Key Takeaways

- Nexteer is set to outperform market expectations through rapid adoption of advanced steering technologies and major new business wins, especially in electrification and autonomy.

- Expansion into brake-by-wire and software integration strengthens its role as a key partner to automakers, boosting both market share and profit margins.

- Heavy reliance on key customers, evolving market technology, supply chain risks, and limited product diversification threaten Nexteer's long-term growth and profitability.

Catalysts

About Nexteer Automotive Group- A motion control technology company, develops, manufactures, and supplies steering and driveline systems to original equipment manufacturer worldwide.

- Analyst consensus sees Nexteer capturing moderate upside from electrification and autonomy trends, but this view underweights the magnitude of demand for motion-by-wire and steer-by-wire tech, which is rapidly becoming non-negotiable for next-generation EV and autonomous platforms-Nexteer's accelerating bookings pipeline and customer wins with global EV leaders signal a multi-year step-change in both revenue growth and gross margins.

- While consensus highlights market share gains through China and India localization, they overlook the velocity of new business wins, including re-conquesting lost North American contracts, and Nexteer's dominant position with Chinese OEMs; this aligns the company for outsized, sustained revenue gains and secures strategic pricing power not yet reflected in forward earnings valuations.

- Nexteer's entry into the electromechanical brake-by-wire market represents a major horizontal expansion, opening an entirely new, high-growth revenue stream with large cross-selling opportunities across its existing customer base, materially raising long-term sales and improving profit mix.

- The shift to software-defined vehicles and new mobility models is driving OEMs to favor fully integrated suppliers-Nexteer's expanding software suite and system integration capabilities position it as a critical sole-source partner rather than a component supplier, setting up a structural improvement in both top-line growth and long-term EBIT margins.

- Increased industry complexity due to mechatronic integration and intensifying safety/regulatory demands are driving consolidation among auto suppliers; Nexteer is poised not just to withstand but to actively benefit from this trend, enhancing its market share and margins through potential targeted acquisitions and greater content-per-vehicle, which supports superior earnings growth and cash generation.

Nexteer Automotive Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Nexteer Automotive Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Nexteer Automotive Group's revenue will grow by 11.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.4% today to 4.4% in 3 years time.

- The bullish analysts expect earnings to reach $258.5 million (and earnings per share of $0.1) by about July 2028, up from $61.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 32.7x today. This future PE is greater than the current PE for the HK Auto Components industry at 11.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.88%, as per the Simply Wall St company report.

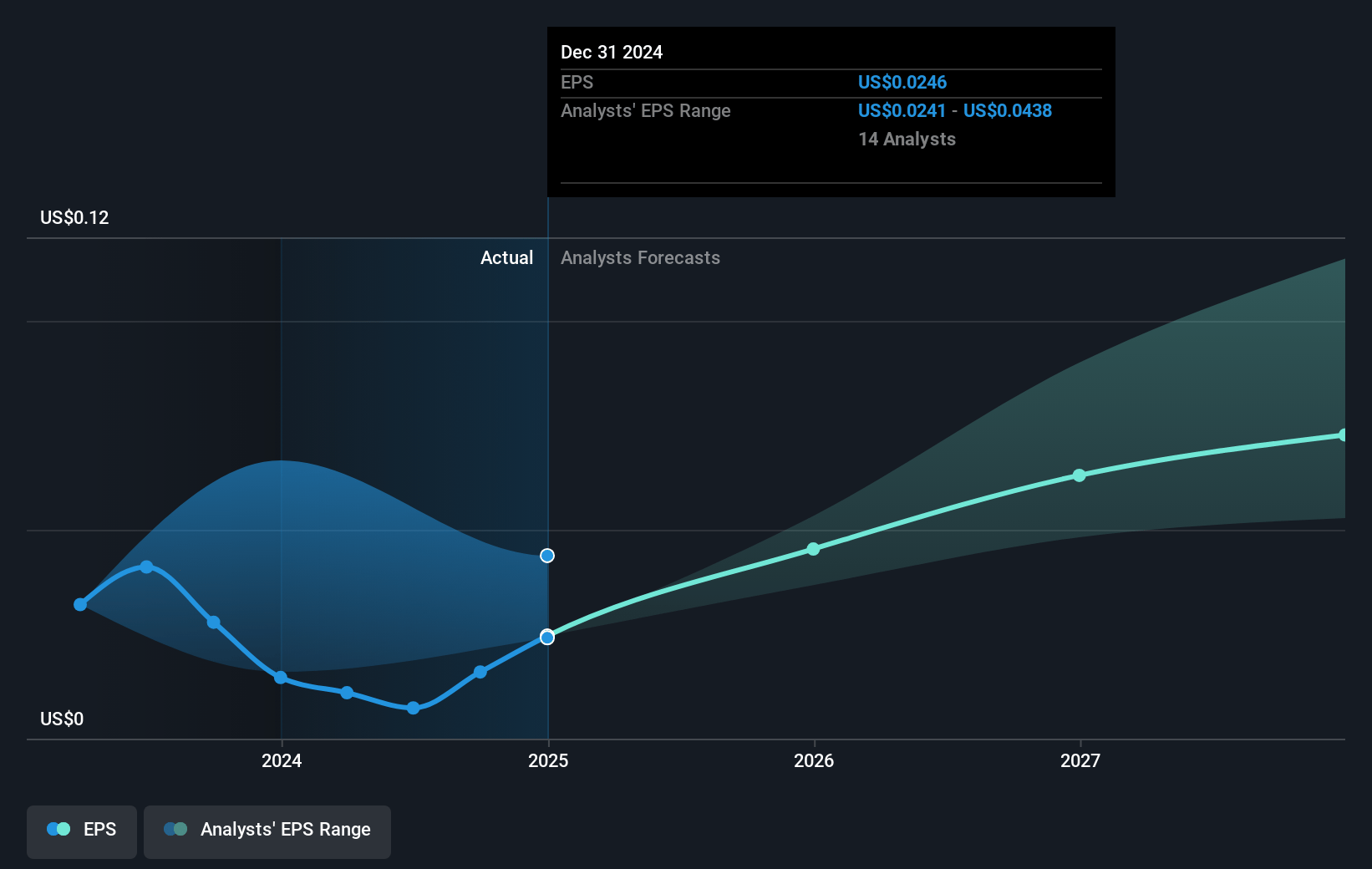

Nexteer Automotive Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Nexteer's significant exposure to major customers like General Motors and Stellantis means a shift in purchasing decisions or the loss of a major contract-such as what happened previously in North America-could materially reduce future revenues and earnings stability.

- The transition to electric and autonomous vehicles, which often require different steering and driveline technologies, threatens to make Nexteer's legacy products less relevant, potentially eroding its addressable market and resulting in lower long-term revenue growth.

- Intensifying competition from vertically integrated OEMs and new tech suppliers-particularly in software-defined and motion-by-wire chassis systems-risks margin compression and lost business, which could weigh on net margins and long-term profitability.

- The company's supply chain remains vulnerable to tariffs, rare earth mineral restrictions, and evolving trade tensions, particularly in North America and China; continued volatility in these areas could drive up costs and lead to lower net margins.

- Despite launches in new technologies, Nexteer is still heavily concentrated in steering systems and driveline components, so any major industry technology shift away from these core offerings could significantly undermine future revenues and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Nexteer Automotive Group is HK$8.04, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Nexteer Automotive Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$8.04, and the most bearish reporting a price target of just HK$5.02.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.9 billion, earnings will come to $258.5 million, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 6.9%.

- Given the current share price of HK$6.32, the bullish analyst price target of HK$8.04 is 21.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.