Key Takeaways

- Persistent fee compression, rising competition, and regulatory costs are expected to limit Wise's revenue growth and long-term margin expansion.

- Local digital alternatives and slower global remittance growth risk reducing Wise's addressable market and could challenge optimistic expectations for future performance.

- Strong organic growth, expanding partnerships, and product innovation position Wise for sustained revenue gains and margin improvement as it captures a growing global payments market.

Catalysts

About Wise- Provides cross-border and domestic financial services for personal and business customers in the United Kingdom, rest of Europe, the Asia-Pacific, North America, and internationally.

- The persistent downward pressure on cross-border transaction fees, driven by rising competition and Wise's own strategy of passing operational efficiencies to customers through further price reductions, is expected to compress take rates and limit revenue growth over time.

- High and rising global regulatory and compliance costs, along with ongoing investments to meet new standards, could increasingly burden Wise's operations as it expands into new markets, likely increasing cost of sales and administrative expenses and limiting future margin expansion.

- Proliferation of local digital banking solutions and alternative digital settlement rails (including potential rapid adoption of Central Bank Digital Currencies and stablecoins) threatens to disintermediate Wise's services, reducing addressable cross-border volumes and eventually constraining top-line growth.

- Compounding investments into infrastructure, technology, and headcount-while necessary for future expansion-will require Wise to sustain high reinvestment rates, likely resulting in long-term net margins remaining within or even below management's target range, despite scale efficiencies.

- Wise's long-term earnings and ROI remain highly dependent on continued strong customer acquisition and platform partnership ramp-up; however, as the international remittance market matures, the risk of slower growth rates may contribute to overoptimistic expectations embedded into the current stock valuation.

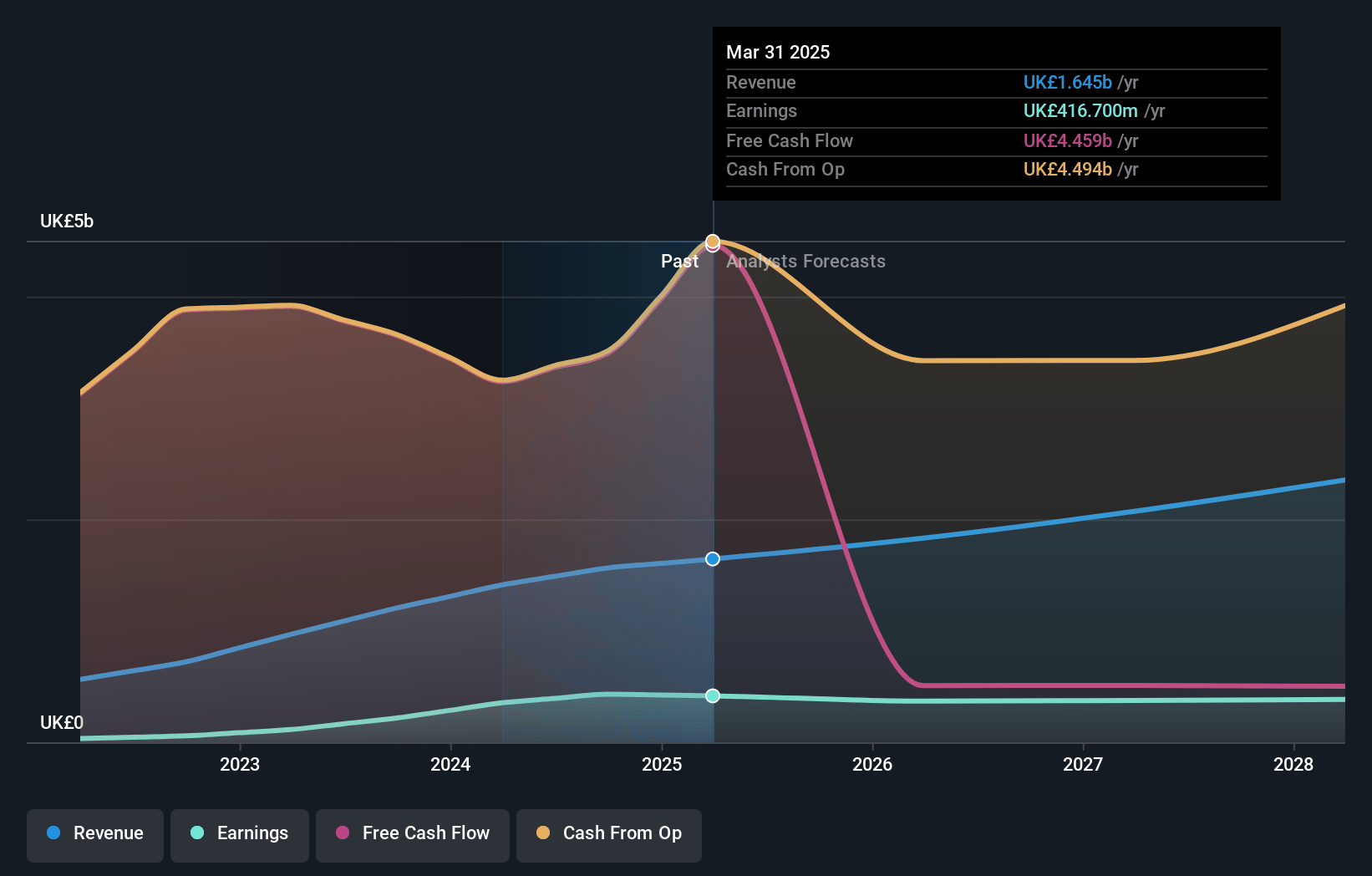

Wise Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wise's revenue will grow by 13.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 25.3% today to 16.3% in 3 years time.

