Last Update01 May 25Fair value Decreased 1.94%

AnalystConsensusTarget has decreased revenue growth from 4.0% to 3.5%.

Read more...Key Takeaways

- Partnership with Formula One could enhance brand visibility and attract new demographics, potentially boosting revenue and earnings.

- Revitalized flagship stores and strategic events drive future revenue growth and enhance brand prominence and consumer engagement.

- Declining operating income and challenges in key markets like Asia and Wines & Spirits may pressure LVMH's margins and overall earnings growth.

Catalysts

About LVMH Moët Hennessy - Louis Vuitton Société Européenne- Operates as a luxury goods company worldwide.

- LVMH has entered a significant 10-year partnership with Formula One involving key brands like Vuitton, Moët & Chandon, and TAG Heuer. This could enhance brand visibility and potentially boost revenue and earnings, as the alignment with Formula One could attract new demographics and markets.

- The revitalization and continued opening of flagship stores, such as Tiffany's in New York and upcoming stores in Beverly Hills and Geneva, along with strategic events and exhibitions, could drive future revenue growth, enhancing the brand's prominence and consumer engagement.

- In the Wines & Spirits division, despite current challenges, a new management team is expected to drive a recovery within two years. This outlook suggests a potential rebound in revenue and earnings, leveraging their expertise and the hopeful stabilization of market conditions.

- The successful performance of Sephora, with a tenfold increase in revenue since acquisition, highlights significant growth potential. This can contribute positively to revenue and margins as markets stabilize and expansion strategies unfold, especially in Selective Retailing.

- The restructured investments into LVMH's luxury hotels and experiential brands like Cheval Blanc and Belmond offer an avenue for diversified revenue streams. This approach aligns with market demand for luxury experiences, potentially boosting revenue as travel and tourism recover globally.

LVMH Moët Hennessy - Louis Vuitton Société Européenne Future Earnings and Revenue Growth

Assumptions

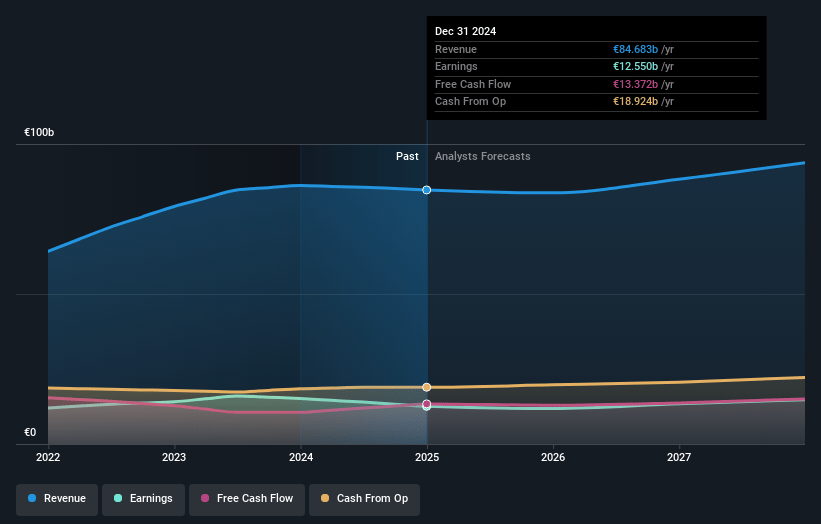

How have these above catalysts been quantified?- Analysts are assuming LVMH Moët Hennessy - Louis Vuitton Société Européenne's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.8% today to 15.8% in 3 years time.

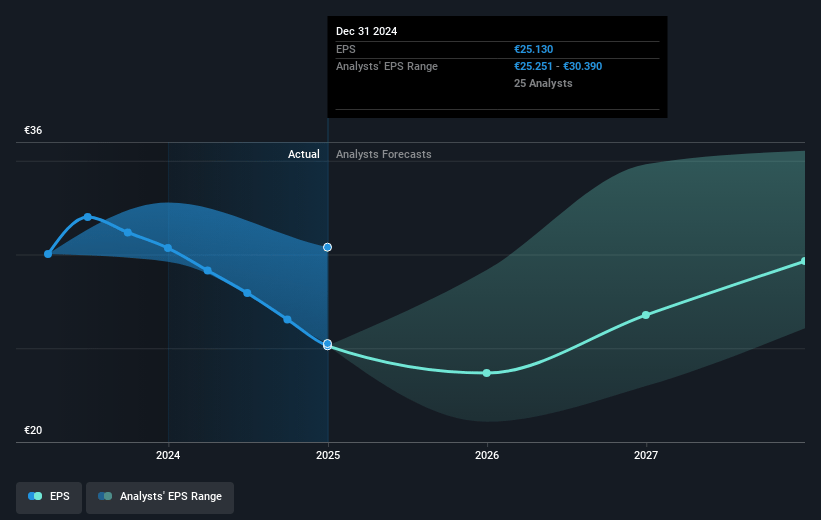

- Analysts expect earnings to reach €14.9 billion (and earnings per share of €30.03) by about May 2028, up from €12.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €17.3 billion in earnings, and the most bearish expecting €13.0 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.3x on those 2028 earnings, up from 19.4x today. This future PE is greater than the current PE for the GB Luxury industry at 19.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.68%, as per the Simply Wall St company report.

LVMH Moët Hennessy - Louis Vuitton Société Européenne Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reported operating income for LVMH is declining, with a mention of a 14% decrease in recurring operations profit, largely due to increased operating costs outpacing revenue growth, which may negatively impact net margins.

- Asia, a significant market for LVMH, is experiencing economic challenges, with a notable roughly 10% drop in revenue for the region, potentially affecting overall revenue growth.

- Wines & Spirits reported a negative 8% in organic growth and a significant 36% drop in operating income, attributed to a decrease in volume, price, and mix, posing risks to earnings in this segment.

- DFS, part of the Selective Retailing division, faced substantial losses, reportedly due to currency impact and reduced mainland Chinese tourists, which could exert pressure on net margins and overall earnings.

- The challenges related to ForEx impacts and inability to offset these through price adjustments have resulted in a €1 billion negative effect on operating profit, posing a risk to earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €628.741 for LVMH Moët Hennessy - Louis Vuitton Société Européenne based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €811.0, and the most bearish reporting a price target of just €500.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €93.8 billion, earnings will come to €14.9 billion, and it would be trading on a PE ratio of 26.3x, assuming you use a discount rate of 7.7%.

- Given the current share price of €487.9, the analyst price target of €628.74 is 22.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.