Key Takeaways

- Rising sustainability demands and consolidation in grocery retail threaten Ocado's pricing power, contract terms, and margin stability.

- Heavy investment in automation and underperforming divisions risk negative earnings if client expansion lags amid economic and geopolitical headwinds.

- Expanded automation offerings, efficiency gains, and new market opportunities position Ocado for sustainable revenue growth, improved profitability, and greater financial resilience.

Catalysts

About Ocado Group- Operates as an online grocery retailer in the United Kingdom and internationally.

- Ocado's long-term profitability is threatened by new regulatory and consumer scrutiny around the sustainability of automated fulfillment, as rising demands for low-carbon operations may significantly increase energy and compliance costs for its warehouse and logistics operations, reducing net margins over time.

- The proliferation of AI and automation technology in logistics makes it easier for new and existing competitors to replicate Ocado's solutions, undermining its long-term pricing power and eroding high-margin technology licensing revenues as clients gain greater bargaining power and alternative options.

- Heavy fixed-cost investments into proprietary fulfilment infrastructure and automation may be increasingly difficult to recoup if Ocado fails to rapidly expand its client base amid global economic uncertainty and heightened geopolitical risks, leading to persistently negative earnings and diminishing returns on invested capital.

- The ongoing underperformance of the deconsolidated online grocery retail business, combined with rising wage and delivery costs, could continue to sap earnings contributions and weigh on Ocado's overall revenue growth if the JV fails to achieve sustained profitability or loses share to more adaptable ultra-fast delivery models.

- Global consolidation among major grocery retailers, while theoretically expanding Ocado's addressable market, is more likely to concentrate client power and drive tougher contract negotiations, which could suppress future recurring revenue growth and keep operating leverage below investor expectations.

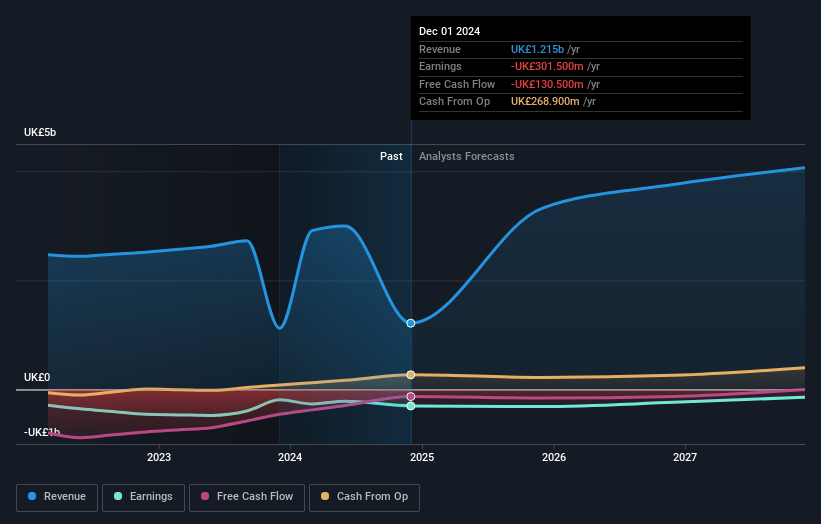

Ocado Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Ocado Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Ocado Group's revenue will grow by 49.7% annually over the next 3 years.

- The bearish analysts are not forecasting that Ocado Group will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Ocado Group's profit margin will increase from -26.7% to the average GB Consumer Retailing industry of 2.3% in 3 years.

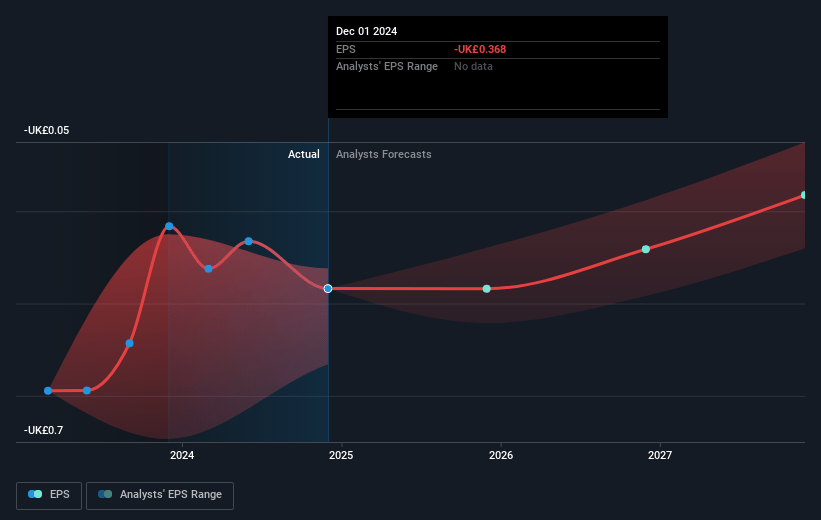

- If Ocado Group's profit margin were to converge on the industry average, you could expect earnings to reach £98.0 million (and earnings per share of £0.12) by about July 2028, up from £-344.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.9x on those 2028 earnings, up from -8.3x today. This future PE is greater than the current PE for the GB Consumer Retailing industry at 19.0x.

- Analysts expect the number of shares outstanding to grow by 0.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Ocado Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ocado is seeing strong growth in Technology Solutions, with recurring revenue up 10 percent and average live modules up 9 percent, indicating the scalability and stickiness of its platform, which could drive higher future revenue and operating leverage.

- Roll-off of exclusivity agreements is expected to open up multiple new markets for Ocado, and the company reports an active and growing sales pipeline, which may result in additional high-margin contracts and broaden its geographic diversification, supporting long-term revenue expansion.

- Investment in and deployment of a wider range of automation and hybrid solutions allows Ocado to flexibly serve both large and small grocers in different stages of e-commerce maturity, making its addressable market significantly larger and potentially translating to higher recurring income over time.

- Ocado Retail, though deconsolidated, reported 16 percent revenue growth, improving utilization, and strong customer acquisition dynamics, implying core technology remains highly competitive and attractive to partners, which could sustain and grow earnings via license and service fees.

- Recent improvements in operational efficiency-including automation driving labor savings, declining technology costs, and robust discipline in fixed costs-suggest the path to sustainable positive cash flow and margin expansion is achievable, directly supporting future earnings and financial resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Ocado Group is £2.1, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Ocado Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.0, and the most bearish reporting a price target of just £2.1.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be £4.3 billion, earnings will come to £98.0 million, and it would be trading on a PE ratio of 22.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of £3.41, the bearish analyst price target of £2.1 is 62.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.