Last Update01 May 25Fair value Decreased 0.073%

Key Takeaways

- Sage is advancing AI integration to boost operational efficiency and customer engagement, fostering revenue growth through adoption and retention.

- Strategic expansion and disciplined cost control are driving revenue growth and enhancing operating margins, supporting long-term earnings and shareholder value.

- Intensifying competition and slower customer acquisition, mixed with uncertainties in AI monetization, challenge Sage's revenue growth, retention, and long-term innovation.

Catalysts

About Sage Group- Provides technology solutions and services for small and medium businesses in the United States, the United Kingdom, France, and internationally.

- Sage Group is integrating AI into more business workflows with the introduction of Sage Copilot, a GenAI-powered digital assistant. This innovation can enhance operational efficiencies and customer engagement, driving future revenue growth through increased adoption and retention.

- Sage is focusing on scaling their platform, investing in core product development and integrating solutions into suites. This approach is expected to enhance customer value and cross-sell opportunities, thereby supporting sustained top-line revenue growth.

- The company is strategically expanding its successful products such as Sage Intacct into new markets like Europe. This expansion is likely to drive revenue growth through new customer acquisitions in untapped markets.

- Sage demonstrates disciplined cost control while prioritizing investment in sales, marketing, and R&D, which supports improved operating margins and long-term earnings. This balance of growth and efficiency could help improve net margins and earnings in the coming years.

- Sage has initiated a share buyback program, highlighting strong cash generation and a robust financial position. This can enhance earnings per share (EPS) and drive shareholder value, influencing investor perception positively.

Sage Group Future Earnings and Revenue Growth

Assumptions

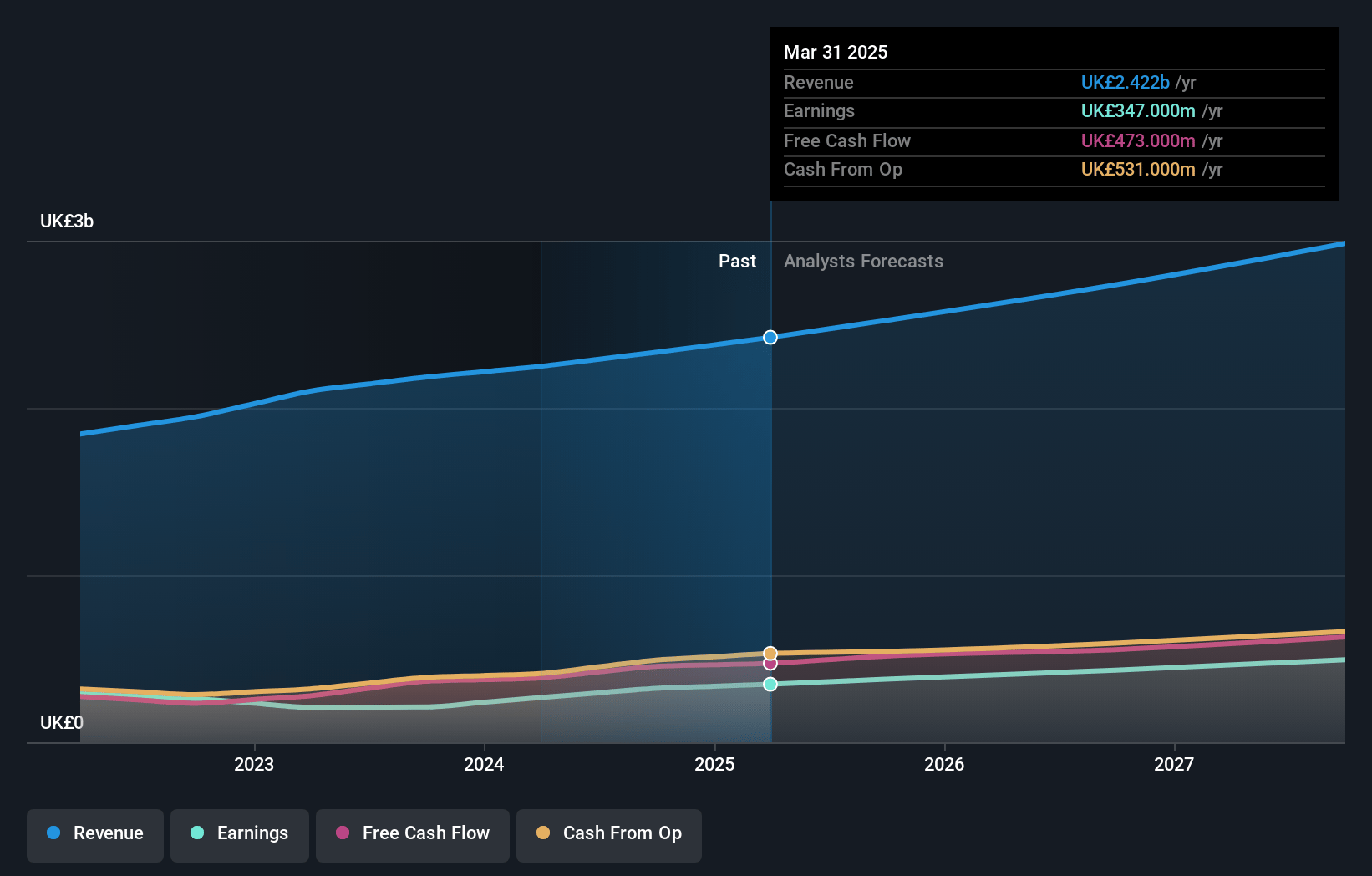

How have these above catalysts been quantified?- Analysts are assuming Sage Group's revenue will grow by 9.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.9% today to 16.3% in 3 years time.

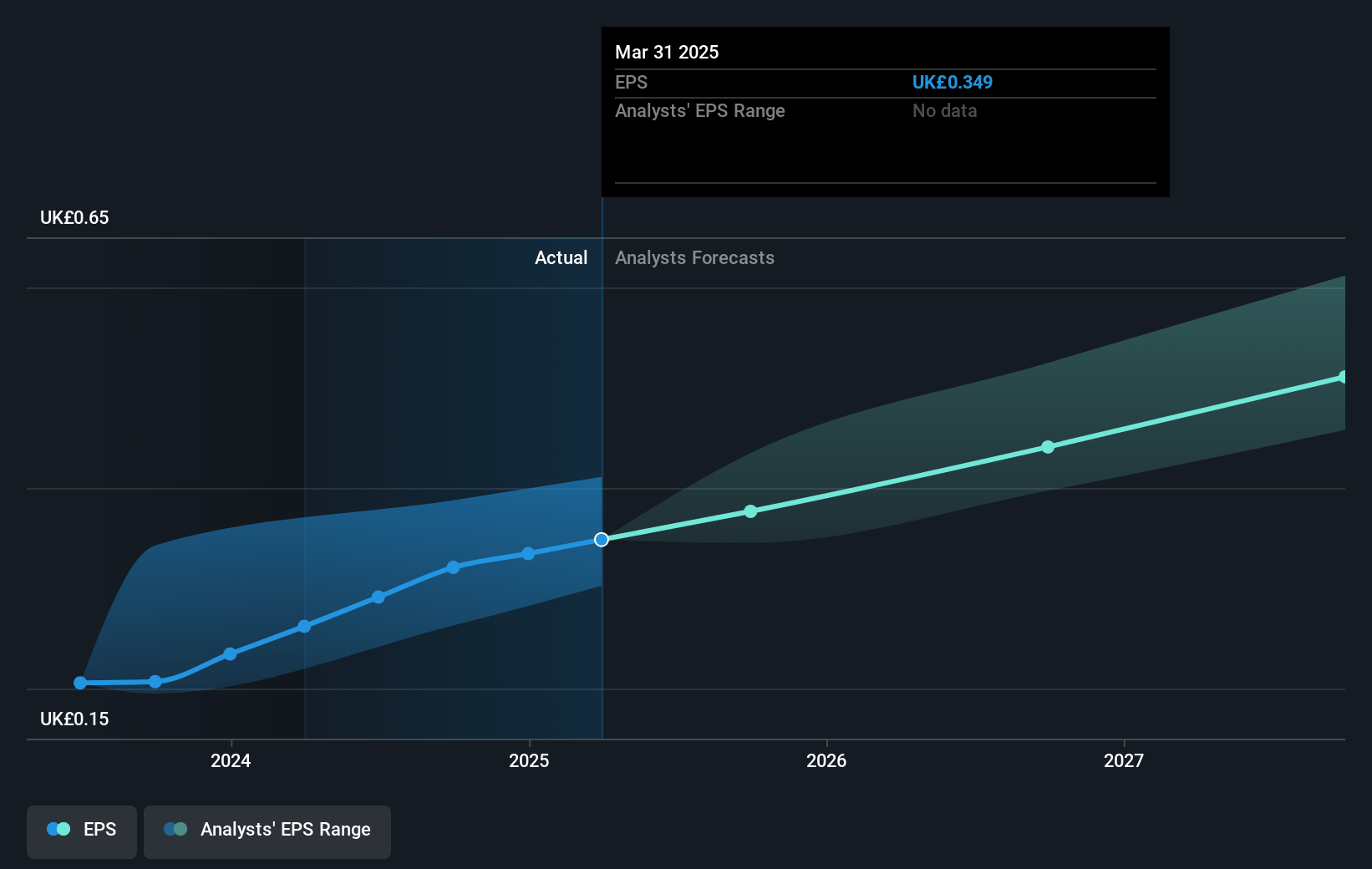

- Analysts expect earnings to reach £492.2 million (and earnings per share of £0.5) by about May 2028, up from £323.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £571 million in earnings, and the most bearish expecting £442 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.1x on those 2028 earnings, down from 37.0x today. This future PE is greater than the current PE for the GB Software industry at 30.0x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.45%, as per the Simply Wall St company report.

Sage Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The competitive environment for Sage Group is intensifying, with companies like Intuit and SAP expanding their offerings toward SMBs. This could potentially impact Sage's revenue growth and market share as customers have more choices.

- Despite strong growth in segments like Sage Intacct, there are signs of slower new customer acquisition (NCA) in North America, primarily due to cautious CFO decision-making. This could affect average revenue per user (ARPU) and limit top-line revenue momentum.

- Sage Copilot, a key AI-driven initiative, has yet to be monetized fully, which adds uncertainty to future earnings from this segment. The gradual scaling and variable monetization strategies could delay revenue realization.

- There is a slight decrease in the renewal rate by value from 102% to 101%, indicating potential challenges in customer retention and upsell, which are crucial for sustaining ARR growth and long-term revenue stability.

- While margin expansion is highlighted as a success, investment in R&D relative to sales has decreased, which may impact future innovation capability and competitive positioning, potentially restraining long-term EPS growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £13.456 for Sage Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £16.0, and the most bearish reporting a price target of just £10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £3.0 billion, earnings will come to £492.2 million, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 8.5%.

- Given the current share price of £12.38, the analyst price target of £13.46 is 8.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.