Last Update 01 Dec 25

Fair value Decreased 5.64%GEN: Sequential Margin Improvements Will Drive Profitability Higher Through 2025

Genuit Group's analyst price target has been revised downward from £4.86 to £4.58 as analysts factor in a higher discount rate along with modest changes in key financial forecasts.

What's in the News

- Genuit Group plc has issued new earnings guidance for the full year 2025, projecting underlying operating profit between £92 million and £95 million (Key Developments).

- The company expects sequential increases in underlying operating margins in the second half of 2025, with improvements attributed to price increases and productivity gains from the Genuit Business System (Key Developments).

- Additional cost efficiencies are anticipated to support improved profitability throughout 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased moderately, moving from £4.86 to £4.58.

- Discount Rate has risen slightly, rising from 8.78% to 9.17%.

- Revenue Growth forecast has increased, increasing from 6.81% to 7.17%.

- Net Profit Margin has declined marginally, falling from 9.82% to 9.51%.

- Future P/E ratio estimate has decreased, dropping from 22.08x to 21.52x.

Key Takeaways

- New UK regulations and sustainability trends position Genuit's innovative products for increased market share and premium pricing, driving both revenue and margin growth.

- Operational efficiencies and focused acquisitions in sustainable segments are set to strengthen profitability, improve cash flow, and diversify the company's revenue base.

- Heavy reliance on a weak UK market, integration risks from recent acquisitions, and rising regulatory and input cost pressures threaten profitability and long-term growth prospects.

Catalysts

About Genuit Group- Develops and produces solutions for water, climate, and ventilation management in the construction industry in the United Kingdom, rest of Europe, and internationally.

- The imminent implementation of new UK regulations-particularly the AMP8 water cycle investment and the Future Home Standard-are expected to significantly expand the addressable market for Genuit's water management, ventilation, and sustainable building solutions, driving material revenue growth from 2026 onward.

- Regulatory drivers supporting sustainability, climate resilience, and improved water management (such as Awaab's Law and enhanced standards for energy-efficient homes) position Genuit's innovative, low-carbon product portfolio to capture share and command premium pricing, contributing to both top-line and net margin expansion.

- The company's ongoing product innovation-evidenced by high-growth solutions like MVHR with cooling and integrated blue-green roof systems-aligns with long-term increases in demand for green buildings and climate-adaptation infrastructure, supporting sustained revenue acceleration and margin improvement as these product lines scale.

- Continued operational efficiency gains through the Genuit Business System, automation, and productivity initiatives are expected to drive annual operating leverage and working capital improvement, structurally enhancing underlying net margins and free cash flow over the medium term.

- Genuit's disciplined M&A strategy in high-growth, sustainability-focused segments enables both revenue diversification and market share gains; as recent subscale acquisitions are integrated and scaled, they are expected to deliver earnings accretion and lift overall group profitability.

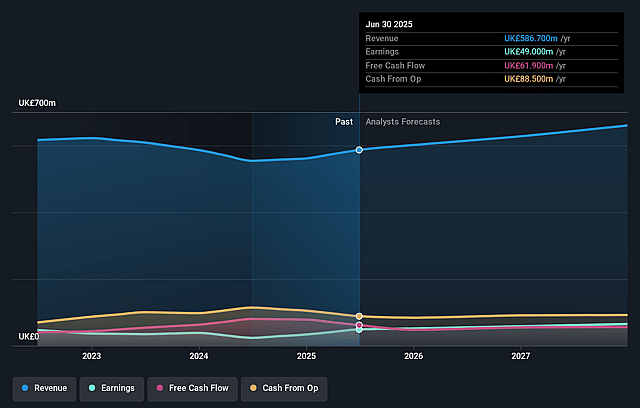

Genuit Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Genuit Group's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.4% today to 9.8% in 3 years time.

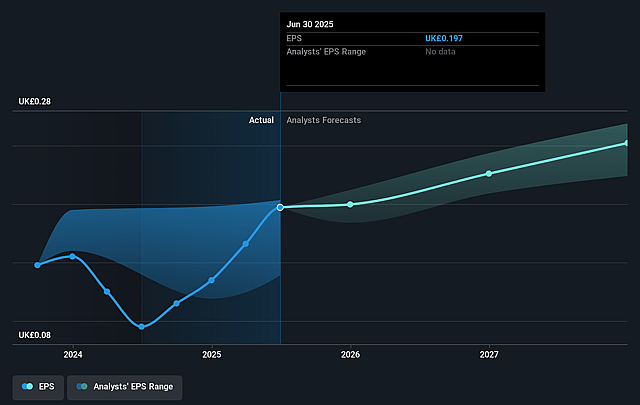

- Analysts expect earnings to reach £70.2 million (and earnings per share of £0.26) by about September 2028, up from £49.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from 17.4x today. This future PE is greater than the current PE for the GB Building industry at 13.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.78%, as per the Simply Wall St company report.

Genuit Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Genuit's exposure to a flat and still-challenging UK construction and RMI (repair, maintenance, improvement) market, with limited evidence of near-term recovery in large renovation projects and consumer confidence, creates significant long-term revenue risk if the broader market remains subdued or worsens.

- The company's current reliance on UK operations-with only 10% of revenues from international sales-leaves earnings and cash flow acutely vulnerable to local economic conditions, regulatory changes, or housing market shocks, especially as geographic diversification remains limited.

- Integration and scaling up of recent small, subscale acquisitions (Omnie, Sky Garden) currently dilute margins and carry the risk of prolonged underperformance or restructuring costs; persistent lower profitability from these segments could weigh on group net margins and overall earnings if synergies are not fully realized.

- Structural cost pressures-including ongoing National Insurance and minimum wage increases-demonstrate an environment of rising labor input costs; if not offset by price increases or productivity improvements, these trends could exert continuous downward pressure on operating and EBIT margins.

- Increasing regulatory scrutiny and mandates around the use of plastics, recycling requirements, and potential shifts in client preferences towards non-plastic or alternative materials (including sustainability-driven substitutes) threaten core product relevance and could necessitate costly investment or lead to gradual erosion of long-term revenue, particularly if Genuit's innovation pace slows relative to the industry.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.856 for Genuit Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £5.45, and the most bearish reporting a price target of just £4.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £714.8 million, earnings will come to £70.2 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 8.8%.

- Given the current share price of £3.43, the analyst price target of £4.86 is 29.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.