Key Takeaways

- Escalating subsidy wars, regulatory pressures, and saturated urban markets threaten to erode margins and slow Meituan's future revenue and profit growth.

- Overseas expansion poses high capital risk and faces uncertain demand, increasing potential for sustained operating losses and management distraction.

- Strong network effects, innovation in AI and logistics, and diversified business lines position Meituan for sustained growth, profitability, and resilience against short-term market challenges.

Catalysts

About Meituan- Operates as a technology driven retail company in the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally.

- China's slowing economic growth and risk of stagnating per capita income may undermine Meituan's long-term revenue trajectory, as weakening consumer demand for local and on-demand services could cap transaction volumes and reduce future topline growth.

- Sustained and escalating irrational subsidy wars-driven by aggressive new entrants like JD and Ele.me-will likely force Meituan to shoulder persistently high promotional costs, which could result in sharp net margin deterioration and erode operating profit for an extended period.

- Intensifying government regulatory scrutiny, including new requirements for gig worker welfare and food safety transparency, will increase Meituan's compliance and labor costs structurally, exerting sustained downward pressure on net margins and raising execution risk across core and emerging verticals.

- Overseas expansion plans-particularly in complex, unpredictable markets such as Brazil and Saudi Arabia-will consume significant capital and management attention, but are highly vulnerable to local competition, foreign regulatory risks, and uncertain demand, increasing the possibility of protracted operating losses and capital misallocation that drag on consolidated earnings.

- With urban markets showing signs of saturation and the cost of customer acquisition climbing due to digital ad inflation and media fragmentation, Meituan faces a higher risk of slowing user growth and rising sales and marketing expenses, constraining future revenue and profit growth as the core O2O market matures.

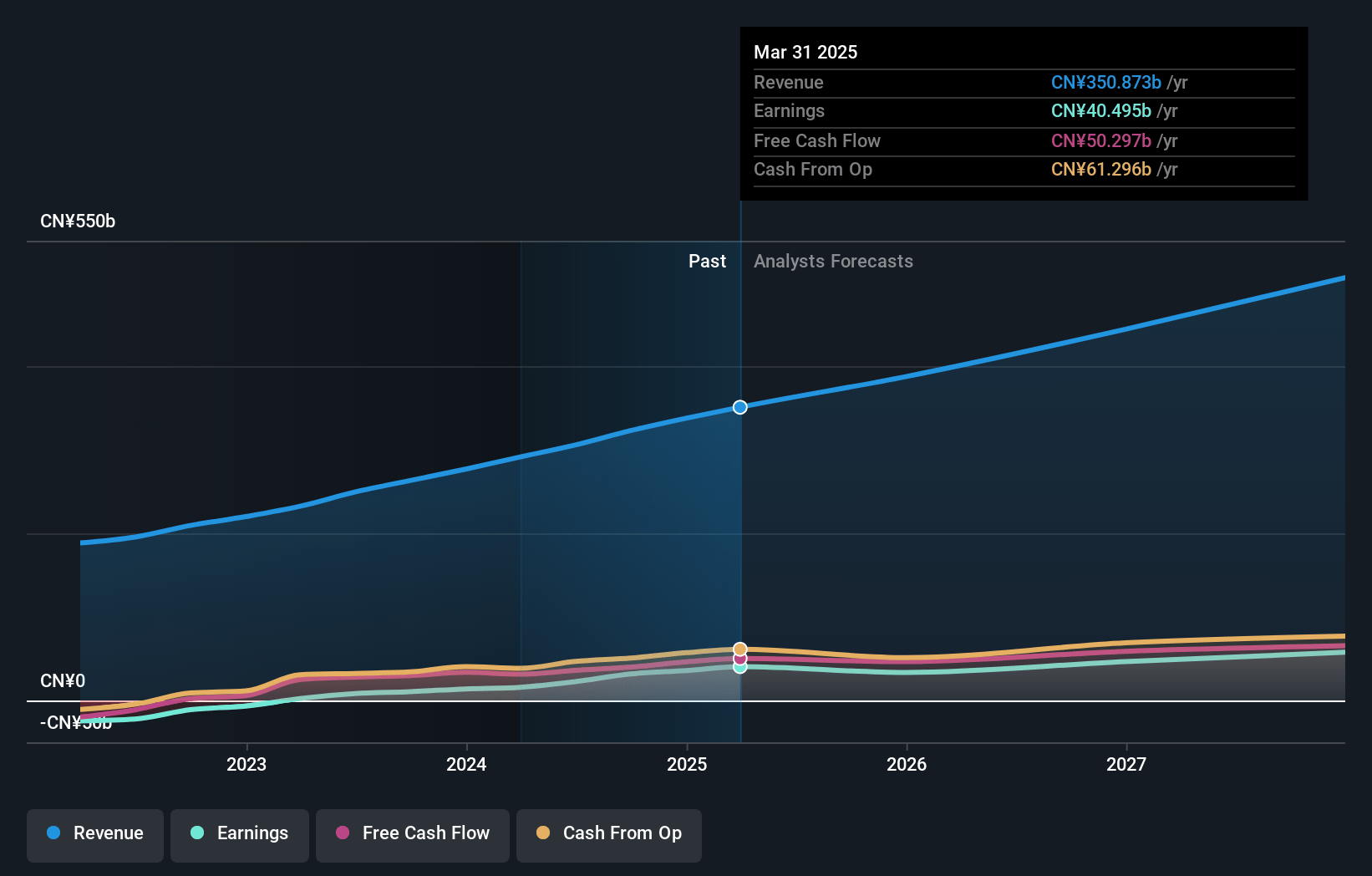

Meituan Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Meituan compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Meituan's revenue will grow by 11.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 11.5% today to 7.2% in 3 years time.

