Key Takeaways

- Revitalized brand strategies and operational agility could drive quicker-than-expected margin expansion and sales growth, bolstered by effective inventory management and strong digital investments.

- The company's multi-brand portfolio, focus on heritage, and sustainability initiatives uniquely position it to capture rising demand in emerging markets and among eco-conscious consumers.

- Heavy brand investment amid falling revenues and overreliance on Gucci heighten risks as channel cuts, weak digital strategy, and luxury market headwinds threaten long-term growth.

Catalysts

About Kering- Manages the development of a collection of renowned houses in fashion, leather goods, and jewelry in the Asia Pacific, Western Europe, North America, Japan, and internationally.

- Analyst consensus expects modernized icons and elevated client strategies to gradually improve revenue and margins, but these estimates may dramatically understate Gucci's rebound potential, as the groundwork laid during the last 18 months enables a sharp recovery once fashionability and innovation are reignited, suggesting potential for net margins and sales growth to return to historic highs sooner than anticipated.

- Analysts broadly agree that retail rationalization and focusing on full-priced sales will enhance sales density and profitability, yet the underappreciated impact of Kering's rigorous inventory reduction and operational agility means gross margin expansion and improved earnings could accelerate above expectations due to higher sell-through rates and superior fixed-cost absorption.

- Kering's unique, multi-brand luxury portfolio positions it to capture outsized gains from the global rise in upper-middle class consumers, especially in emerging Asian markets, which could support double-digit revenue growth as demand for authentic heritage brands consolidates around global leaders.

- With digitalization and e-commerce making luxury accessible globally, Kering's robust investments in omnichannel experiences and global online platforms are set to meaningfully expand addressable market size and drive sustained high single-digit growth in online revenue and margin expansion as digital sales become a larger share of mix.

- Kering's industry-leading ESG initiatives and rigorously certified climate commitments differentiate its brands for affluent, sustainability-minded consumers, providing significant pricing power, higher customer loyalty, and premium positioning-supporting long-term earnings growth and margin resilience even in more competitive markets.

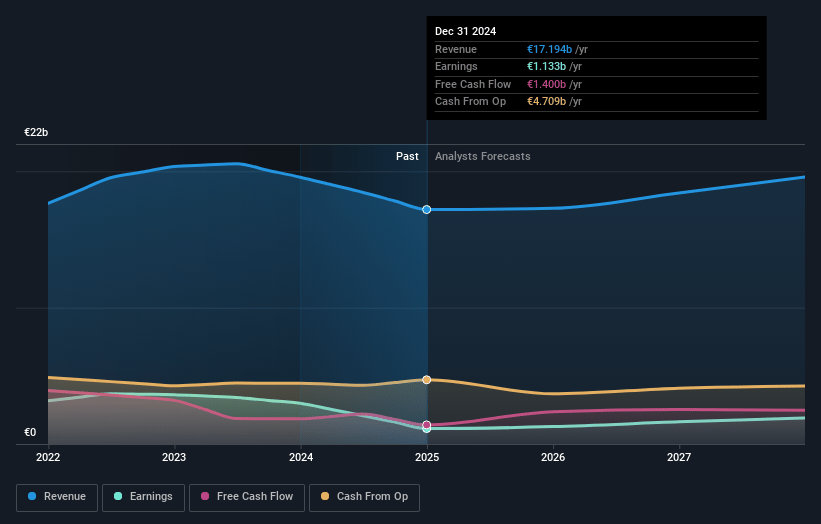

Kering Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Kering compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Kering's revenue will grow by 2.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.6% today to 8.6% in 3 years time.

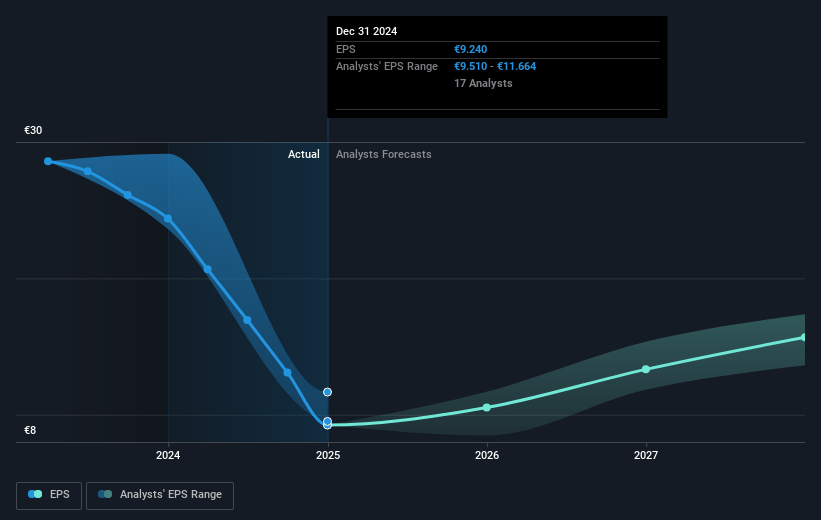

- The bullish analysts expect earnings to reach €1.6 billion (and earnings per share of €13.57) by about July 2028, up from €1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 28.9x on those 2028 earnings, up from 21.5x today. This future PE is greater than the current PE for the GB Luxury industry at 20.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.07%, as per the Simply Wall St company report.

Kering Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is continuing to invest heavily to revitalize underperforming brands and elevate product quality, while simultaneously contending with declining revenues and significantly compressed operating margins, raising the risk that ongoing investment outlays will delay a sustained rebound in net earnings.

- Kering remains structurally dependent on Gucci, which contributed over 45% of group revenues in 2024, and is currently amid a creative and commercial transition with ongoing declines in permanent lines; this dependence increases the risk of earnings volatility if Gucci's turnaround efforts falter or experience further brand fatigue.

- The group's move toward tighter exclusivity and drastic reductions in wholesale and outlet channels is reducing overall volume and revenues, and in the absence of strong like-for-like growth in core retail stores, this channel rationalization could structurally depress top-line growth.

- Macro trends such as lingering anti-luxury sentiment, rising consumer focus on sustainability, and demographic headwinds among aspirational luxury buyers are already evident in weak performance in key markets (especially China and Western Europe), and risk further restricting addressable market growth and sales potential long term.

- Kering's digital and e-commerce sales declined 20% in 2024 and account for only 11% of retail sales; failure to accelerate digital transformation and match peers' omnichannel innovation could erode future market share and revenue growth, particularly as luxury purchasing habits shift online.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Kering is €282.7, which represents two standard deviations above the consensus price target of €188.3. This valuation is based on what can be assumed as the expectations of Kering's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €360.0, and the most bearish reporting a price target of just €145.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €18.6 billion, earnings will come to €1.6 billion, and it would be trading on a PE ratio of 28.9x, assuming you use a discount rate of 10.1%.

- Given the current share price of €198.68, the bullish analyst price target of €282.7 is 29.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives