Last Update 15 Dec 25

Fair value Increased 3.00%TSCO: Modest Margin Inflection And Consumer Headwinds Will Shape Near-Term Performance

Analysts have modestly raised their Tesco price target, reflecting a slightly higher fair value estimate of approximately $4.84, up from about $4.70, supported by incremental improvements in revenue growth, profit margin and expected future valuation multiples.

Analyst Commentary

Analyst opinion on Tesco remains cautiously constructive, with recent price target adjustments reflecting incremental confidence in the group’s ability to execute on its strategy while navigating a still fragile consumer backdrop.

Bullish Takeaways

- Bullish analysts see Tesco as a relative hedge against consumer uncertainty. They cite its focus on value, strong private label offering and scale advantages in food retail as supportive of steady traffic and share gains.

- Recent model updates point to improving confidence in a margin inflection over the medium term. Cost efficiencies, mix optimization and disciplined capital allocation are seen as supporting a gradual uplift in underlying profitability.

- The current valuation discount to Tesco’s historical averages is viewed by bullish analysts as increasingly difficult to justify, particularly if management continues to deliver consistent like for like growth and cash generation.

- Commentary around long term initiatives, including digital expansion, loyalty personalization and supply chain upgrades, reinforces the view that Tesco has the building blocks in place to sustain low to mid single digit growth while maintaining attractive returns.

Bearish Takeaways

- Bearish analysts remain concerned that a still pressured consumer, ongoing food price deflation in some categories and intense competition could cap Tesco’s ability to reprice meaningfully higher. This could limit upside to margins and valuation multiples.

- There is some skepticism about the pace and durability of any margin inflection. Critics highlight execution risk around cost savings, technology investments and store refurbishments that must be delivered without disrupting operations.

- Sentiment is also tempered by the risk that consensus expectations drift higher following recent upgrades, raising the bar for future quarters and increasing the chance of disappointment if sales trends or cost discipline soften.

- A subset of cautious analysts argue that while Tesco’s strategic positioning is solid, the near term risk reward looks more balanced, with limited re rating potential unless the company can clearly outperform both its peers and its own upgraded guidance.

What's in the News

- Tesco is strengthening its baby category appeal with a new end-of-aisle "one stop shop" bathtime display in UK and Ireland stores, developed with Solution International Nordics AB to drive incremental sales and support a joint 2026/27 promotional plan (Key Developments).

- Pacvue has launched an integrated partnership with Tesco Media and Epsilon Retail Media, enabling brands to run, automate and measure sponsored product campaigns on Tesco with new "Sales at Checkout" reporting for improved attribution and cross-retailer comparability (Key Developments).

- Solution International is expanding its "Grow with Peppa" character merchandise range in Tesco, adding baby feeding products across up to 510 stores and online, targeting value-conscious parents and aligning with a broader Peppa Pig strategy refresh (Key Developments).

- Tesco PLC has set its interim dividend at 4.80 pence per share for the 26 weeks ended 23 August 2025, maintaining its policy of paying 35% of the prior full-year dividend, with payment due on 21 November 2025 and an available DRIP option for shareholders (Key Developments).

Valuation Changes

- Fair Value Estimate has risen slightly from $4.70 to approximately $4.84 per share, reflecting a modest upgrade to Tesco’s intrinsic valuation.

- Discount Rate is effectively unchanged, ticking up only marginally from 7.95% to about 7.96%, implying a stable risk and return assumption.

- Revenue Growth has increased slightly from around 2.81% to approximately 2.86%, indicating a modestly stronger top line outlook.

- Net Profit Margin has risen modestly from about 2.76% to roughly 2.79%, signalling a small improvement in expected underlying profitability.

- Future P/E multiple has edged higher from 16.5x to about 16.8x, suggesting a slightly richer valuation as confidence in medium term earnings sustainability improves.

Key Takeaways

- Investments in quality, innovation, and digital expansion aim to boost customer satisfaction, market share, and top-line growth.

- Streamlined operations and personalized pricing strategies focus on enhancing net margins and customer loyalty, supporting revenue and earnings growth.

