Last Update 19 Aug 25

Fair value Increased 6.36%Close Brothers Group’s higher consensus price target reflects improved profitability, as net profit margin increased from 12.95% to 14.22%, while a modestly lower future P/E suggests enhanced value, resulting in a new fair value of £4.93.

Valuation Changes

Summary of Valuation Changes for Close Brothers Group

- The Consensus Analyst Price Target has risen from £4.63 to £4.93.

- The Net Profit Margin for Close Brothers Group has risen from 12.95% to 14.22%.

- The Future P/E for Close Brothers Group has fallen slightly from 8.95x to 8.73x.

Key Takeaways

- Sale of Asset Management division enhances capital and focuses on core lending, potentially driving future growth.

- Technology investments and strategic acquisitions enhance efficiency, geographic reach, and resilience, supporting margin improvement and potential earnings stability.

- Regulatory reviews and costs, along with strategic moves like divesting Asset Management, create uncertainty and could negatively affect Close Brothers' earnings and capital strength.

Catalysts

About Close Brothers Group- A merchant banking company, engages in the provision of financial services to small businesses and individuals in the United Kingdom.

- The sale of the Asset Management division (CBAM) to Oaktree is expected to strengthen Close Brothers' capital position by increasing CET1 capital by approximately 100 basis points, allowing the company to focus on its core lending business which could drive future revenue growth.

- Close Brothers is making significant progress on cost-saving initiatives, expecting to generate annualized savings of around £20 million by the end of the 2025 financial year, which should improve net margins by enhancing future cost efficiency.

- Implementing a technology transformation program is expected to simplify processes, reduce costs, and increase efficiencies across the banking division. This should optimize operations and support higher margins and potentially better earnings in the future.

- The acquisition of Close Brothers Motor Finance in Ireland offers opportunities for geographic expansion, expecting to bring benefits from aligning pricing and underwriting standards and launching new products. This could lead to growth in loan volumes and revenue in the Irish market.

- Close Brothers plans strategic actions such as securitization of its motor finance portfolio and potential partnerships, aiming to strengthen the capital structure and improve financial resilience. This could position the group to better absorb any market uncertainties, potentially supporting future earnings stability.

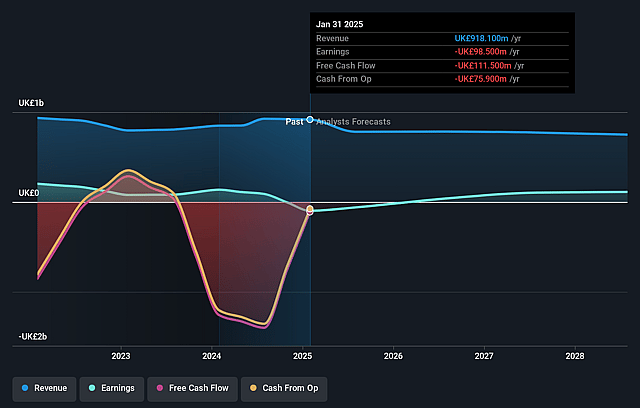

Close Brothers Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Close Brothers Group's revenue will decrease by 3.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.6% today to 11.5% in 3 years time.

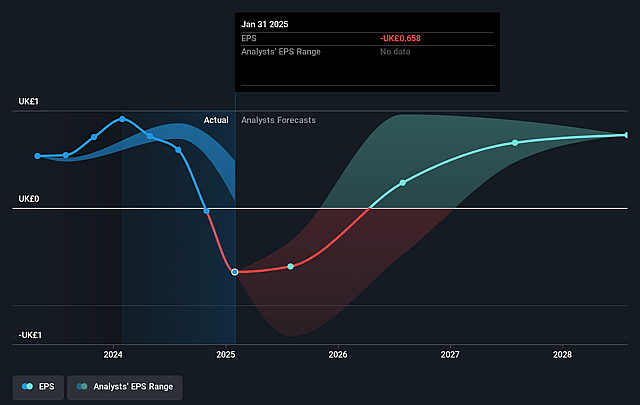

- Analysts expect earnings to reach £95.9 million (and earnings per share of £0.59) by about March 2028, up from £89.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting £145.2 million in earnings, and the most bearish expecting £25 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.6x on those 2028 earnings, up from 5.5x today. This future PE is greater than the current PE for the GB Banks industry at 7.0x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.87%, as per the Simply Wall St company report.

Close Brothers Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The FCA's ongoing review of historical motor finance commissions introduces significant uncertainty for Close Brothers Group, which could potentially lead to regulatory fines or redress payments, impacting net earnings.

- The sale of the Asset Management division (CBAM) might streamline operations but also reduces diversification and could impact revenue streams if the core lending business underperforms.

- Unfavorable market conditions continue to negatively impact Winterflood's performance, posing a risk to sustained revenue and earnings if these conditions persist.

- Increased expenses from regulatory and assurance costs as well as the acquisition in Ireland are eroding net margins, with costs already rising 10% year-on-year.

- The uncertainty related to provisions for potential redress, due to the motor finance review, means future financial liabilities could arise, impacting the group's capital strength and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of £4.472 for Close Brothers Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of £6.0, and the most bearish reporting a price target of just £2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be £834.2 million, earnings will come to £95.9 million, and it would be trading on a PE ratio of 8.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of £3.32, the analyst price target of £4.47 is 25.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Close Brothers Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.