Last Update 21 Aug 25

Fair value Increased 74%The significant rise in Yixin Group's net profit margin from 9.61% to 12.54% and its higher future P/E ratio have driven analysts to sharply raise the consensus price target from HK$2.01 to HK$3.50.

What's in the News

- Board to meet to approve interim results and consider interim dividend for H1 2025.

Valuation Changes

Summary of Valuation Changes for Yixin Group

- The Consensus Analyst Price Target has significantly risen from HK$2.01 to HK$3.50.

- The Net Profit Margin for Yixin Group has significantly risen from 9.61% to 12.54%.

- The Future P/E for Yixin Group has significantly risen from 13.54x to 15.53x.

Key Takeaways

- AI-driven digital transformation and asset-light strategy are set to boost profitability, expand high-margin technology services, and diversify recurring revenue streams.

- Strong positioning in NEV and used car financing underpins revenue growth, with favorable industry fundamentals supporting market share gains and stable earnings.

- Rising credit risk, intensifying competition, regulatory pressures, partnership vulnerabilities, and shifting market trends threaten profitability, revenue growth, and core business sustainability.

Catalysts

About Yixin Group- Operates as an online automobile finance transaction platform in China.

- Rapid adoption of AI and digital risk management throughout all stages of financing and customer acquisition is expected to significantly increase approval efficiency, reduce fraud risk, and lower operating expenses, which should drive higher net margins and improved profitability over time.

- Sustained expansion in new energy vehicle (NEV) financing-with NEV transactions now making up over half of total financing volume-positions Yixin to capture secular growth from consumer shifts towards green mobility, thereby supporting continued revenue growth and increased platform income.

- Accelerated market share gains in the structurally underpenetrated used car finance segment, aided by AI-driven credit solutions and industry consolidation, create opportunities for higher-margin business and a broader, more stable customer base, positively impacting both revenue growth and net earnings.

- Strategic shift to a technology-driven and "asset-light" platform-by commercializing and exporting proprietary AI models and fintech solutions-promises new, recurring high-margin revenue streams from technology services, diversifying income mix and supporting margin expansion.

- Improving industry fundamentals, including rationalization and regulatory support against unhealthy competition, are leading to a more stable and efficient market structure that favors tech-enabled leaders like Yixin, enhancing visibility of earnings and reducing credit risks.

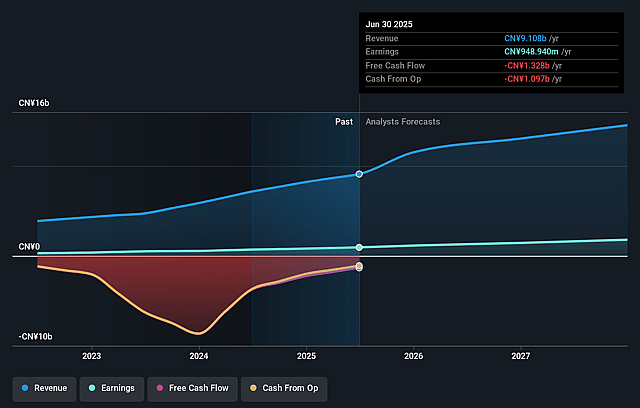

Yixin Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Yixin Group's revenue will grow by 20.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.4% today to 12.5% in 3 years time.

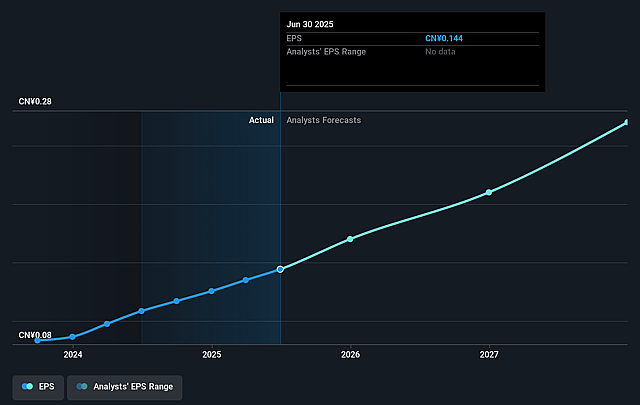

- Analysts expect earnings to reach CN¥2.0 billion (and earnings per share of CN¥0.27) by about September 2028, up from CN¥948.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, down from 19.7x today. This future PE is greater than the current PE for the HK Consumer Finance industry at 10.7x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.53%, as per the Simply Wall St company report.

Yixin Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid expansion into the used car financing market and increased exposure to long-tail customers heightens credit risk; rising delinquency and provisioning rates-especially if underwriting standards weaken or economic conditions deteriorate-could pressure net margins and overall profitability.

- Intensified industry competition, including from banks, fintechs, and automakers launching direct-to-consumer financing, may erode Yixin Group's market share and bargaining power, potentially limiting revenue growth and squeezing net margins.

- Ongoing and increasing regulatory oversight-especially anti-involution policies, credit risk controls, and evolving fintech/compliance standards in China and overseas-may increase compliance costs, restrict lending activities, and constrain sector-wide growth, negatively impacting both revenue and earnings.

- The company's business model heavily relies on partnerships with car dealers, OEMs, and financial institutions; any disruption or less favorable terms in these critical relationships could materially hinder loan origination volumes and revenue generation.

- Secular trends such as the shift toward shared mobility (e.g., ride-hailing, car-sharing) and stricter environmental regulations-especially those impacting gasoline and diesel vehicles-threaten to weaken the demand for individual car ownership and the used car market, undermining the company's core revenue drivers over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of HK$3.5 for Yixin Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥16.1 billion, earnings will come to CN¥2.0 billion, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 9.5%.

- Given the current share price of HK$3.01, the analyst price target of HK$3.5 is 14.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.