- Intense competition, economic uncertainty, regulatory changes, and supplier cost increases could compress Tesco's margins despite investments in quality, service, and colleague pay.

Catalysts

About Tesco- Operates as a grocery retailer in the United Kingdom, Republic of Ireland, the Czech Republic, Slovakia, and Hungary.

- Tesco's focus on boosting customer satisfaction through investments in quality, innovation, and enhanced shopping experiences is expected to drive future market share gains, potentially increasing revenue growth.

- Sustained efforts in streamlining operations and achieving cost savings under their 'Save to Invest' program are likely to enhance net margins by improving operational efficiency and offsetting cost pressures.

- The decision to continue expanding their digital presence and capabilities, including the Tesco Whoosh rapid delivery service and Marketplace, is poised to boost orders and basket sizes, contributing to top-line growth.

- The strategic emphasis on Clubcard and personalized pricing strategies, coupled with expanded promotional offers, aims to deepen customer loyalty and increase sales volume, positively impacting both revenue and net margins.

- A robust commitment to shareholder returns, as evidenced by significant share buybacks, supports confidence in EPS growth while maintaining a strong balance sheet allows for strategic investments that can drive future earnings.

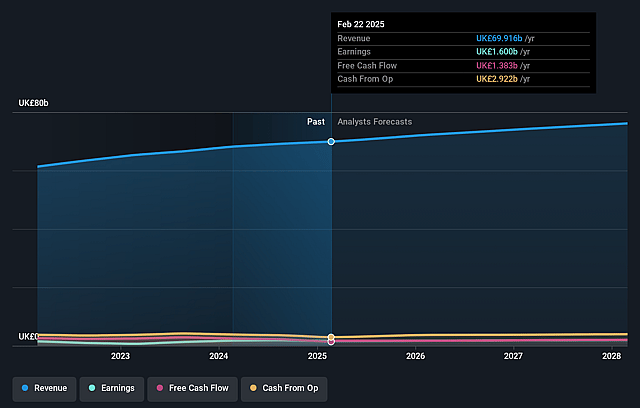

Tesco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tesco's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 2.6% in 3 years time.

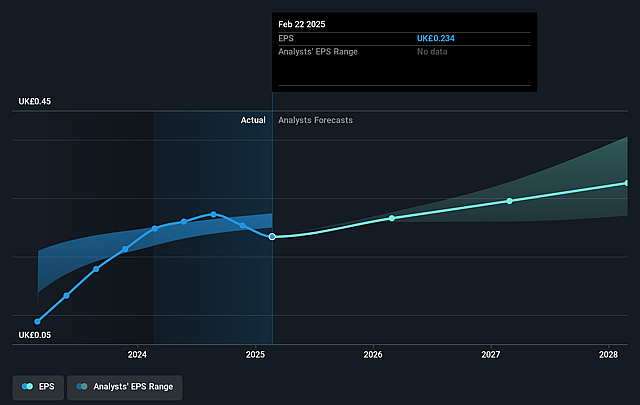

- Analysts expect earnings to reach £2.0 billion (and earnings per share of £0.33) by about September 2028, up from £1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, down from 17.5x today. This future PE is about the same as the current PE for the GB Consumer Retailing industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 1.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.76%, as per the Simply Wall St company report.

Tesco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense competition in the U.K. food retail sector requires Tesco to maintain high levels of quality, value, and service, which could compress net margins as they invest heavily to stay competitive.

- The economic uncertainty and pressure on household budgets may negatively impact consumer sentiment and reduce overall consumer spending, potentially hindering revenue growth.

- Increased investment in U.K. colleague store pay and wages could elevate operating expenses, affecting net margins if not offset by revenue growth.

- Regulatory changes and tax increases could impose additional costs, affecting earnings and net income if not mitigated by price increases or operational efficiencies.

- The volatility in commodity markets and exchange rates, combined with increased supplier costs, could further squeeze margins if Tesco cannot pass these costs onto consumers without losing market share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.292 for Tesco based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.75, and the most bearish reporting a price target of just £3.16.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £76.0 billion, earnings will come to £2.0 billion, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 7.8%.

- Given the current share price of £4.31, the analyst price target of £4.29 is 0.4% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Tesco?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.