Key Takeaways

- Focus on UK fiber expansion and 5G growth is key for revenue and earnings through increased customer acquisition and ARPU growth.

- Cost transformation and structural reorganization aim to improve margins, offsetting revenue pressures and supporting long-term EBITDA and cash flow growth.

- Revenue declines in BT Group's Business division tied to global trading and regulatory costs could weaken growth amid competition and operational challenges.

Catalysts

About BT Group- Provides communications products and services in the United Kingdom, Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

- BT Group is doubling down on UK fiber build and take-up, which is expected to drive future growth in revenue and earnings through increased customer acquisition and higher ARPU (Average Revenue Per User).

- Cost transformation programs are delivering significant savings and are expected to continue, helping to improve net margins and offset pressures from lower or stagnant revenues.

- The expansion of 5G and fiber customer bases, as well as increased mobile subscriber and converged customer growth, is expected to contribute to future revenue growth as BT migrates customers to next-generation platforms.

- Structural transformation in the Business segment, along with simplifying and modernizing global operations, is expected to improve customer satisfaction and potentially return the business to revenue and EBITDA growth over the medium term.

- Openreach's operational momentum in fiber build and take-up is expected to continue with ARPU growth from indexation and product mix enhancements, underpinning long-term EBITDA and free cash flow growth.

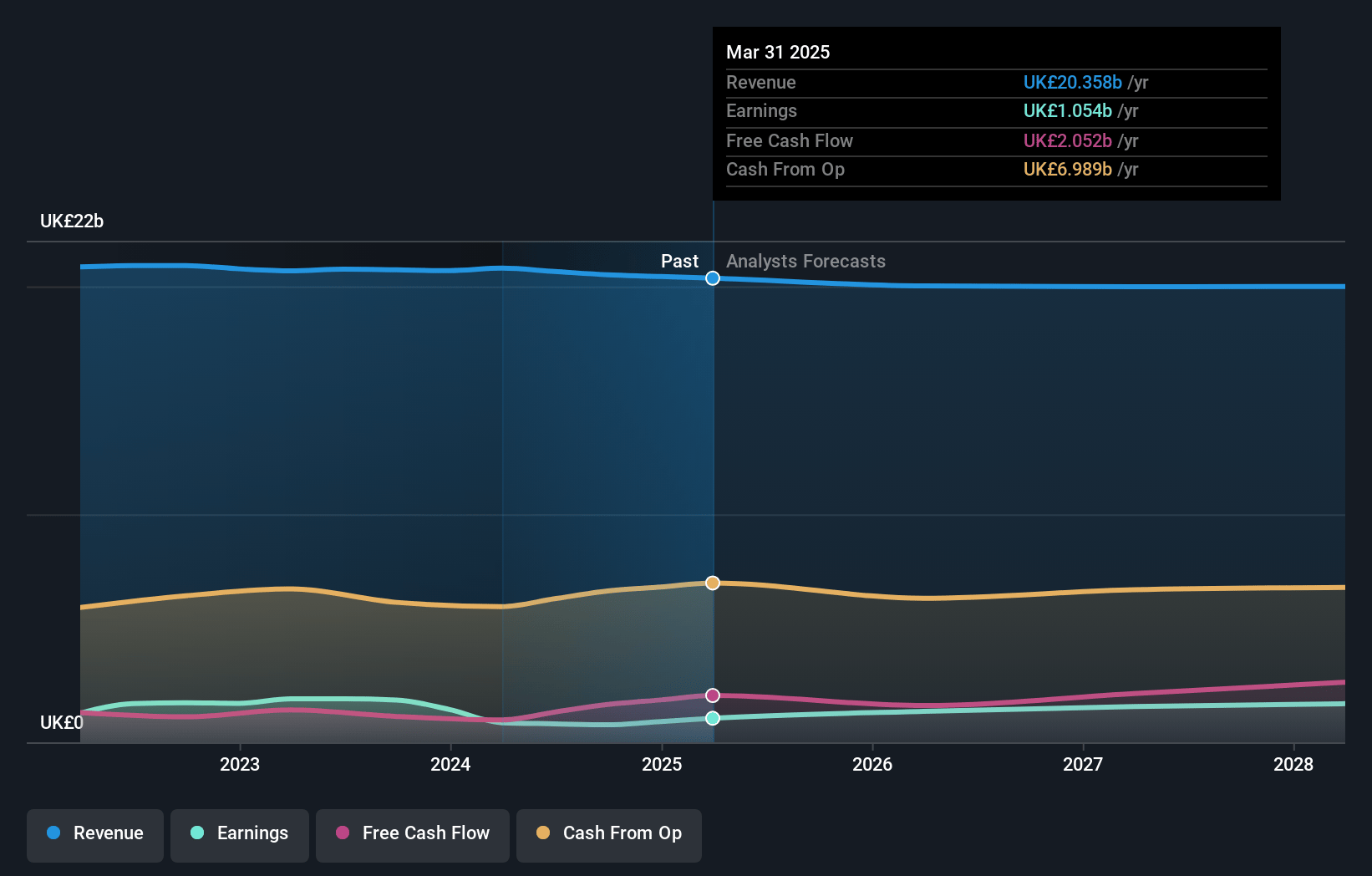

BT Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BT Group's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.2% today to 8.5% in 3 years time.

