Key Takeaways

- Increased automation and new tech-focused competitors threaten Eurofins' traditional lab business, pressuring revenue and margins as the sector evolves away from centralized models.

- Heavy reliance on acquisitions, regulatory pressures, and rising costs undermine profitability and limit Eurofins' ability to deliver anticipated synergy and margin improvements.

- Investments in efficiency, resilient demand across sectors, and disciplined capital management are driving sustained profitability, cash flow strength, and ongoing shareholder value creation.

Catalysts

About Eurofins Scientific- Provides various analytical testing and laboratory services worldwide.

- As automation and advanced digital platforms accelerate across the diagnostic and analytical sectors, Eurofins' core laboratory model faces a growing risk of disruption by tech-focused entrants and decentralized testing solutions, which is likely to erode long-term revenue growth and compress net margins as industry value creation shifts away from traditional centralized labs.

- The company's heavy reliance on acquisitive growth, with persistent integration challenges and underperforming startups diluting group EBITDA by more than €70 million, signals persistent margin drag and undermines the ability to deliver anticipated synergy-led earnings improvements in the medium to long term.

- With rising regulatory scrutiny and growing public skepticism around data privacy and genetic testing, Eurofins is increasingly exposed to potentially costly compliance requirements and reputational risk, leading to higher operating expenses and the possibility of future litigation, which could further impact net margins and earnings growth.

- Escalating capital expenditures, including large discretionary investments in lab infrastructure and proprietary IT systems that remain underutilized, risk compressing future free cash flow and returns on invested capital as secular market growth slows and utilization rates fall short of expectations.

- Intensifying price competition, commoditization of testing services, and consolidation among key customer groups with increased purchasing power are set to limit Eurofins' pricing ability and reduce EBITDA margins, making it difficult for the company to achieve its targeted margin expansion or sustain high cash conversion rates over the long term.

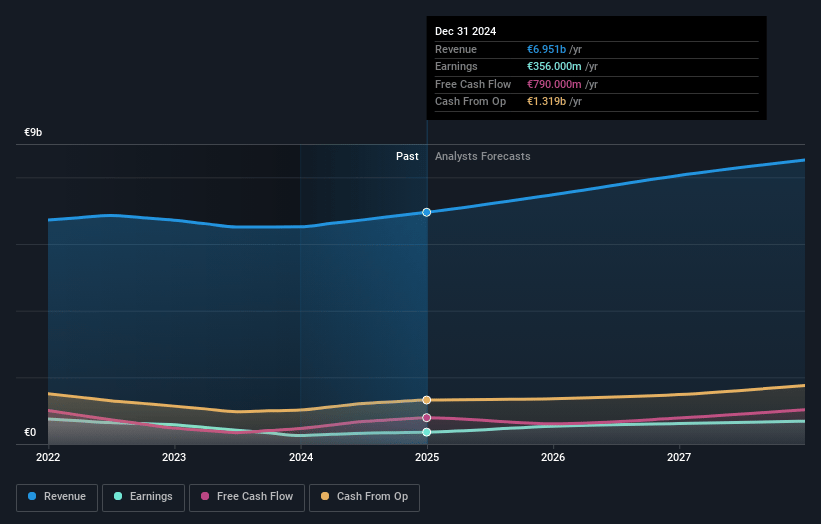

Eurofins Scientific Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Eurofins Scientific compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Eurofins Scientific's revenue will grow by 6.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.1% today to 8.7% in 3 years time.

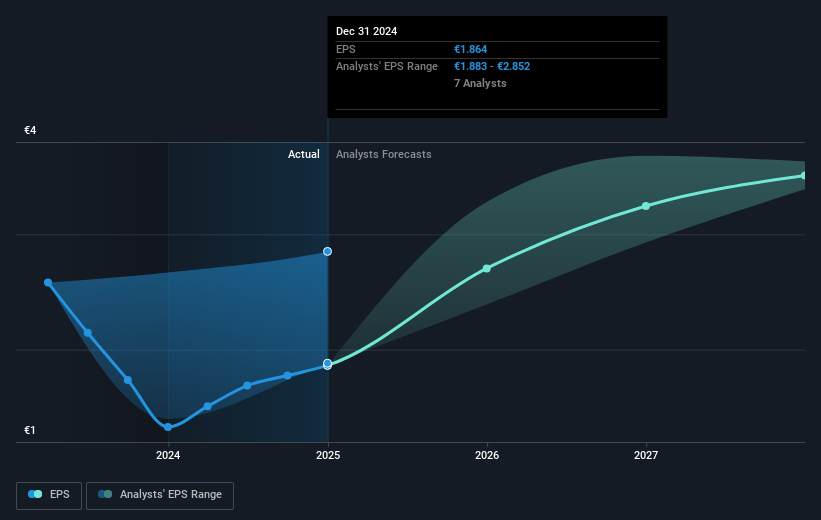

- The bearish analysts expect earnings to reach €723.6 million (and earnings per share of €3.91) by about July 2028, up from €356.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, down from 30.4x today. This future PE is lower than the current PE for the GB Life Sciences industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 2.4% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.22%, as per the Simply Wall St company report.

Eurofins Scientific Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Eurofins has demonstrated strong, resilient revenue growth (averaging 9% annually since 2019), outperforming peers even during periods of extraordinary market volatility, suggesting structural demand for its services and implying that long-term revenue expansion remains robust despite short-term headwinds.

- The company's ongoing major investments in automation, digitalization, and a hub-and-spoke laboratory model are now starting to reduce operating expenses and improve efficiency, supporting a sustained increase in EBITDA margins and profitability over the coming years.

- High-margin mature business lines are already achieving close to target profitability, and as start-up and recently acquired businesses are integrated into this model, group-wide net earnings are likely to rise, increasing the prospect for higher returns and stronger free cash flow.

- Secular growth drivers such as tightening regulatory requirements in food, environment, and pharma, along with rising health-consciousness and the expansion of personalized medicine, are fueling consistent demand for Eurofins' laboratory services, underlying revenue resilience even if specific end-markets face temporary weakness.

- Eurofins is maintaining financial discipline through strong working capital management, steady deleveraging, and discretionary capital allocation, which has allowed it to increase share buybacks and shareholder distributions without sacrificing investments in future growth, supporting higher earnings per share and potential upward share price movement.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Eurofins Scientific is €46.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Eurofins Scientific's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €89.0, and the most bearish reporting a price target of just €46.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €8.3 billion, earnings will come to €723.6 million, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 6.2%.

- Given the current share price of €60.46, the bearish analyst price target of €46.0 is 31.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.