Last Update 10 Nov 25

Fair value Increased 4.46%SANOMA: Rising Forward Earnings Multiples And Dividend Payouts Will Drive Share Upside

Analysts have raised their price target for Sanoma Oyj from €11.97 to €12.50, citing updated valuation models as well as a recalibration of growth and profitability assumptions.

What's in the News

- Sanoma revised its earnings guidance for 2025, narrowing its sales outlook to between EUR 1.29 billion and EUR 1.31 billion. Operational EBIT is expected at the higher end of the original guidance, from EUR 180 million to EUR 190 million (Key Developments).

- The Board of Directors announced key dates for the second and third instalments of the 2024 dividend. EUR 0.13 per share will be paid in September and another EUR 0.13 per share will be paid in November 2025 (Key Developments).

- The Annual General Meeting held on 29 April 2025 resolved that the total dividend for 2024 would be EUR 0.39 per share, distributed in three instalments (Key Developments).

Valuation Changes

- Fair Value: Raised from €11.97 to €12.50, reflecting a modest increase in the company's estimated intrinsic value.

- Discount Rate: Decreased from 6.04% to 5.83%, indicating a lower perceived risk or cost of capital in valuation calculations.

- Revenue Growth: Lowered from 1.97% to 1.32%, signaling tempered expectations for top-line expansion.

- Net Profit Margin: Reduced from 12.95% to 9.83%, indicating a decline in projected profitability margins.

- Future P/E: Increased from 12.38x to 17.59x, suggesting a higher valuation multiple is being applied to forward earnings.

Key Takeaways

- Expansion of digital learning and AI integration is driving recurring, high-margin revenues and operational efficiencies, supporting margin growth and premium product positioning.

- Cost-saving initiatives and curriculum updates, coupled with stable government funding, position the company for stronger operating leverage and solid top-line growth.

- Reliance on cyclical markets, disruptive digital competition, and execution risks threaten revenue stability, margin improvement, and long-term earnings growth across core segments.

Catalysts

About Sanoma Oyj- Operates as a media and learning company in Finland, the Netherlands, Poland, Spain, Belgium, and internationally.

- Acceleration in digital learning solutions, especially direct-to-consumer digital offerings in markets like Poland, is expanding high-margin, recurring revenue streams, aligning with ongoing shifts by schools, parents, and governments toward digital education and subscription-based products-supporting both revenue growth and higher net margins.

- Ongoing integration of AI into learning platforms and media content development is expected to drive operational efficiencies, enabling margin expansion through lower production costs, while also supporting differentiated, premium-priced educational products-positively impacting net margins and future earnings.

- Program Solar and other efficiency initiatives are delivering tangible reductions in paper, printing, and fixed costs, improving the cost base; further benefits from these programs are anticipated as volumes rise in 2026, which positions the company for stronger operating leverage and higher EBIT/earnings.

- Anticipated curriculum renewals in 2026, backed by consistent government funding commitments in key European markets, suggest a visible pipeline of demand for Sanoma's scalable educational content, pointing to solid top-line growth with potential for increased market share.

- Continued success in digital media subscription bundling and price increases, along with effective churn management, is stabilizing and modestly growing average revenue per user, partially offsetting secular declines in advertising revenues and reinforcing improvements in revenue predictability and operational EBIT.

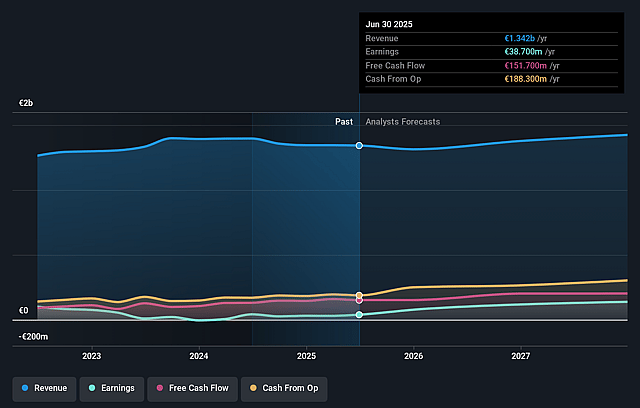

Sanoma Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sanoma Oyj's revenue will grow by 2.0% annually over the next 3 years.

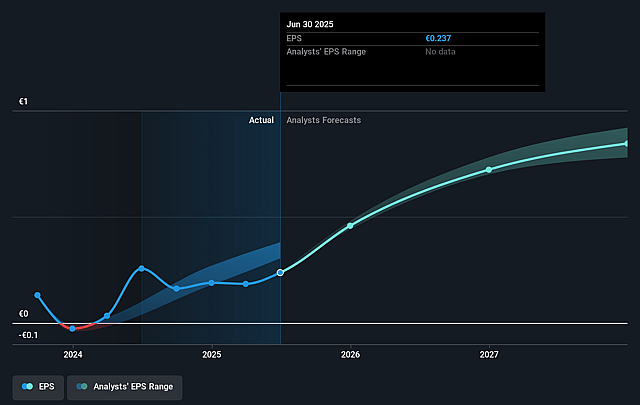

- Analysts assume that profit margins will increase from 2.9% today to 12.8% in 3 years time.

- Analysts expect earnings to reach €181.7 million (and earnings per share of €0.82) by about September 2028, up from €38.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.9x on those 2028 earnings, down from 45.9x today. This future PE is lower than the current PE for the GB Media industry at 20.1x.

- Analysts expect the number of shares outstanding to decline by 0.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.08%, as per the Simply Wall St company report.

Sanoma Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing decline in B2B advertising sales, especially in TV, continues to put pressure on Media Finland's revenues, with management explicitly highlighting limited visibility and persistent macro headwinds in the advertising market which may negatively impact top-line growth and profitability if not offset by subscription sales.

- Heavy reliance on large curriculum renewal cycles and public sector funding for the Learning segment introduces significant volatility and risk; any unexpected policy shifts, delayed government spending, or curriculum changes not materializing as planned could undermine revenue stability and earnings growth.

- Discontinuation of low-value distribution contracts in Learning, although deliberate, represents a structural reduction in recurring revenues of €25–30 million annually, and this trend is expected to persist, inhibiting topline revenue expansion in certain markets.

- Expected improvements in operational margins are largely dependent on ongoing cost-cutting programs (e.g., Program Solar) and digital transformation; any slowdown, ineffective investment in digital or AI initiatives, or execution challenges may erode anticipated margin gains and limit net earnings growth.

- The accelerating shift toward digital platforms and emerging competition from global edtech and media players creates ongoing pricing pressure and threatens Sanoma's market share across both Learning and Media, potentially resulting in revenue stagnation or contraction, and impairing the company's long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €11.3 for Sanoma Oyj based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.4 billion, earnings will come to €181.7 million, and it would be trading on a PE ratio of 11.9x, assuming you use a discount rate of 6.1%.

- Given the current share price of €10.92, the analyst price target of €11.3 is 3.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.