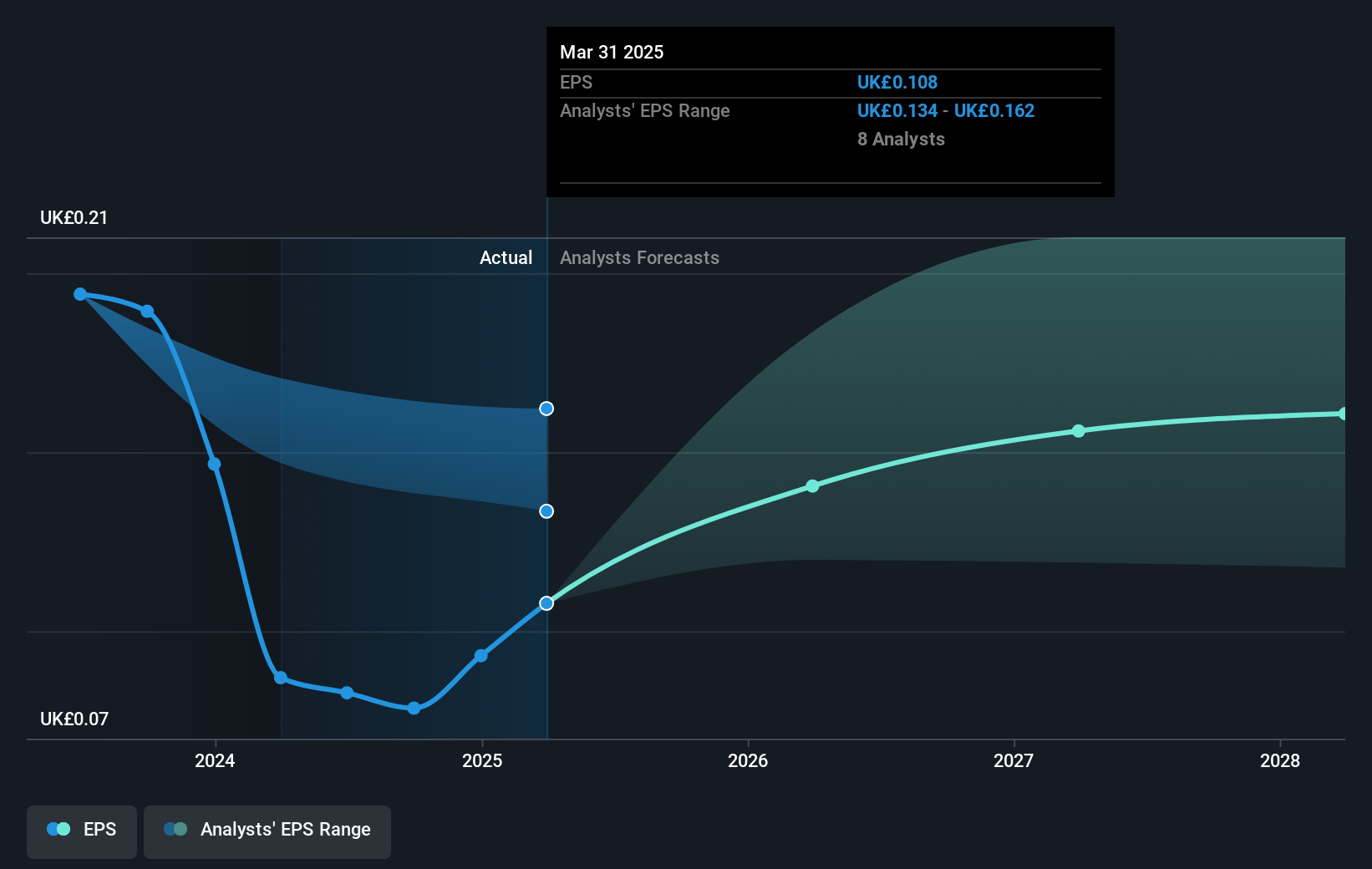

- Analysts expect earnings to reach £1.7 billion (and earnings per share of £0.14) by about July 2028, up from £1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £2.2 billion in earnings, and the most bearish expecting £1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.9x on those 2028 earnings, down from 18.5x today. This future PE is lower than the current PE for the US Telecom industry at 16.5x.

- Analysts expect the number of shares outstanding to grow by 1.04% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.98%, as per the Simply Wall St company report.

BT Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Revenue declines in BT Group's Business division, particularly driven by non-U.K. trading in global and portfolio channels, could continue to pose a risk to overall revenue stability and growth.

- The impact of challenging conditions in the Business segment outside the U.K., coupled with slower decision-making in public sector contracts due to the U.K. government's spending reviews, may result in prolonged revenue weakness.

- Elevated competition in areas where BT does not provide full fiber services could continue to result in broadband line losses, impacting BT's market share and revenue growth.

- Regulatory changes, such as the additional National Insurance contributions and increased living wage requirements, are expected to increase operational costs by £100 million annually, potentially impacting net margins and earnings if not fully offset by cost-saving measures.

- Slower than anticipated demand for international low-margin equipment sales and necessary transformations within the global segment may limit EBITDA and free cash flow growth if demand does not recover or costs are not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.047 for BT Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.99, and the most bearish reporting a price target of just £1.18.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £20.0 billion, earnings will come to £1.7 billion, and it would be trading on a PE ratio of 14.9x, assuming you use a discount rate of 7.0%.

- Given the current share price of £1.99, the analyst price target of £2.05 is 2.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.