Key Takeaways

- Strong growth in data and mobile money segments, driven by rising smartphone adoption and an expanding African user base, underpins sustained revenue and margin expansion.

- Financial resilience is improving through balance sheet de-dollarization, local currency debt, and strategic investments in network infrastructure and operational efficiency.

- Severe currency devaluation, high costs, rising leverage, regulatory uncertainty, and digital disruption threaten revenue growth, profitability, and long-term market position.

Catalysts

About Airtel Africa- Provides telecommunications and mobile money services in Nigeria, East Africa, and Francophone Africa.

- The rapid, ongoing increase in Africa’s population and sustained urbanization, combined with low but rising smartphone penetration, is driving a large and expanding user base; management highlighted a 3% annual population growth and smartphone penetration rising 4 percentage points, with significant further headroom—supporting robust long-term volume-driven revenue growth.

- Accelerating adoption of data services and digital payments is evident, with 47% annual growth in data traffic, 17% year-over-year growth in data ARPU, and over 30% revenue growth in both data and mobile money segments; these trends underpin sustained double-digit constant currency revenue and EBITDA expansion.

- Airtel Money’s growth runway remains strong: only 27% of customers use the service, leaving substantial penetration opportunity, while the breadth of use cases and transaction values are increasing; management expects ongoing high-margin revenue growth and strong free cash flow conversion from this segment.

- The company’s continued network investment (including 4G/5G, fiber rollout, and infrastructure sharing agreements) and strategic cost efficiency programs are improving customer experience and operating leverage, supporting margin expansion and higher returns on invested capital.

- De-dollarization of the balance sheet (with 93% of OpCo debt now in local currency), decreased exposure to FX-driven finance costs, and increased local debt pushdown position Airtel Africa for improved net earnings stability and resilience in reported profits, especially as macroeconomic volatility stabilizes.

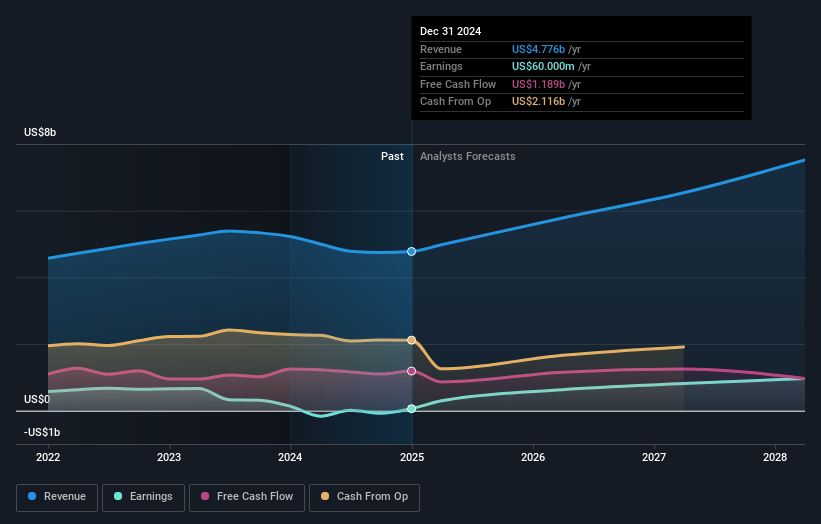

Airtel Africa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Airtel Africa's revenue will grow by 15.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.4% today to 12.2% in 3 years time.

