Key Takeaways

- Digital transformation and cost-cutting initiatives are driving greater efficiency, client acquisition, and profitability across core retail and digital banking operations.

- Strong ESG focus and business diversification enhance client retention, revenue stability, and reduce earnings volatility across geographic and business segments.

- Heavy dependence on restructuring, regulatory pressures, and digital disruption threaten earnings stability, growth prospects, and competitiveness amid evolving global and retail banking landscapes.

Catalysts

About Société Générale Société anonyme- Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

- SocGen’s effective execution of digital transformation across its BoursoBank and French retail operations, including record client acquisition and leading digital satisfaction scores, is positioning the group to expand market share, improve cross-selling, and enhance cost efficiency—drivers likely to boost both revenue growth and net margins over the medium to long term.

- Continued robust expansion of ESG and sustainable finance products, evidenced by portfolio decarbonization and high external sustainability ratings, enhances SocGen’s ability to retain clients, tap new fee-based revenue streams, and strengthen franchise value, favorably impacting fee income and earnings stability.

- Ongoing cost-reduction and restructuring efforts (branch reductions, tech investments, group-wide efficiency focus) have delivered sustainable operating leverage improvements, seen in sharply lower cost-to-income ratios across divisions, supporting higher net margins and improved profitability.

- SocGen’s strong capital position (CET1 ratio well above regulatory minimums) and disciplined risk management provide a buffer for organic growth and flexibility for potential capital returns (e.g., higher dividends or buybacks), which could enhance future earnings per share.

- The bank’s geographical and business diversification—especially its leadership position in Europe and growing presence in high-potential segments such as structured finance and advisory—decreases earnings volatility and unlocks cross-border growth opportunities, supporting resilient long-term revenue streams.

Société Générale Société anonyme Future Earnings and Revenue Growth

Assumptions

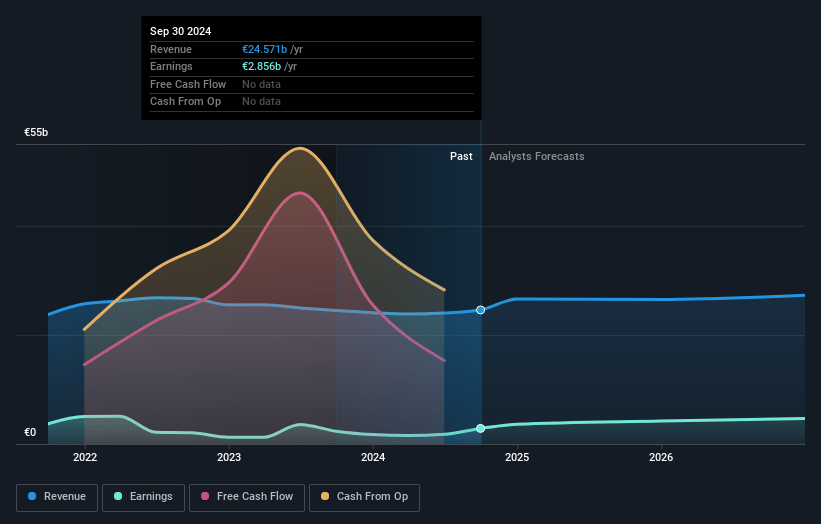

How have these above catalysts been quantified?- Analysts are assuming Société Générale Société anonyme's revenue will grow by 3.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.1% today to 18.4% in 3 years time.

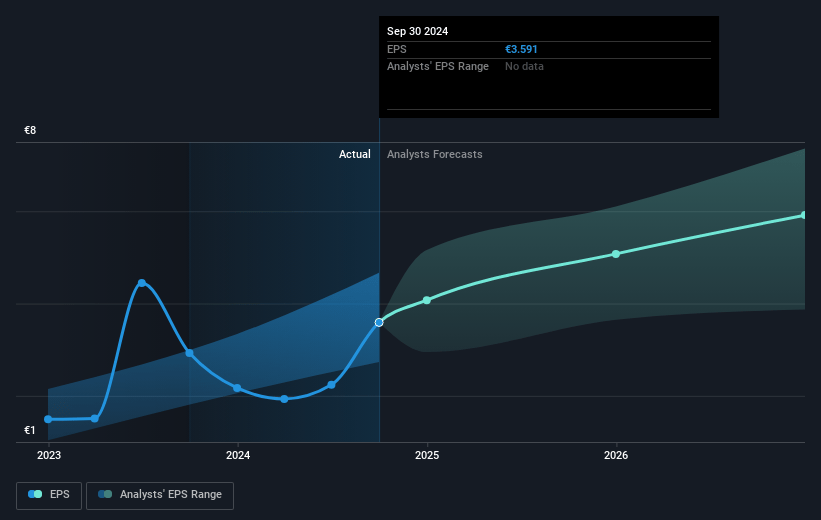

- Analysts expect earnings to reach €5.3 billion (and earnings per share of €7.03) by about May 2028, up from €4.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €7.3 billion in earnings, and the most bearish expecting €3.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from 8.5x today. This future PE is greater than the current PE for the GB Banks industry at 7.1x.

- Analysts expect the number of shares outstanding to decline by 0.33% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Société Générale Société anonyme Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Société Générale’s ongoing reliance on cost reductions and restructuring (including disposals, branch mergers, and transformation charges) creates execution risk; if cost savings or operational improvements are not sustained or new initiatives fall short, group net margins and overall earnings could be pressured over the long term.

- The bank’s exposure to international (especially African and emerging) markets introduces geopolitical, credit, and currency volatility, risking higher loan loss provisions and earnings instability, particularly if global macroeconomic or trade disruptions occur.

- Persistent challenges in materially growing French and European retail banking revenues—due to fierce competition, muted economic growth, and neutral/low-margin home loan origination—could cap top-line growth and limit net interest income improvement.

- The increasing complexity and cost burden from regulatory requirements (e.g., Basel IV, IFRS 9 provisioning, anti-money laundering, and ESG compliance) may constrain Société Générale’s lending capacity, elevate operational expenses, and moderate returns on equity.

- Accelerating digitalization and the rise of fintech, neobanks, and non-bank financial intermediaries could erode Société Générale’s traditional fee and lending businesses, especially if digital adoption and deposit/customer migration outpace SocGen’s own digital innovation, impacting revenue and client retention.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €49.118 for Société Générale Société anonyme based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €56.0, and the most bearish reporting a price target of just €31.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €28.9 billion, earnings will come to €5.3 billion, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 7.0%.

- Given the current share price of €47.96, the analyst price target of €49.12 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.