Last Update 11 Dec 25

UU.: Dividend Outlook And Regulatory Framework Will Shape Near-Term Performance

Analysts have nudged their price target on United Utilities Group higher, raising it from approximately £12.61 to £13.27 per share. This reflects improved confidence in the company’s earnings visibility and defensive cash flow profile.

Analyst Commentary

Recent price target revisions highlight a constructive stance on United Utilities Group, with bullish analysts pointing to a resilient earnings outlook and supportive regulatory backdrop as key drivers of upside potential.

Bullish Takeaways

- Price target increase to 1,327 GBp signals renewed confidence in the company’s ability to deliver stable, inflation linked returns over the medium term.

- Defensive, regulated cash flows are viewed as well positioned to weather macroeconomic volatility, supporting a premium valuation versus some sector peers.

- Visibility on capital investment and allowed returns under the current regulatory framework underpins expectations for steady earnings growth.

- Dividend sustainability and potential for gradual payout growth are seen as key supports for total shareholder return.

Bearish Takeaways

- Even after the target hike, some bearish analysts remain cautious that the shares already discount much of the regulated earnings visibility, limiting further multiple expansion.

- Execution risk around large scale capital projects and operational efficiency targets could pressure returns if costs are not tightly controlled.

- Future regulatory determinations, particularly around allowed returns and customer bill levels, are viewed as a potential headwind to long term earnings growth.

- Higher interest rates and financing costs may weigh on valuation for a capital intensive, highly geared business, if not offset by stronger cash flow generation.

What's in the News

- Issued earnings guidance for fiscal 2025/26, targeting revenue of £2.5 billion to £2.6 billion, adjusted for inflation, and earnings per share of around 100 pence (company guidance).

- Announced an interim dividend of 17.88 pence per ordinary share for the six months ended 30 September 2025, a 3.5 percent increase year on year, in line with its CPIH linked dividend policy (company announcement).

- Confirmed the interim dividend timetable, with an ex dividend date of 18 December 2025, record date of 19 December 2025, and payment date of 2 February 2026 (company announcement).

Valuation Changes

- Fair Value Estimate remains unchanged at approximately £13.03 per share, indicating no revision to the intrinsic value assessment despite updated assumptions.

- The Discount Rate has risen slightly from about 8.41 percent to 8.46 percent, reflecting a modestly higher required return for equity holders.

- Revenue Growth is effectively unchanged at around 7.75 percent, suggesting stable expectations for top line expansion in real terms.

- Net Profit Margin is stable at roughly 21.0 percent, implying no material shift in long term profitability assumptions.

- The Future P/E has edged up marginally from about 18.14x to 18.16x, pointing to a slightly higher valuation multiple applied to forward earnings.

Key Takeaways

- Investment in technology and pollution prevention enhances efficiency, reduces costs, and improves margins by lowering operational expenses and regulatory penalties.

- Significant capital investment and community engagement projects are expected to drive future growth, boost revenue, and support sustainable long-term dividends.

- Concerns regarding regulatory challenges, rising costs, and required investments may pressure United Utilities' profitability, cash flow, and financial flexibility.

Catalysts

About United Utilities Group- Provides water and wastewater services in the United Kingdom.

- United Utilities' investment in advanced technology such as satellite imaging and telecoms' fiber networks to detect leaks is anticipated to significantly reduce water loss, potentially boosting revenue and improving net margins due to lower operational costs.

- The company's proactive approach to pollution prevention using thermal imaging drones and AI systems is expected to further enhance operational efficiency and environmental compliance, helping maintain or improve net margins by reducing regulatory penalties.

- The significant capital investment planned for AMP8, with an overarching plan for further enhancement including a £200 million investment for Lake Windermere, indicates strong future growth potential in revenue as infrastructure improvements can lead to service expansions and increased customer satisfaction.

- United Utilities is ramping up its community and employment efforts by engaging 45 delivery partners and 30 local regional partners to deliver AMP8 initiatives, which is expected to support regional economic growth and contribute to long-term sustainable revenue increases.

- The company's comprehensive response to the regulatory draft determination, including proposals for £2 billion of additional enhancements, posits a robust growth trajectory that could potentially enhance earnings and drive higher future dividend payouts aligned with increasing RCV.

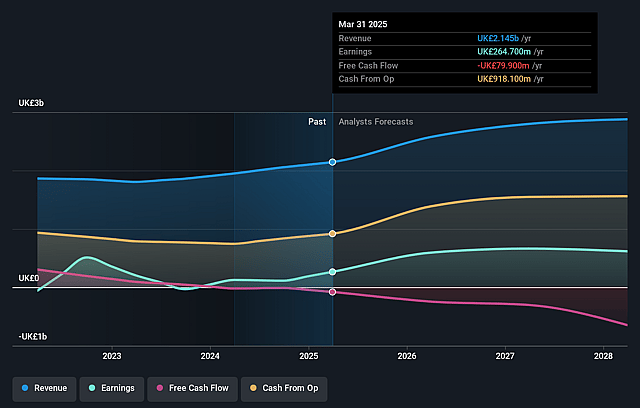

United Utilities Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming United Utilities Group's revenue will grow by 10.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.3% today to 21.5% in 3 years time.

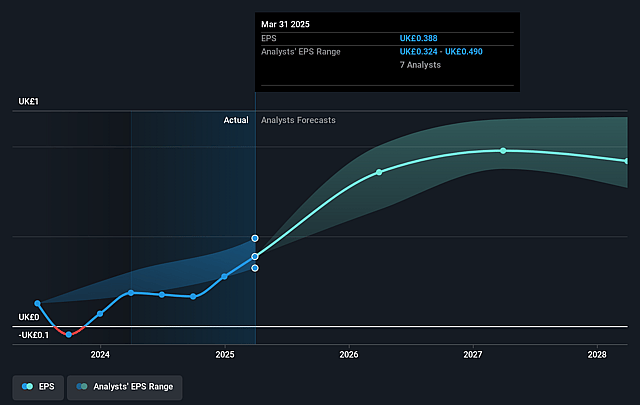

- Analysts expect earnings to reach £617.3 million (and earnings per share of £0.92) by about September 2028, up from £264.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £794 million in earnings, and the most bearish expecting £523 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 28.3x today. This future PE is lower than the current PE for the GB Water Utilities industry at 30.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

United Utilities Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Moody's and S&P have placed United Utilities' ratings on negative outlook, reflecting concerns about the stability and supportiveness of the regulatory environment for U.K. water companies, which could impact future profitability and access to capital. (Earnings, Cost of Capital)

- The company's operational costs have increased by 5%, with additional expenses related to the accelerated depreciation of assets. Rising costs could strain net margins if not offset by corresponding revenue increases. (Net Margins)

- Despite improvements, further investments will be needed for pollution control and infrastructure upgrades, such as power supply resilience and wastewater service improvements, which could pressure future cash flows and capital expenditure. (Cash Flow, Capital Expenditure)

- The commitment to invest in accelerated spill reductions and a £200 million investment plan for Lake Windermere may require significant capital allocation, potentially affecting the company's financial flexibility. (Liquidity, Capital Allocation)

- There is risk associated with the ambitious growth and investment plans in AMP8, which require successful execution and effective cost management to achieve anticipated returns and operational improvements. (Revenue, Cost Management)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £12.867 for United Utilities Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £15.35, and the most bearish reporting a price target of just £11.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.9 billion, earnings will come to £617.3 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of £11.0, the analyst price target of £12.87 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on United Utilities Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.