Last Update 06 Dec 25

ELIX: Index Inclusions Will Drive Strong Future Momentum And Upside Potential

Narrative Update on Elixirr International

Analysts have nudged their price target on Elixirr International slightly higher to align more closely with its steady fair value estimate of £11.30, citing marginally lower discount rates and sustained expectations for strong revenue growth and profit margins.

What's in the News

- Elixirr International plc has been added to the FTSE All Share Index, increasing its visibility among UK institutional investors (index announcement).

- The company has also been included in the S&P Global BMI Index, broadening its exposure to global passive and benchmark-driven funds (index announcement).

Valuation Changes

- Fair Value Estimate, unchanged at £11.30 per share, indicating a stable central valuation view.

- Discount Rate, edged down slightly from 7.36 percent to 7.34 percent, supporting a marginally higher present value of future cash flows.

- Revenue Growth, effectively unchanged at around 18.4 percent, reflecting steady expectations for top line expansion.

- Net Profit Margin, broadly stable at about 19.9 percent, signalling no material shift in long term profitability assumptions.

- Future P/E, eased slightly from 15.35x to 15.34x, implying a near identical valuation multiple on forward earnings.

Key Takeaways

- Strong insider commitment and strategic acquisitions focus on AI and organizational transformation, fueling growth and earnings potential.

- Geographical and industry diversification, combined with talent enhancement, positions Elixirr for resilience and sustained revenue growth.

- Heavy reliance on a few sectors and potential acquisition integration issues could threaten revenue growth and financial stability amidst competition and employee retention challenges.

Catalysts

About Elixirr International- Through its subsidiaries, provides management consultancy services in the United Kingdom, the United States, and internationally.

- Elixirr's leadership team has demonstrated strong commitment to growth with 97-98% of pre-IPO options still held by insiders, reducing dilution risk and signaling belief in the company’s future. This continuity and insider confidence suggest future stability and potential earnings growth.

- The company has made strategic acquisitions like Insigniam to enhance its service offerings, focusing on high-growth areas such as AI and organizational transformation, which can drive revenue growth through cross-sell opportunities and new client acquisition.

- Elixirr is expanding its geographical presence, with recent acquisitions focused in the U.S.—the largest consulting market—providing a platform for substantial revenue growth and increased market share.

- The firm is proactively diversifying its industry focus, reducing dependency on single sectors by serving clients across 13 industries and increasing the number of high-value gold clients, which strengthens its resilience and ability to maintain steady revenue during economic downturns.

- Elixirr is enhancing its human capital by attracting high-caliber talent with an entrepreneurial remuneration model and expanding its workforce capabilities, especially by leveraging new hires to drive business development, which can increase net margins and long-term earnings.

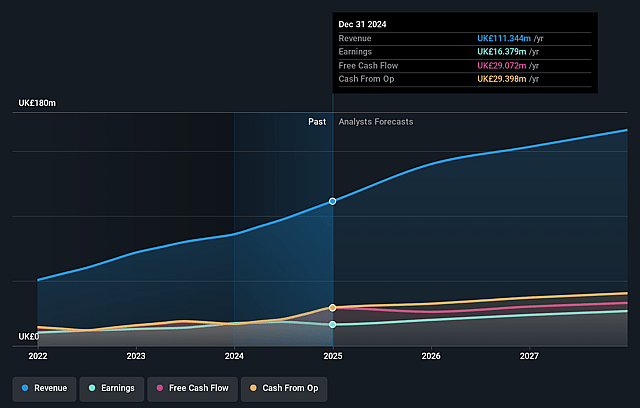

Elixirr International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Elixirr International's revenue will grow by 14.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.7% today to 16.4% in 3 years time.

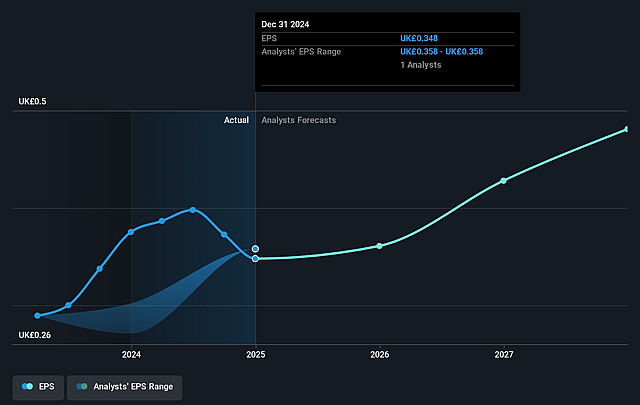

- Analysts expect earnings to reach £27.2 million (and earnings per share of £0.52) by about May 2028, up from £16.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.2x on those 2028 earnings, up from 21.7x today. This future PE is greater than the current PE for the GB Professional Services industry at 22.3x.

- Analysts expect the number of shares outstanding to grow by 1.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.66%, as per the Simply Wall St company report.

Elixirr International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces potential challenges from employee churn, particularly if the equity incentive model does not continue to engage top performers, which could impact the company's ability to deliver consistent revenue growth.

- The gross margin is lower compared to some professional services businesses. If it does not improve, it could pressure net margins, especially as they scale up their operations.

- There is heavy reliance on a few sectors and markets for current growth. Economic downturns or industry-specific challenges could adversely affect client spending, impacting total revenue.

- The execution risk associated with the company's aggressive acquisition strategy could lead to integration issues or failure to realize expected synergies, negatively affecting earnings.

- Increasing competition from larger consultancies with similar services may limit Elixirr’s ability to capture additional market share, possibly impacting revenue and long-term financial growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £10.367 for Elixirr International based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £11.0, and the most bearish reporting a price target of just £9.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £165.3 million, earnings will come to £27.2 million, and it would be trading on a PE ratio of 23.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of £7.45, the analyst price target of £10.37 is 28.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Elixirr International?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.