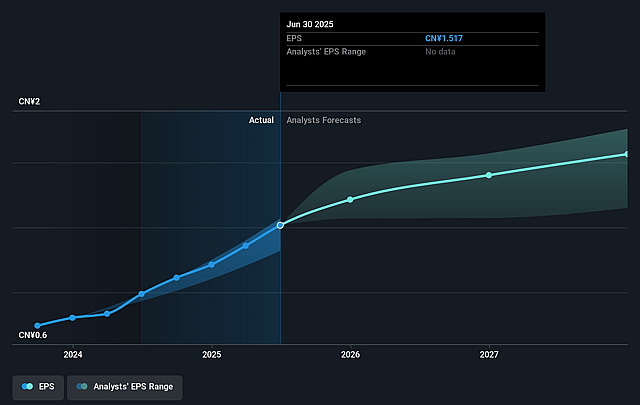

- Analysts expect earnings to reach CN¥58.4 billion (and earnings per share of CN¥2.06) by about September 2028, up from CN¥40.2 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥43.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.0x on those 2028 earnings, down from 16.6x today. This future PE is greater than the current PE for the HK Metals and Mining industry at 13.1x.

- Analysts expect the number of shares outstanding to decline by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.03%, as per the Simply Wall St company report.

Zijin Mining Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical factors and resource nationalism are rising, leading to increased overseas risks, which could negatively impact earnings and profits from international operations.

- Degrading ore grades and increasing costs in areas like transportation, labor, and depreciation could pressure Zijin's ability to maintain its margins.

- Uncertainty in the lithium market, with declining demand and prices, could hinder revenue growth and the profitability of Zijin's new projects.

- The company’s expansion strategy involves significant investments and M&A activities, which carry financial risks that could affect net margins if the ventures do not perform as expected.

- The emphasis on large-scale, long-term projects like the Julong Copper mine may tie up capital and resources, potentially impacting short-term earnings and financial flexibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$28.72 for Zijin Mining Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$32.52, and the most bearish reporting a price target of just HK$22.67.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥409.3 billion, earnings will come to CN¥58.4 billion, and it would be trading on a PE ratio of 15.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of HK$27.6, the analyst price target of HK$28.72 is 3.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zijin Mining Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.