Key Takeaways

- Accelerated integration, operational discipline, and innovative products are driving faster-than-expected margin gains and robust revenue growth across multiple high-value specialty markets.

- Regionalized manufacturing and surging global demand for sustainable materials position Arkema for resilience, premium pricing, and above-peer earnings growth despite rising protectionism.

- Stricter regulations, weak end-market demand, supply chain disruptions, evolving sustainability trends, and rising competition threaten Arkema's profit margins and long-term growth prospects.

Catalysts

About Arkema- Manufactures and sells specialty materials in Europe, the United States, Canada, Mexico, China, Hong Kong, Taiwan, and internationally.

- Analyst consensus expects growth projects like the Singapore polyamide 11 plant and U.S. PVDF expansions to generate over 400 million euros EBITDA within four years; however, strong initial ramp-up, continued robust demand in electronics and batteries, and Arkema's proven execution suggest outperformance that could see these projects exceeding targets and accelerating revenue and margin accretion sooner than 2028.

- While consensus highlights cost savings of 250 million euros by 2028, operational discipline, digitalization, and the rapid integration of Dow Adhesives and PIAM are unlocking synergies at a faster pace, potentially yielding higher net margins and cash flows than analysts currently model.

- Arkema's decisive pivot towards high-performance polymers and specialty materials amid surging global demand for sustainable and low-carbon solutions stands to drive double-digit revenue growth, as its innovative bio-based and recyclable products rapidly gain share in fast-growing markets like EVs, batteries, renewable energy, and infrastructure.

- The company's manufacturing footprint, which ensures local-for-local production in major regions like the U.S., Europe, and Asia, offers major resilience and market share gains as global protectionism rises and supply chains regionalize, supporting stronger earnings stability and higher pricing power.

- Recent breakthroughs such as ultra-thin PI films for electronics and advanced fluorospecialties for green buildings are catalyzing new premium end-markets, positioning Arkema for consistent above-peer growth in both EBITDA and net income driven by innovation-led volume and pricing upside.

