Last Update21 Aug 25Fair value Increased 74%

The significant rise in Yixin Group's net profit margin from 9.61% to 12.54% and its higher future P/E ratio have driven analysts to sharply raise the consensus price target from HK$2.01 to HK$3.50.

What's in the News

- Board to meet to approve interim results and consider interim dividend for H1 2025.

Valuation Changes

Summary of Valuation Changes for Yixin Group

- The Consensus Analyst Price Target has significantly risen from HK$2.01 to HK$3.50.

- The Net Profit Margin for Yixin Group has significantly risen from 9.61% to 12.54%.

- The Future P/E for Yixin Group has significantly risen from 13.54x to 15.53x.

Key Takeaways

- Collaboration with Tencent and AI implementation boosts technological capabilities, driving revenue growth and net margin improvement.

- Expansion in NEV auto financing and fintech growth positions Yixin Group for substantial future earnings and enhanced profitability.

- Aggressive growth and expansion strategies, paired with intense competition and reliance on new technology, pose substantial financial and operational risks to Yixin Group.

Catalysts

About Yixin Group- Operates as an online automobile finance transaction platform in China.

- The partnership with major shareholder Tencent and collaboration in fields such as big data, AI, and cloud computing could significantly enhance Yixin Group's technological capabilities, driving forward higher revenue growth and improving efficiency to boost net margins.

- Expansion in the auto financing of new energy vehicles (NEVs), with transaction volumes and financing amounts increasing by over 50% and 44% respectively, positions Yixin Group to capitalize on the rapidly growing NEV market in China, contributing substantially to future revenue growth.

- The fintech business, witnessing explosive growth with a 107% increase in transaction volume year-over-year, along with revenue surging by 490%, suggests a strong potential for future earnings growth and margin improvement due to technology-driven financial innovations.

- Yixin Group's investment in AI technology for risk management and operational efficiency is expected to reduce costs and enhance profitability, showing potential for an increase in net margins and thereby positively impacting earnings.

- The company's strategy to optimize the asset management structure via AI-aided risk assessments and financial solutions for clients aims to sustain high asset quality, which could lead to more stable earnings and improve investor confidence.

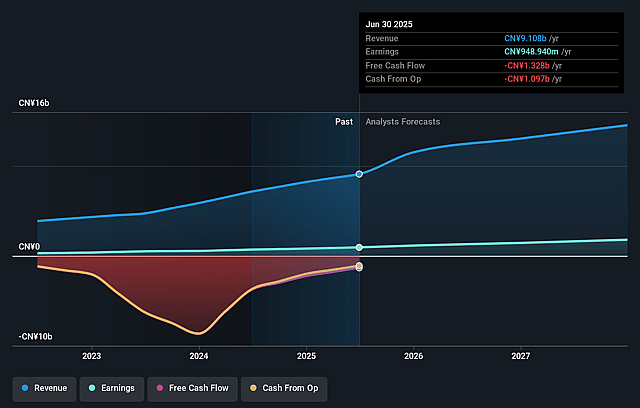

Yixin Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yixin Group's revenue will grow by 19.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.9% today to 9.6% in 3 years time.

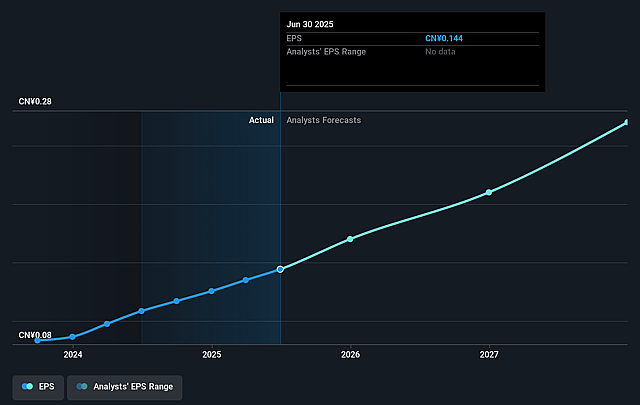

- Analysts expect earnings to reach CN¥1.4 billion (and earnings per share of CN¥0.2) by about April 2028, up from CN¥809.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, down from 13.6x today. This future PE is greater than the current PE for the HK Consumer Finance industry at 12.6x.

- Analysts expect the number of shares outstanding to grow by 3.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.88%, as per the Simply Wall St company report.

Yixin Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's focus on rapid expansion and high growth targets, such as a 70% estimated increase in transaction volume in the next year, may lead to overextension and increased financial risk, potentially impacting net margins and overall financial stability.

- Intense competition in the auto finance sector, particularly from banks entering the market, could pressure Yixin Group's market share and profitability, impacting future revenue streams.

- Despite the rapid growth in fintech services, the company's dependency on new technology adoptions and AI penetration could lead to execution risks and substantial costs, affecting earnings if not managed effectively.

- There is a noted discrepancy in the financial penetration rate between China and developed markets, which although indicating growth potential, also highlights the challenge Yixin faces in increasing its market share, impacting revenue over time.

- High volume loans, while beneficial in the short term for business expansion, pose a risk of straining cash flow and liquidity, especially if market conditions worsen, potentially impacting the company's net margins and financial health in 2025.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$2.012 for Yixin Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥14.1 billion, earnings will come to CN¥1.4 billion, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of HK$1.73, the analyst price target of HK$2.01 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.