Key Takeaways

- Momentum in Asia and Latin America, combined with strong store and DTC channel growth, positions Samsonite for significant operating leverage and sustained earnings expansion.

- Premium innovations and diversified revenue streams make Samsonite less cyclical, supporting durable revenue growth and consistently strong cash flow across global markets.

- Prolonged weak demand, cost pressures, shifting travel habits, and heightened competition threaten Samsonite's growth prospects, margin sustainability, and ability to maintain its market position.

Catalysts

About Samsonite Group- Engages in the design, manufacture, sourcing, and distribution of luggage, business and computer bags, outdoor and casual bags, and travel accessories in Asia, North America, Europe, and Latin America.

- While analyst consensus sees store expansion and DTC channel growth driving margin improvement, the exceptionally strong execution-opening 64 net new stores with flat SG&A costs-signals Samsonite could unlock much greater operating leverage, setting up for a step-change in net margin and EBITDA margin as revenue returns to trend.

- Analyst consensus anticipates the benefit of ongoing product innovation, especially with lightweight and sustainable launches; however, the scale, velocity, and resonance of these rollouts, including Tumi's unprecedented lightweight collections and global hits like Paralux/Lite-Geo, point to a multi-year period of outsized revenue growth and gross margin expansion driven by premiumization, far beyond current expectations.

- The rapid resurgence in India, momentum in China, and accelerating gains in Latin America indicate Samsonite will disproportionately capture growth from rising middle classes and travel booms in these high-population regions, transforming its revenue base with higher growth rates and lower cyclicality than the market currently assigns.

- Structural shifts in consumer behavior toward experiential spending and "bleisure" travel will drive sustained replacement cycles for luggage and travel gear, making Samsonite's sales less cyclical and more recurring than investors appreciate, supporting both revenue stability and premium valuation multiples in the long-run.

- The company's unique geographic, product, and channel diversification-two-thirds of sales outside the U.S., non-travel categories nearing 36% of revenue, and a flexible supply chain-positions Samsonite to capture global e-commerce growth and quickly mitigate regional volatility, setting the stage for sustained double-digit earnings growth and consistent cash flow generation.

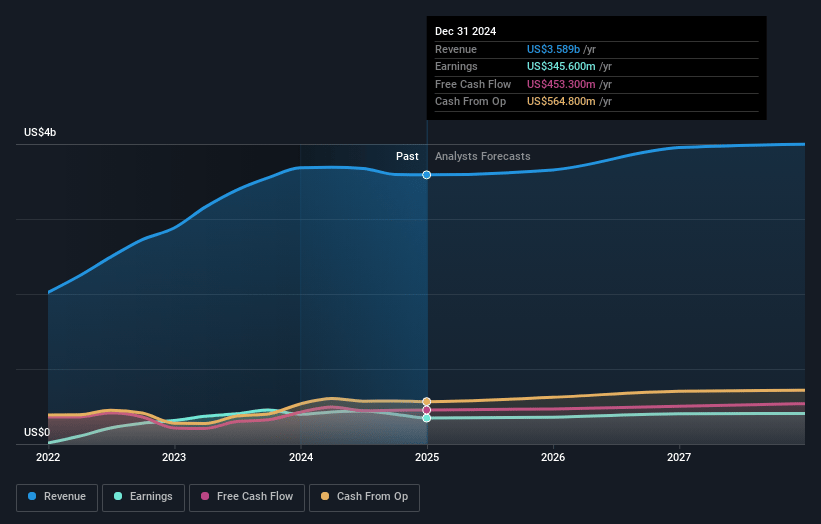

Samsonite Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Samsonite Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Samsonite Group's revenue will grow by 5.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.8% today to 10.8% in 3 years time.

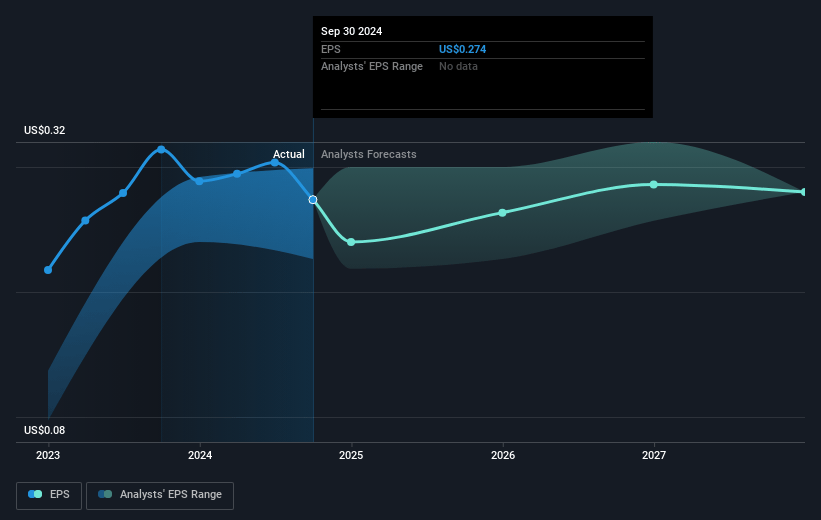

- The bullish analysts expect earnings to reach $451.4 million (and earnings per share of $0.31) by about July 2028, up from $309.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.5x on those 2028 earnings, up from 9.1x today. This future PE is greater than the current PE for the HK Luxury industry at 9.4x.

- Analysts expect the number of shares outstanding to decline by 5.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.62%, as per the Simply Wall St company report.

Samsonite Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing macroeconomic uncertainty, including volatile consumer sentiment in major markets like North America and Asia, continues to suppress demand for luggage and travel accessories, increasing the risk of sustained pressure on Samsonite's revenues and earnings growth in the medium and long term.

- The fluid and escalating global tariff and regulatory environment, especially involving U.S. imports and Asia-based manufacturing, poses significant cost inflation and supply chain uncertainty that can compress gross margins and erode net profits unless fully offset by price increases or cost mitigation.

- The company acknowledges that margin and sales trends are being buoyed largely by disciplined cost management, yet a repeat of record quarters appears unlikely due to lower sales and reduced adjusted EBITDA, highlighting a vulnerability in net margin sustainability if top-line growth fails to rebound.

- Secular shifts such as rising sustainability expectations and changes in consumer travel patterns (like increased remote work and reduced discretionary travel) may structurally reduce demand for traditional luggage products, shrinking the addressable market and potentially impacting long-term revenue and market share.

- The company faces ongoing competitive threats from both premium direct-to-consumer brands and value-focused Asian competitors, which could force Samsonite to lower average selling prices and intensify promotion-undermining gross margins and weakening pricing power with repercussions on future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Samsonite Group is HK$30.97, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Samsonite Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$30.97, and the most bearish reporting a price target of just HK$13.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $451.4 million, and it would be trading on a PE ratio of 13.5x, assuming you use a discount rate of 9.6%.

- Given the current share price of HK$16.02, the bullish analyst price target of HK$30.97 is 48.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.