- Analysts expect earnings to reach £387.7 million (and earnings per share of £0.37) by about July 2028, down from £416.7 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as £339.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.3x on those 2028 earnings, up from 27.6x today. This future PE is greater than the current PE for the GB Diversified Financial industry at 16.7x.

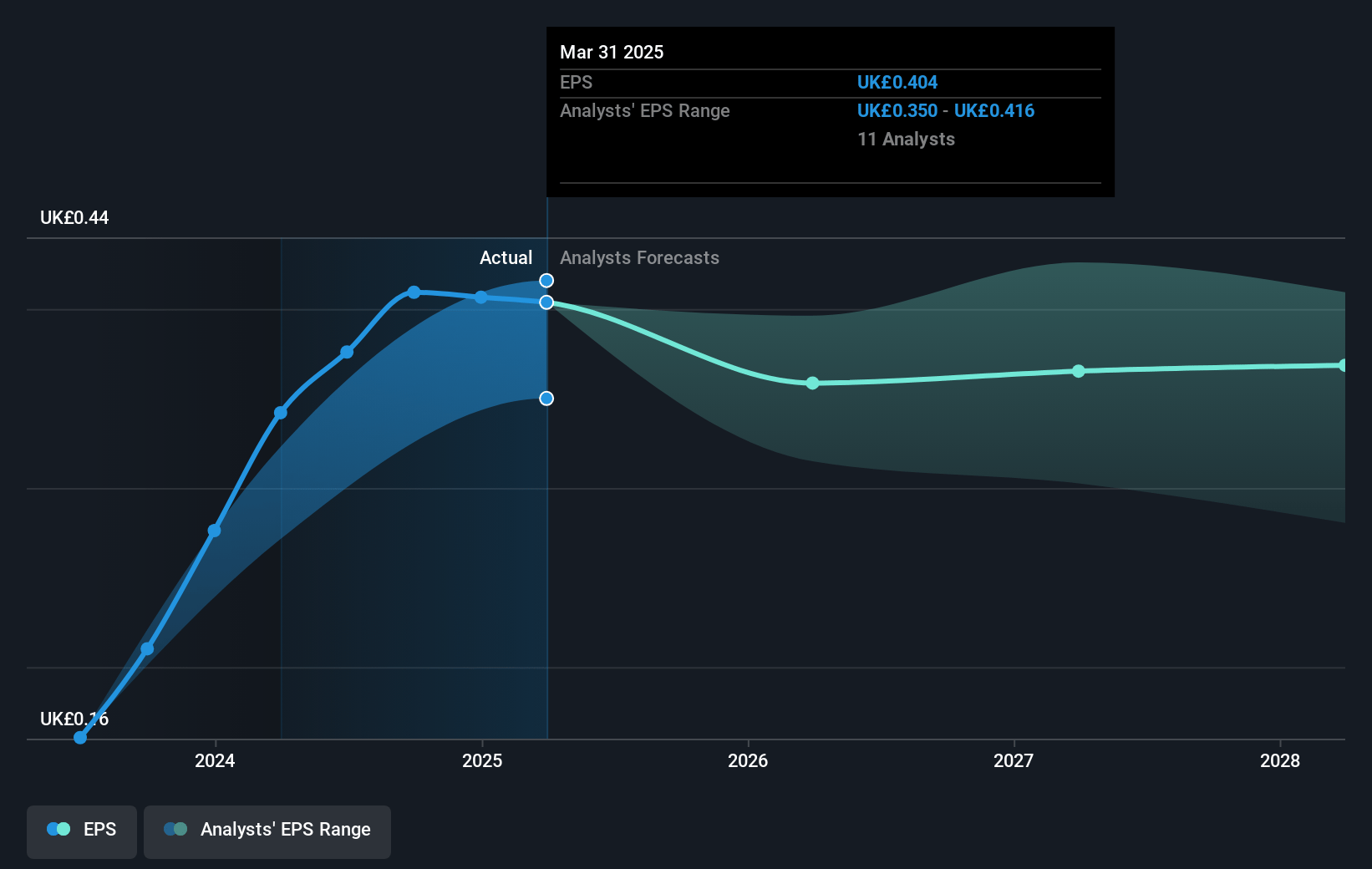

- Analysts expect the number of shares outstanding to decline by 0.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Wise Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wise continues to benefit from long-term secular trends such as the growth of globalization and cross-border commerce, with a massive and still underpenetrated £32 trillion total addressable market (TAM), which supports ongoing customer and revenue growth despite fee reductions.

- The company's consistent double-digit growth in customers (21%) and cross-border volume (23%) year-on-year-driven largely by word-of-mouth and sticky SME cohorts-demonstrates strong organic demand and sustained competitive advantage, providing resilience in revenues and customer retention.

- Expansion and integration of Wise Platform with major banks (e.g., Itau and Raiffeisen) and anticipated increases in platform revenue (mid-term goal of 10%, long term 50%) position Wise to capture significant institutional and B2B flows, which could drive future revenue, margin scaling, and brand value.

- Wise is investing heavily in product ecosystem expansion (Wise Account, cards, asset products, and features for SMEs), increasing customer holdings (up 33% yoy), helping to diversify and boost ARPU and customer lifetime value, which supports long-term revenue and earnings growth.

- As Wise scales and further automates its technology and infrastructure, cost of sales growth remains well below income growth (5% vs. 16%), expanding gross margins to 75% and supporting operational leverage, which is likely to drive long-term margin expansion and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £11.923 for Wise based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £14.2, and the most bearish reporting a price target of just £7.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.4 billion, earnings will come to £387.7 million, and it would be trading on a PE ratio of 38.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of £11.32, the analyst price target of £11.92 is 5.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.