Last Update01 May 25Fair value Decreased 1.75%

Key Takeaways

- Informa's strategic focus on high-growth markets and technology investments could enhance revenue, margins, and operational efficiencies.

- Expansion in B2B events and strategic partnerships may drive substantial revenue growth, supported by robust financial strategies like share buybacks.

- Informa faces revenue volatility from one-off deals, geopolitical disruptions, foreign exchange risks, and strategic risks in partnerships and AI integration challenges.

Catalysts

About Informa- Operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally.

- Informa's international expansion and the strategic repositioning towards high-growth geographic markets such as the United States, China, and the GCC region suggest a potential for sustained revenue growth beyond 2025.

- The company's investment in technology platforms and AI, including proprietary AI tools like Elysia, is set to enhance operational efficiencies and improve product offerings, which should positively impact net margins and earnings over time.

- The strategic partnership with venues like the Dubai World Trade Center aims to accelerate growth in key sectors such as healthcare and energy, potentially leading to substantial revenue increases from these expanded operations.

- The company's focus on expanding its B2B events portfolio, with increased brand syndication and geographic expansion, supports a robust pipeline for revenue and earnings, driven by the anticipated stronger penetration in high-growth sectors.

- Resumption of share buybacks, paired with strong free cash flow and a robust balance sheet, signals a commitment to return capital to shareholders while continuing to invest strategically in organic growth, potentially boosting earnings per share (EPS).

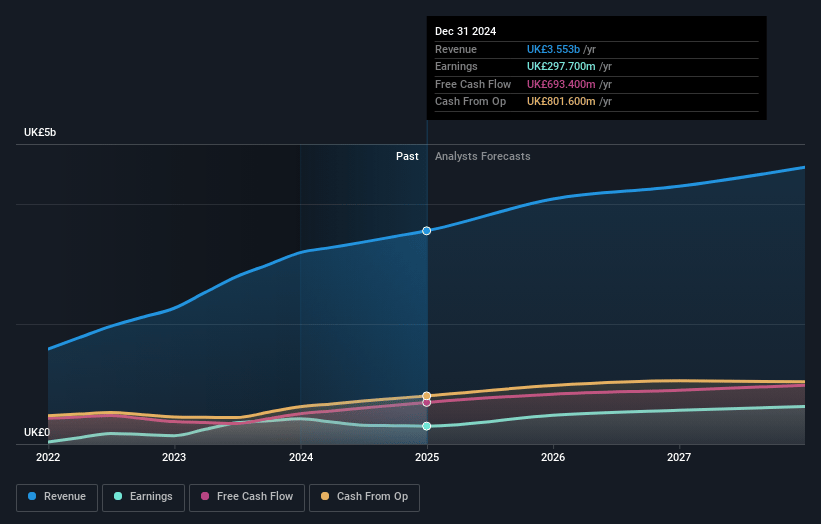

Informa Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Informa's revenue will grow by 8.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 13.2% in 3 years time.

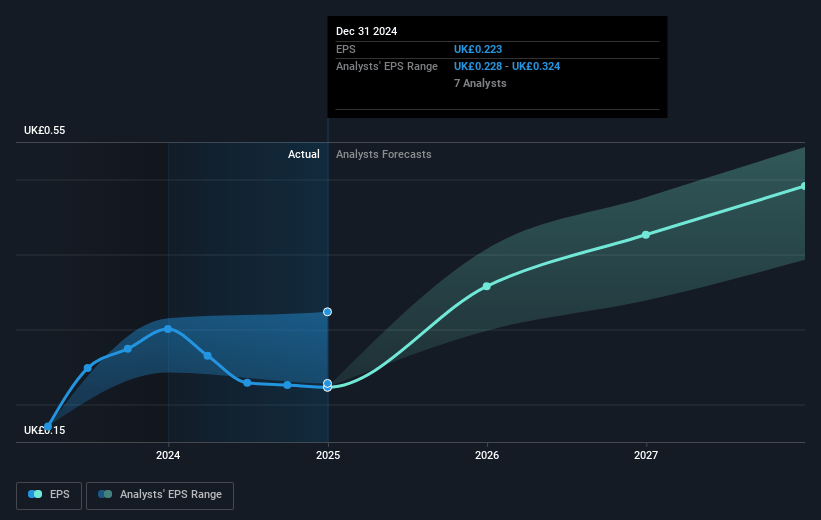

- Analysts expect earnings to reach £599.2 million (and earnings per share of £0.47) by about May 2028, up from £297.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £660.5 million in earnings, and the most bearish expecting £514 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.3x on those 2028 earnings, down from 32.0x today. This future PE is greater than the current PE for the GB Media industry at 12.1x.

- Analysts expect the number of shares outstanding to decline by 0.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.17%, as per the Simply Wall St company report.

Informa Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Some of Informa's revenue in the academic market is derived from one-off contractual deals that may not repeat, which could lead to revenue volatility in future years. This may impact revenue and predictability of earnings.

- Economic and political factors such as tariffs, funding cuts, and geopolitical issues, especially in key markets like the U.S. and China, could disrupt trade and negatively affect Informa's events and exhibitions business, impacting revenue and operating profit.

- Informa's significant presence in international markets exposes it to foreign exchange risk and international regulatory challenges, which could affect net margins and overall financial performance.

- The company's reliance on partnerships, such as those in Dubai, may present integration challenges and strategic risks, which, if not managed well, could affect operating margins and profitability.

- Although embracing AI is seen as beneficial, it poses a risk if not leveraged effectively alongside human capabilities, which could lead to inefficient resource use or missed market opportunities, impacting revenue growth and operational efficiency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £9.654 for Informa based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £10.7, and the most bearish reporting a price target of just £8.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £4.6 billion, earnings will come to £599.2 million, and it would be trading on a PE ratio of 25.3x, assuming you use a discount rate of 7.2%.

- Given the current share price of £7.28, the analyst price target of £9.65 is 24.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.