Key Takeaways

- Rapid efficiency gains from carbon neutrality and business group integration are driving structural margin improvements and enhanced free cash flow potential.

- Strong positioning in electric and next-gen mobility markets, backed by premium technology offerings and OEM partnerships, supports diverse, resilient, above-market revenue growth.

- Heavy dependence on legacy products, slow adaptation to electrification, and customer concentration expose the company to margin erosion, shrinking markets, and persistent earnings risk.

Catalysts

About OPmobility- Designs and produces intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for all mobility players in Europe, North America, China, rest of Asia, South America, the Middle East, and Africa.

- Analysts broadly agree that OPmobility's push toward carbon neutrality will enhance margins through efficiency, but recent results indicate the benefits are being realized faster and at a larger scale than anticipated, setting up a structural step-change in net margin and free cash flow beginning in 2025 as energy costs and overheads fall sharply.

- Analyst consensus cites business group consolidation and improved cost control supporting margin expansion, but this may understate the transformative impact-the integration of Exterior and Lighting, combined with advanced digitalization and ongoing SG&A and factory rationalization, is likely to unlock much greater operating leverage and could drive sustainable double-digit operating margin growth within several years.

- The accelerating adoption of electric vehicles and OEM outsourcing trends are positioning OPmobility to deliver outsized growth, as their advanced smart glass, thermal management, and module integration offerings are becoming key requirements for OEM compliance with stricter emissions and safety regulations, supporting premium pricing and strong multi-year revenue visibility.

- OPmobility's increasing penetration of next-generation mobility markets, including heavy-duty vehicles, railway electrification, and range-extended EVs, opens up significant new addressable markets, supporting a more diverse top-line growth engine and potential for mid-teens annual revenue uplift as these segments mature.

- The company's deepening partnerships with leading global OEMs and aggressive customer diversification-including major wins with disruptive EV makers in China and North America-are building a resilient recurring revenue base, reducing cyclicality, and setting up a long runway for above-market earnings growth and stronger dividend capacity.

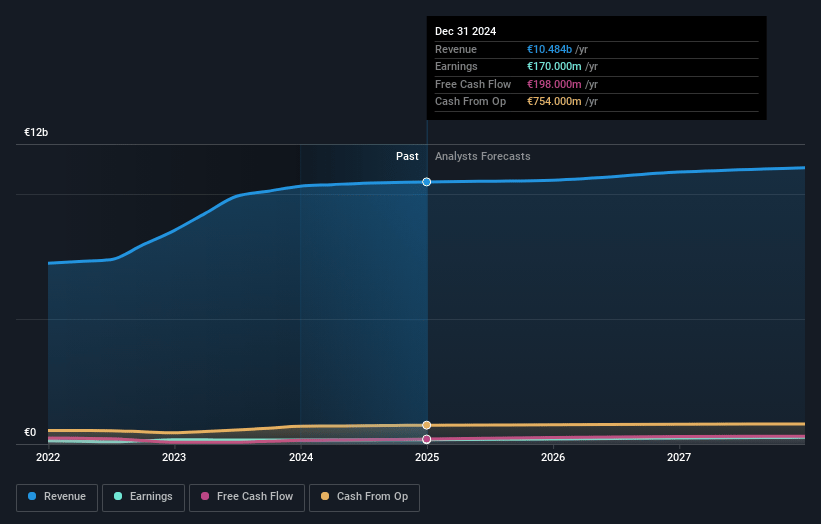

OPmobility Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on OPmobility compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming OPmobility's revenue will grow by 3.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.6% today to 3.4% in 3 years time.

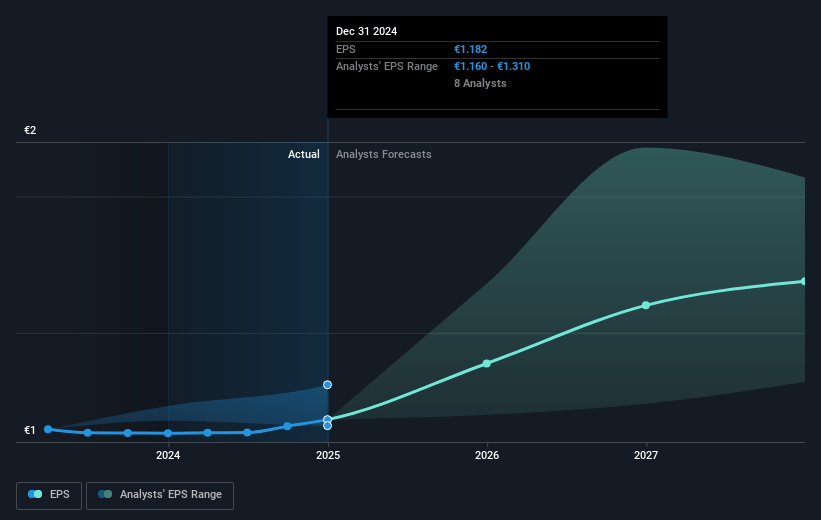

- The bullish analysts expect earnings to reach €397.2 million (and earnings per share of €2.2) by about July 2028, up from €170.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.5x on those 2028 earnings, down from 10.4x today. This future PE is lower than the current PE for the GB Auto Components industry at 10.0x.

- Analysts expect the number of shares outstanding to decline by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.14%, as per the Simply Wall St company report.

OPmobility Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- OPmobility's significant reliance on internal combustion engine (ICE) components, particularly in Europe, exposes it to structural long-term decline as electrification accelerates globally, which puts downward pressure on future revenues if its transition to EV and related technologies is slower or less effective than industry demand.

- The slow growth and delayed profitability in the recently acquired lighting division, as well as continued negative results for at least another year, create ongoing earnings drag and reduce net margins at a time when industry competition and technological shifts are intense.

- OPmobility's high customer concentration in traditional European OEMs, particularly those losing share in China and facing regulatory uncertainty in Europe, increases vulnerability; if these OEMs underperform or further lose market position, OPmobility's revenue could materially decline.

- Growing vertical integration among automakers (especially EV-focused new entrants and Chinese OEMs), along with industry consolidation and aggressive price competition, threatens to shrink OPmobility's addressable market and compress profitability, risking both revenue growth and margin preservation.

- Increased demands of sustainability regulations, circular economy requirements, and supply chain localization-coupled with ongoing capex and restructuring to adapt to new technologies (hydrogen, battery, renewable materials)-could result in persistent margin pressure and heightened risk to free cash flow and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for OPmobility is €14.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of OPmobility's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €14.0, and the most bearish reporting a price target of just €7.4.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €11.7 billion, earnings will come to €397.2 million, and it would be trading on a PE ratio of 6.5x, assuming you use a discount rate of 10.1%.

- Given the current share price of €12.35, the bullish analyst price target of €14.0 is 11.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.