Key Takeaways

- Premium segment growth, operational efficiency, and industrial standardization position Alstom for significant margin and earnings expansion beyond consensus expectations.

- Leadership in green mobility and strong global presence allow Alstom to capitalize on infrastructure trends and recurring revenue from high-value services.

- Shifts in mobility trends, policy priorities, geopolitical risks, and competitive pressures threaten future demand, market access, and profit margins for Alstom.

Catalysts

About Alstom- Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

- While analyst consensus expects gross margin improvement from a higher Services and Signalling mix, there is clear evidence that margin accretion could dramatically accelerate as nearly 60% of orders now stem from these premium segments, combined with an anticipated self-help uplift from German restructuring and industrial standardization that could unlock margin expansion well ahead of expectations-directly benefiting adjusted EBIT and net earnings.

- Analysts broadly agree that Alstom's industrial efficiency programs and supply chain stabilization will lift net margins over time; however, with a 50% planned increase in average output by 2030 from manufacturing standardization, and R&D investment driving up to 30% cost reduction in train development, operational leverage and earnings growth could materially outpace consensus models.

- Alstom's unmatched global footprint and multi-local manufacturing capability uniquely position it to capture a disproportionate share of the multi-year wave of public transport infrastructure spending, especially as localization requirements intensify in major markets-which could translate into sustained, above-market revenue growth and structural improvements in backlog quality.

- The accelerating shift toward decarbonization and green mobility mandates is a powerful, underappreciated tailwind for Alstom, which has achieved emissions reductions targets five years ahead of schedule and is poised for first-mover gains in hydrogen and battery electric trains, potentially opening up new high-margin addressable markets and commanding a premium on Orders, driving both top-line and margin expansion.

- Alstom's increasing penetration of high-speed rail projects and aftermarket life-cycle services-bolstered by the opening of new competitive corridors such as Channel Tunnel access and expanding digital maintenance offerings-sets the stage for a virtuous cycle of recurring revenue, margin stability, and long-term earnings compounding far in excess of current valuation assumptions.

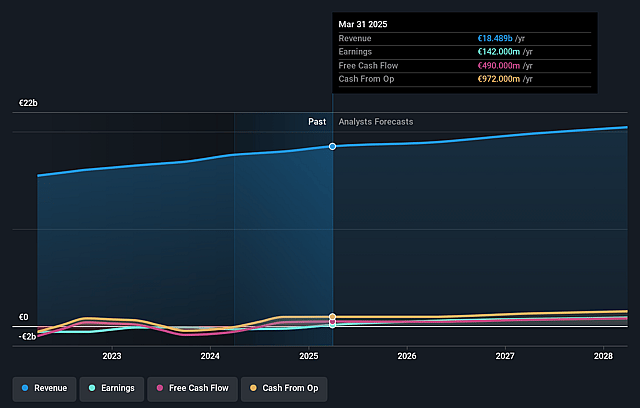

Alstom Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Alstom compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Alstom's revenue will grow by 5.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.8% today to 5.7% in 3 years time.

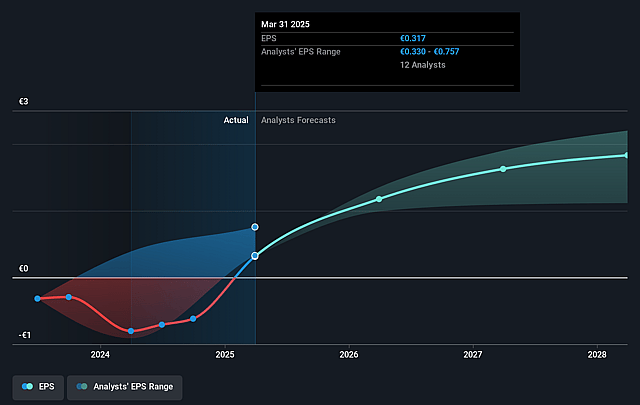

- The bullish analysts expect earnings to reach €1.2 billion (and earnings per share of €2.43) by about September 2028, up from €142.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, down from 68.5x today. This future PE is lower than the current PE for the GB Machinery industry at 27.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.29%, as per the Simply Wall St company report.

Alstom Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The shift toward autonomous and alternative mobility solutions, such as electric vehicles, shared mobility, and hyperloop, threatens to reduce long-term demand for traditional rail transport, risking lower addressable market size and softening Alstom's revenue growth over time.

- Decarbonization and energy transition policies may redirect public investment away from rail and towards electric vehicle and renewable energy infrastructure, presenting budget competition that could lead to fewer new projects and curtail sales and order intake, impacting future revenues.

- Persistent geopolitical instability, trade tensions, and more stringent "Buy National" and local content requirements could disrupt Alstom's cross-border projects, delay contract deliveries, or restrict access to key markets, reducing Alstom's accessible revenue pool while increasing cost pressure and potentially eroding margins.

- Alstom's heavy backlog exposure in several large markets, especially in Europe and Germany, leaves it vulnerable to regional budget changes, slower project ramp-ups, or order delays; any abrupt slowdowns in these key areas would directly compromise revenue visibility and earnings consistency.

- Recurring challenges with margin pressure-including cost overruns, complex project execution, and aggressive price competition from state-backed Chinese players and other new entrants-could limit the expected improvement in profit margins and constrain long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Alstom is €33.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Alstom's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €33.0, and the most bearish reporting a price target of just €9.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €21.6 billion, earnings will come to €1.2 billion, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 8.3%.

- Given the current share price of €21.06, the bullish analyst price target of €33.0 is 36.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Alstom?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.