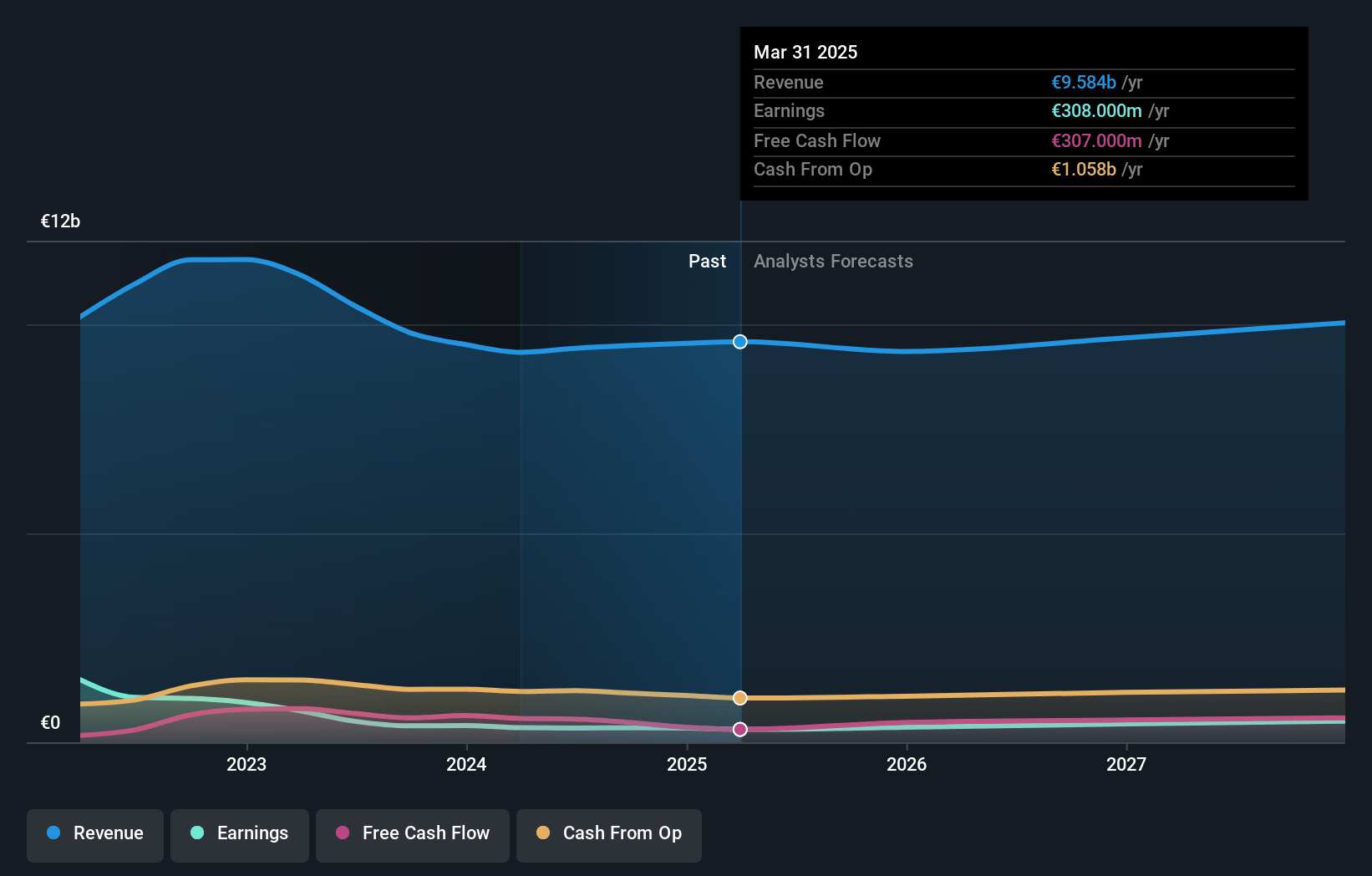

Arkema Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Arkema compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Arkema's revenue will grow by 3.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.2% today to 5.8% in 3 years time.

- The bullish analysts expect earnings to reach €617.8 million (and earnings per share of €8.18) by about July 2028, up from €308.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, down from 15.9x today. This future PE is lower than the current PE for the GB Chemicals industry at 18.0x.

- Analysts expect the number of shares outstanding to grow by 1.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

Arkema Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened ESG regulation and evolving quotas, such as those already impacting Arkema's refrigerant gas business and leading to a near 40% decline in Intermediates EBITDA, may require further product overhauls or compliance-driven investment, putting persistent downward pressure on operating margins and net income.

- Persistent weak demand in key end-markets like industrial adhesives, construction, and coatings-especially in Europe and North America-combined with a "wait-and-see" attitude from major customers, increases revenue volatility and may cap future earnings growth during cyclical downturns.

- The ongoing global supply chain realignment and trade volatility, including new tariffs and higher operational complexity, have already resulted in low sales growth and significant inventory build-ups, as seen in Q1, raising working capital needs while putting pressure on cash flow and profit margins.

- Shifting consumer preferences and regulatory pressure toward sustainable, bio-based, or circular materials pose a substitution risk for Arkema's legacy products, with the risk of long-term volume decline and stagnant revenue if innovation or repositioning efforts fail to keep pace.

- Intense competition from both larger diversified players and fast-moving niche innovators in specialty and high-performance materials could erode Arkema's market share, potentially leading to lower future revenues and reduced net margins if its ongoing R&D and capex commitments do not translate into strong commercial returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Arkema is €100.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Arkema's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €100.0, and the most bearish reporting a price target of just €56.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €10.6 billion, earnings will come to €617.8 million, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of €65.0, the bullish analyst price target of €100.0 is 35.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.