Last Update 27 Oct 25

Fair value Decreased 2.87%Unite Group’s analyst price target was reduced from £9.68 to £9.40, as analysts cite positive trends in international student demand while factoring in adjusted sector expectations.

Analyst Commentary

Recent analysis on Unite Group has surfaced a variety of key points reflecting both optimism and caution in the student accommodation sector. These insights focus on international student demand, evolving sector dynamics, and the company’s growth outlook.

Bullish Takeaways

- Analysts highlight the company as a top pick in the European property sector, citing Unite Group’s leading position in student accommodations.

- Growth prospects are considered favorable due to anticipated increases in international student enrollments, particularly as competing countries implement stricter entry rules.

- The positive outlook for student accommodation is expected to support both occupancy rates and rental growth, which may bolster Unite Group’s revenues.

- Unite Group’s consistent execution and sector specialization are viewed as strong contributors to its long-term value and earnings resilience.

Bearish Takeaways

- The price target reduction reflects tempered valuation expectations, signaling that sector headwinds and broader market adjustments are possible.

- Analysts remain attentive to macroeconomic pressures and policy changes that could impact international student flows and demand sustainability.

- Competitive pressures and regulatory uncertainties in the property sector could present operational challenges in the near term.

What's in the News

- Unite Group PLC was dropped from the FTSE 100 Index. (Key Developments)

- Unite Group PLC was added to the FTSE 250 Index and the FTSE 250 (Ex Investment Companies) Index. (Key Developments)

- The company proposed an interim dividend payment of 12.8 pence per share, representing a 3% increase compared to the previous year. The dividend will be paid on 31 October 2025. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has fallen slightly from £9.68 to £9.40.

- Discount Rate has risen marginally, increasing from 7.43% to 7.46%.

- Revenue Growth estimate remains virtually unchanged at approximately 9.27%.

- Net Profit Margin estimate is essentially stable, holding at 96.34%.

- Future P/E ratio has decreased from 13.21x to 12.84x.

Key Takeaways

- Strong demand and limited new supply boost Unite's pricing power, supporting rent growth, higher revenues, and stable high occupancy.

- Operational advantages, technology investments, and university partnerships position Unite to outperform competitors and expand recurring revenue streams.

- Rising commuter trends, regional oversupply, affordability issues, and increased leverage threaten Unite's occupancy, revenue growth, and profit margins, heightening financial and operational risks.

Catalysts

About Unite Group- Unite was founded in 1991 in Bristol and has grown to become the UK's largest owner, manager, and developer of PBSA serving the country's world-leading higher education sector.

- Persistent strong demand for UK higher education-especially from international students rebounding to pre-COVID levels, rising student visa applications, and the UK's competitive position versus US and Australia-points to sustained high occupancy and supports rental growth, driving higher future revenue and earnings.

- Supply constraints caused by limited new PBSA construction, heightened regulatory hurdles, and declines in HMO bed availability (down 10% over three years) create market scarcity that strengthens Unite's pricing power, supports ongoing rent increases, and should positively impact net operating income and asset valuations.

- Consolidation and operational challenges for competitors (e.g., development hurdles, build cost inflation, access to capital, and tightening regulation) leave Unite's platform, reputation, and university partnerships best placed to capture an expanded range of acquisition and partnership opportunities, accelerating portfolio growth and recurring revenue streams.

- The company's increased focus on high-quality university partnerships and targeted new developments in undersupplied, high-tariff university cities is likely to boost occupancy stability, reduce volatility, and enable margin expansion, supporting recurring earnings growth.

- Ongoing investment in technology platforms and tailored customer offerings (e.g., refreshed core undergraduate product, returning student concepts, and affordable schemes) are expected to enhance student retention, increase rebooking rates, and allow pricing differentiation-leading to improved average rental rates and greater long-term earnings visibility.

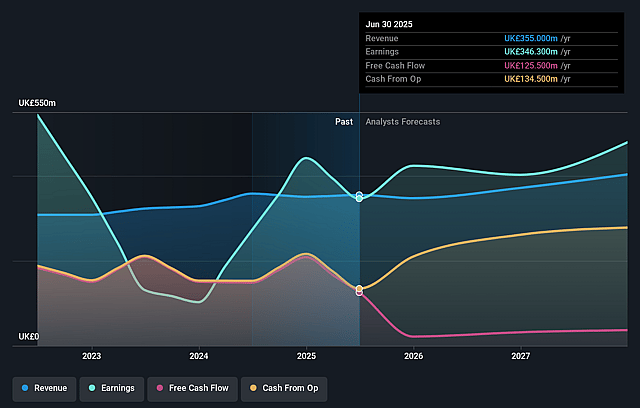

Unite Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Unite Group's revenue will grow by 9.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 97.5% today to 96.2% in 3 years time.

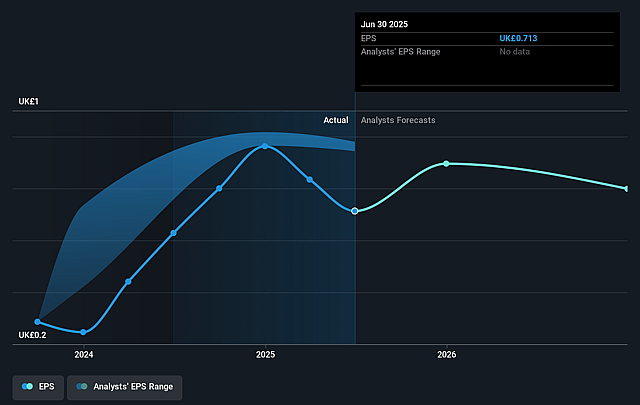

- Analysts expect earnings to reach £446.2 million (and earnings per share of £0.92) by about September 2028, up from £346.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.8x on those 2028 earnings, up from 10.0x today. This future PE is greater than the current PE for the GB Residential REITs industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 0.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.41%, as per the Simply Wall St company report.

Unite Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift in student behavior, with a growing proportion of UK 18-year-olds choosing to live at home and commute to university (now 1 in 3, up from 1 in 4 five years ago), could structurally reduce demand for student accommodation and put downward pressure on occupancy rates and future revenue growth.

- Increased supply in certain regional markets (e.g., Leeds, Nottingham, Bristol, Manchester) has already caused short-term rental and occupancy pressures, and continued local oversupply could negatively impact rental growth and lead to asset underperformance, affecting net margins and long-term returns.

- Unite's reliance on a concentrated group of strong university cities for both development and acquisitions exposes the company to regional demographic, regulatory, or university-specific risks; adverse changes in these markets could result in revenue instability and greater income volatility.

- As the company accelerates refurbishment, acquisition, and development programs, capital expenditure and maintenance costs are set to escalate, while higher leverage (net debt to EBITDA expected to rise to 6–7x) and rising cost of debt (projected to reach 4.5% by 2026) will increase financing expenses, potentially pressuring earnings and free cash flow.

- Affordability concerns are increasing, with 50–60% of PBSA market beds priced below Unite's, and students delaying bookings in search of better deals; stagnant student finances or a slowing in rent growth may limit Unite's ability to sustain above-inflation rental increases, impacting revenue and margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £10.141 for Unite Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £12.05, and the most bearish reporting a price target of just £9.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £463.8 million, earnings will come to £446.2 million, and it would be trading on a PE ratio of 13.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of £7.07, the analyst price target of £10.14 is 30.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.