Key Takeaways

- Strategic acquisitions, digital transformation projects, and digital infrastructure investments are set to drive sustained growth and improved profitability.

- Divestment of non-core assets and normalization of temporary headwinds are expected to stabilize earnings and enhance future financial performance.

- High tax burdens, sluggish Postal Services, reliance on recent M&A for growth, rising minority interests, and reduced energy focus constrain future earnings and revenue expansion.

Catalysts

About Quest Holdings- Engages in the distribution of information technology and telecommunications products in Greece, Romania, Cyprus, Luxembourg, Belgium, Spain, and Italy.

- Strong multi-year pipeline and high backlog in IT Services (over €700 million in signed projects), mainly fueled by ongoing digital transformation needs across both public and private sectors, positions Quest Holdings for sustained revenue and earnings growth.

- Accelerating investments in cloud computing, last-mile delivery, and digital infrastructure (e.g., ACS locker network expansion and Clima sector expansion abroad) align with increased e-commerce adoption and demand for robust logistics solutions, supporting top-line and margin growth.

- Recent integration of Benrubi and completion of other strategic acquisitions are expected to unlock synergies and higher-margin revenue streams, contributing to EBITDA improvement over time.

- Successful sale of non-core energy assets will enhance liquidity and enable reinvestment into core digital and IT segments poised for structural growth, supporting future revenue and earnings stability.

- Current period's elevated tax rate (expected to normalize) and operational headwinds in certain segments have temporarily suppressed net income, setting the stage for potential earnings re-rating as these transitory effects reverse.

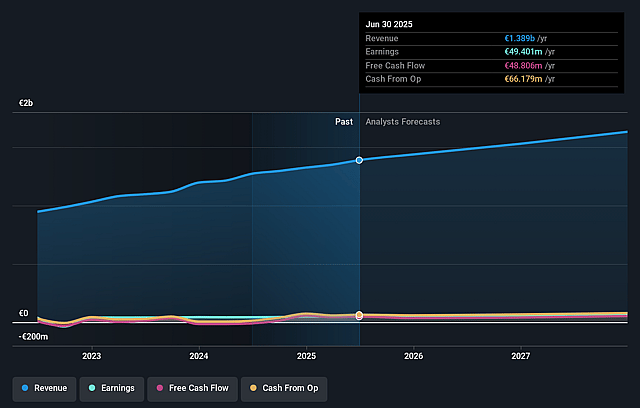

Quest Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Quest Holdings's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.6% today to 4.2% in 3 years time.

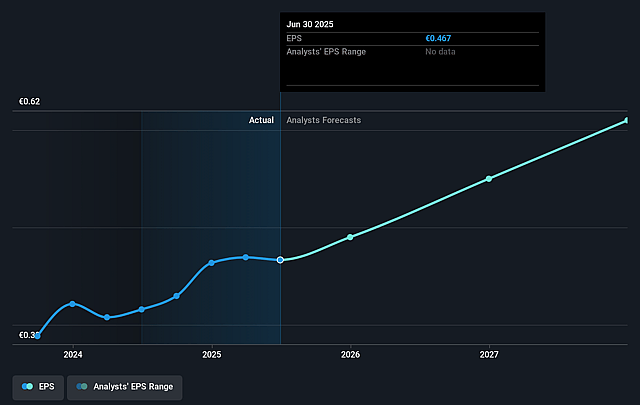

- Analysts expect earnings to reach €70.0 million (and earnings per share of €0.61) by about September 2028, up from €49.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, up from 15.7x today. This future PE is lower than the current PE for the GR Electronic industry at 41.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.92%, as per the Simply Wall St company report.

Quest Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High effective corporate tax rates, particularly at major subsidiaries like Uni Systems (39%) and ACS (32%), as well as deferred tax liabilities and nondeductible expenses, may compress future net margins and earnings if not normalized as management expects.

- Sluggish performance and flat sales in the Postal Services (ACS) segment-especially as e-commerce growth slows and dependency on one-offs like SME digital tools subsidies fades-raise the risk of weaker revenue and earnings growth if these trends persist despite current optimism for improvement.

- The lack of near-term pipeline for further strategic acquisitions or new brand partnerships in the Commercial Activities segment, combined with reliance on recent M&A for growth (e.g., Benrubi), heightens exposure to organic growth slowdowns and limits future revenue expansion opportunities.

- Increased exposure to minority interests in key holdings (20% in ACS, 30% in Benrubi) following partial sales and acquisitions means a higher portion of subsidiary profits will not accrue to Quest Holdings' shareholders, dampening the impact of operational improvements on consolidated net earnings.

- The partial divestment and lack of strategic focus in the Energy segment, combined with continued external risks such as adverse weather, grid curtailments, and regulatory delays, signal potential lost revenue diversification and make Quest Holdings more vulnerable to negative shocks or margin compression in its core ICT and commercial activities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €7.53 for Quest Holdings based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.7 billion, earnings will come to €70.0 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 11.9%.

- Given the current share price of €7.33, the analyst price target of €7.53 is 2.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.