Key Takeaways

- Growth is driven by water infrastructure investment, clean energy trends, and strategic partnerships, diversifying revenue streams and expanding into automation and digital solutions.

- Focus on service, recurring sales, and supply chain resilience is boosting margins, profitability, and enabling continued shareholder returns and potential acquisitions.

- Market volatility, transformation costs, and aggressive investment and M&A strategies may pressure margins and earnings, impacting revenue stability and long-term value.

Catalysts

About Rotork- Designs, manufactures, and markets industrial flow control and instrumentation solutions for the oil and gas, water and wastewater, power, chemical process, and industrial markets in the United Kingdom, Asia Pacific, the United States, Europe, the Middle East, Africa, and internationally.

- Rotork is benefiting from accelerating investment in water infrastructure, desalination, and treatment driven by global water scarcity concerns and regulatory requirements. This is fueling strong growth in its Water & Power division and is expected to support long-term revenue expansion as new mega-projects and regulatory cycles, such as AMP8 in the UK and the US Infrastructure Investment and Jobs Act, ramp up over the next several years.

- The company's expanding presence in electrification and decarbonization projects-especially upstream and midstream Oil & Gas (e.g., LNG, methane reduction, fully electrified platforms)-positions Rotork to capture structural demand from the global transition to cleaner energy and stricter emissions standards. This is likely to mitigate longer-term oil & gas declines and create growth in new energy markets, supporting a resilient and more diversified revenue base.

- Increasing focus on service, aftermarket, and digital asset management (now at 23% of group sales and growing faster than the core business) is expected to boost recurring revenues and margins, as service can drive multiples of initial product sales over a product's lifecycle, improving long-term net margin and earnings quality.

- Strategic partnerships (e.g., Rockwell's Partner Network) and investments in smart/digital products (IQ Pro actuators, IoT-enabled Hanbay acquisitions) are opening up access to new routes to market, accelerating penetration into automation-heavy sectors like data centers, greenfield industrial projects, and adjacent verticals, likely driving incremental top-line growth and improving pricing power over time.

- The company's operational agility, local-for-local supply chain model, and ongoing factory automation/supply chain optimization are enhancing cost structure resilience amid a volatile geopolitical environment, supporting consistent profitability and strong cash generation, which in turn allows for ongoing shareholder returns (buybacks/dividends) and future bolt-on M&A, further supporting long-term EPS growth.

Rotork Future Earnings and Revenue Growth

Assumptions

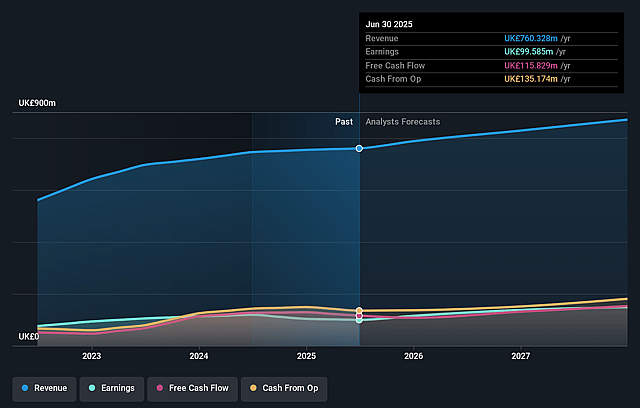

How have these above catalysts been quantified?- Analysts are assuming Rotork's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.1% today to 18.6% in 3 years time.

- Analysts expect earnings to reach £164.9 million (and earnings per share of £0.18) by about September 2028, up from £99.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, down from 28.5x today. This future PE is greater than the current PE for the GB Machinery industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.74% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.07%, as per the Simply Wall St company report.

Rotork Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dependence on continued strong performance in target segments and service offerings carries risk if growth moderates or market focus shifts, which could lead to revenue growth falling below expectations.

- Currency headwinds and ongoing business transformation costs (such as investment in ERP, relocation, and acquisitions) are impacting reported margins and free cash flow, introducing volatility in earnings and profitability.

- The company's exposure to cyclical markets (e.g., Oil & Gas, bulk chemicals) and variability in geographic performance (e.g., weaker Americas region, flat EMEA performance in CPI) may result in periods of revenue stagnation or contraction, affecting overall growth and earnings visibility.

- The need for ongoing investment in technology, R&D, and service headcount (especially to support digitalisation, data center opportunities, and nuclear re-entry) could put sustained pressure on net margins if not matched by incremental revenue, leading to potentially lower earnings quality.

- Increasing M&A activity and reliance on successful bolt-on integrations (e.g., Noah, Hanbay) present risks of suboptimal capital allocation, integration challenges, or overpaying for growth, which may dilute returns on capital employed and impact long-term shareholder value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £3.814 for Rotork based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £4.4, and the most bearish reporting a price target of just £3.45.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £884.0 million, earnings will come to £164.9 million, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of £3.42, the analyst price target of £3.81 is 10.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.