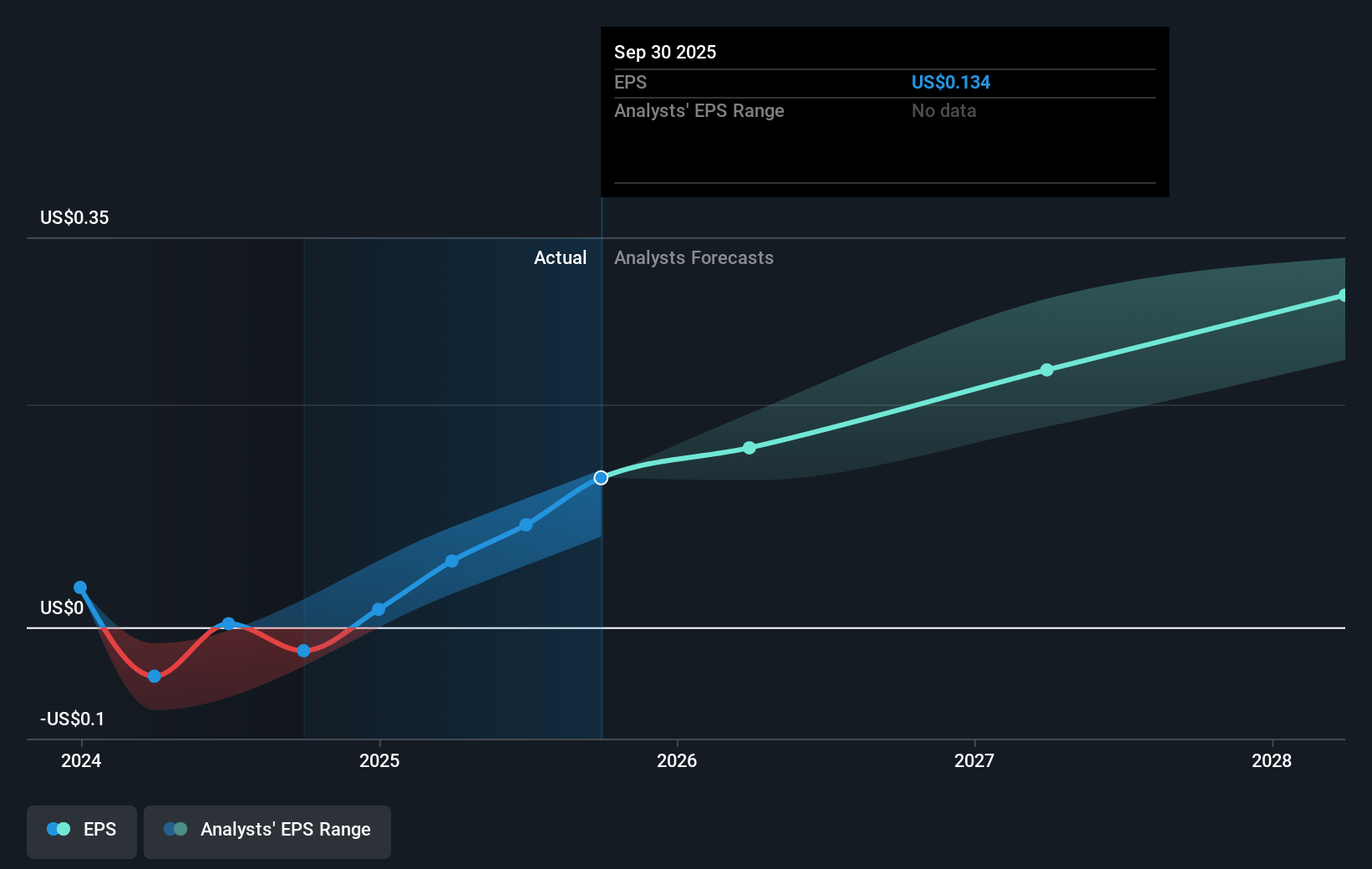

- Analysts expect earnings to reach $927.8 million (and earnings per share of $0.29) by about July 2028, up from $220.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, down from 41.3x today. This future PE is lower than the current PE for the GB Wireless Telecom industry at 40.9x.

- Analysts expect the number of shares outstanding to decline by 1.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.64%, as per the Simply Wall St company report.

Airtel Africa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing and severe currency devaluation—particularly the Nigerian naira—has materially reduced reported USD revenues, EBITDA, and earnings, posing a risk that future results could remain suppressed by local currency weakness and high inflation, despite strong constant currency performance.

- Persistent high operating and energy costs in key markets such as Nigeria—where 35% of OpEx is linked to fuel prices—combined with inflation and macroeconomic volatility, threaten to erode EBITDA margins and pressure net earnings if cost increases cannot be passed onto customers.

- High leverage and increased refinancing risk are evident, with group leverage rising from 1.4x to 2.3x within a year due to tower lease renewals and higher local currency borrowing, which exposes the company to rising local interest rates and higher financing costs, limiting flexibility and reducing net margins.

- Regulatory uncertainty and risk of delayed or constrained price adjustments—as shown by dependence on government approval for tariff hikes in Nigeria—could cap ARPU growth and stall revenue expansion, especially if future regulatory changes are less favorable or if customer price sensitivity is underestimated.

- Structural risks from increasing digital disruption—exemplified by infrastructure-sharing partnerships, potential over-reliance on traditional network investments, and the emergence of satellite-based solutions like Starlink—could erode Airtel Africa’s addressable market, reduce capital returns, and impact long-term revenue and profit outlook.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £2.009 for Airtel Africa based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £2.99, and the most bearish reporting a price target of just £1.38.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $7.6 billion, earnings will come to $927.8 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of £1.86, the analyst price target of £2.01 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.