Last Update 30 Nov 25

Fair value Decreased 0.85%BKG: Future Earnings Guidance And CFO Appointment Will Support Stable Returns

Analysts have revised their price target for Berkeley Group Holdings slightly downward to £43.47. They cite modestly weaker projected revenue growth, which is balanced against a small uptick in expected profit margins and higher discount rates.

What's in the News

- Neil Eady has been appointed as Chief Financial Officer, effective Monday. He brings over two decades of experience in property and development, having held key finance roles within the group and with other leading firms. (Company statement)

- Berkeley Group Holdings has confirmed its earnings guidance and is targeting pre-tax earnings of £450 million for the full year ending 30 April 2026. (Company statement)

Valuation Changes

- Fair Value: Decreased slightly from £43.85 to £43.47.

- Discount Rate: Increased modestly from 9.20% to 9.27%.

- Revenue Growth: Projected rate declined from -0.25% to -0.32%.

- Net Profit Margin: Improved slightly from 14.12% to 14.15%.

- Future P/E: Lowered marginally from 14.74x to 14.65x.

Key Takeaways

- Berkeley 2035 strategy focuses on brownfield development and build-to-rent expansion, aiming to drive long-term revenue and earnings growth.

- Flexible capital allocation plans and anticipated market improvements suggest strong future cash flow, increased sales, and enhanced shareholder returns.

- The transition to new regulations and increased taxation and costs may challenge net margins, impacting long-term profitability and revenue stability.

Catalysts

About Berkeley Group Holdings- Engages in the residential-led and mixed-use property development and ancillary activities in the United Kingdom.

- Introduction of Berkeley 2035 strategy focuses on long-term growth via capitalizing on brownfield land development opportunities, potentially increasing future revenue and earnings.

- Improvement in the planning system, particularly for urban brownfield sites, could unlock existing land value, enhancing future net margins through more efficient development processes.

- Planned expansion of the build-to-rent portfolio is anticipated to drive future value and net income, positively impacting earnings and cash flow.

- Flexible capital allocation with £7 billion identified for investment over ten years, including potential share buybacks and dividends, shows confidence in strong future cash flow and shareholder returns.

- Improved and stable market conditions anticipated to facilitate increased sales volumes and optimize site delivery, potentially leading to higher revenues and consistent operating margins.

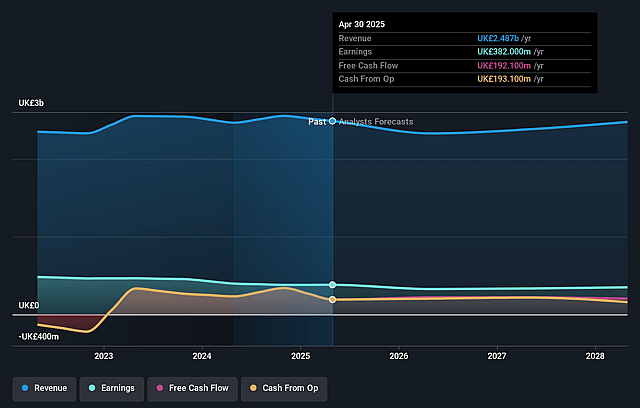

Berkeley Group Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Berkeley Group Holdings's revenue will decrease by 0.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 15.4% today to 14.2% in 3 years time.

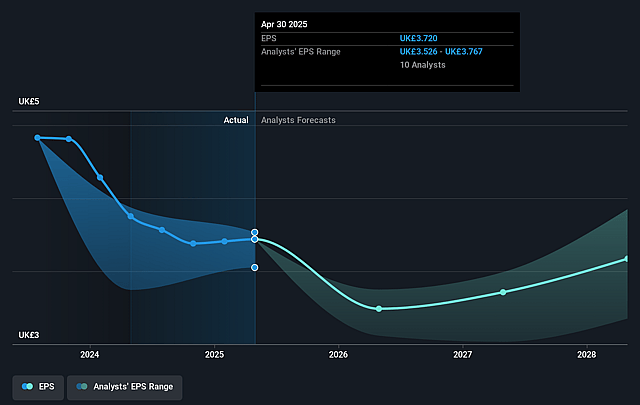

- Analysts expect earnings to reach £350.9 million (and earnings per share of £3.58) by about September 2028, down from £382.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.2x on those 2028 earnings, up from 8.9x today. This future PE is greater than the current PE for the GB Consumer Durables industry at 13.0x.

- Analysts expect the number of shares outstanding to decline by 2.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

Berkeley Group Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to a new building safety regime and regulator may lead to increased costs and potential delays in projects, potentially impacting net margins and overall earnings.

- Inflationary pressures over recent years have significantly raised build costs by over 40%, which might continue to squeeze profit margins and impact net profitability.

- Development viability is challenged by high levels of taxation, including a proposed additional building safety levy and a 4% residential property developers tax, which could reduce net earnings.

- Fluctuations in the real estate market, as evidenced by a 1/3 decrease in sales volumes compared to 2023, could impact revenue stability and long-term profitability.

- Dependency on continued improvement in the planning system for unlocking development opportunities introduces execution risk, which can affect future revenue and return on investment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £44.289 for Berkeley Group Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £52.6, and the most bearish reporting a price target of just £36.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £2.5 billion, earnings will come to £350.9 million, and it would be trading on a PE ratio of 14.2x, assuming you use a discount rate of 8.9%.

- Given the current share price of £35.42, the analyst price target of £44.29 is 20.0% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Berkeley Group Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.