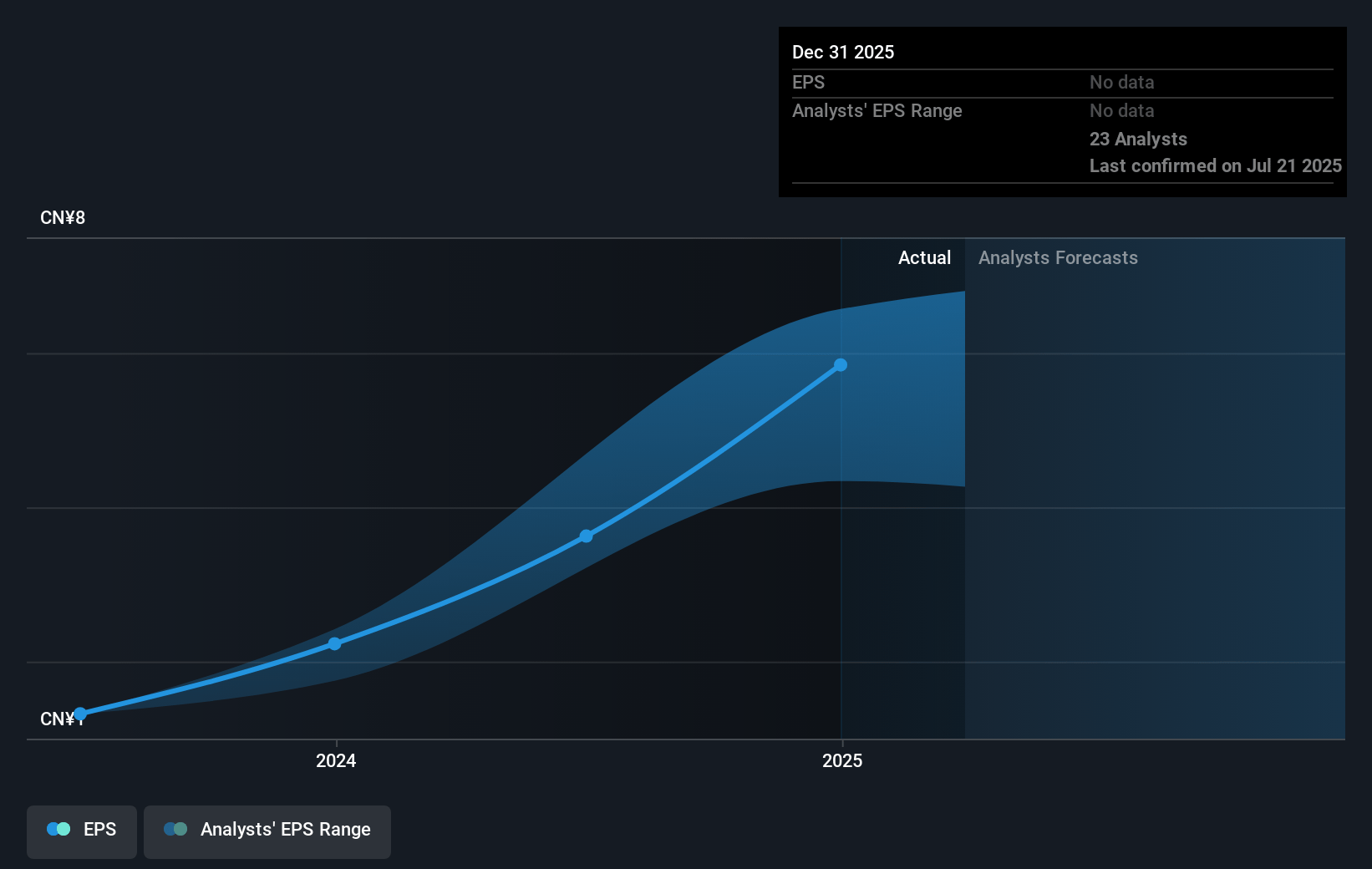

- The bearish analysts expect earnings to reach CN¥35.5 billion (and earnings per share of CN¥nan) by about July 2028, down from CN¥40.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.9x on those 2028 earnings, up from 18.3x today. This future PE is greater than the current PE for the HK Hospitality industry at 18.6x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.82%, as per the Simply Wall St company report.

Meituan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite current competitive pressures, Meituan's ability to grow annual Transacting Users and annual Active Merchants to new highs suggests strong long-term user and merchant network effects, supporting sustained revenue and GMV growth.

- Significant investment in AI technologies, operational efficiency, and logistics-such as optimized delivery networks and AI-driven merchant tools-may lead to improved net margins and enhanced customer retention over time.

- Rapid expansion in high-growth verticals like grocery, healthcare, on-demand retail, and international markets diversifies Meituan's revenue streams, which reduces reliance on any single segment and fosters long-term earnings growth.

- The robust adoption of Meituan's membership programs and cross-category ecosystems, such as the integration of hotel, travel, and local services, increases user stickiness and transaction frequency, driving topline revenue and ecosystem value.

- Meituan's demonstrated resilience and cash-generative core local commerce segment, along with strong operating leverage and disciplined capital allocation, position the company to sustain investment and weather short-term profit fluctuations, ultimately supporting long-term profitability and enterprise value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Meituan is HK$122.8, which represents two standard deviations below the consensus price target of HK$163.95. This valuation is based on what can be assumed as the expectations of Meituan's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$201.05, and the most bearish reporting a price target of just HK$118.16.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CN¥490.9 billion, earnings will come to CN¥35.5 billion, and it would be trading on a PE ratio of 24.9x, assuming you use a discount rate of 8.8%.

- Given the current share price of HK$133.2, the bearish analyst price target of HK$122.8 is 8.5% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.