Key Takeaways

- Accelerated innovation in health-oriented beverages and geographic expansion position Olvi for long-term growth and increased market share across multiple regions.

- Investments in efficiency, sustainability, and digital strategy enhance brand value, operating margins, and resilience amid evolving industry conditions.

- Weak regional demand, cost pressures, regulatory risks, and limited geographic diversification threaten Olvi's revenue stability and long-term margin growth.

Catalysts

About Olvi Oyj- A beverage company, manufactures and sells alcoholic and non-alcoholic beverages in Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus.

- The company's accelerated investment and innovation in non-alcoholic and health-oriented beverages (with 220 new products launched in H1 and a focus on non-alcoholic volume growth outpacing alcoholic) position Olvi to capitalize on the structurally rising consumer demand for healthier, functional beverage options, supporting future revenue growth and improved portfolio premiumization.

- Continued geographic expansion and market share gains in both core and adjacent categories (e.g., over 2% share increase in water in Finland, 2% share increase in beer in Latvia, and tripling of soft drink share in Denmark) suggest Olvi is well placed to benefit from urbanization and economic recovery trends in Central and Eastern Europe, underpinning long-term top-line and market share expansion.

- Ongoing investments in production efficiency, automation, and advanced data analytics (such as the new high-bay warehouse and increased focus on portfolio optimization) are likely to enhance operating margins, offset cost pressures, and support sustained earnings growth as cost inflation stabilizes and scale efficiencies improve.

- Growing emphasis on sustainability and strong local brand presence (highlighted by CDP's A

- rating and recognition from Time Magazine) enhance customer loyalty and competitive positioning as environmental standards tighten industry-wide, supporting long-term brand value and relative price resilience.

- Strengthened digital, marketing, and sales activations-combined with improved execution through new management hires and operational structures-are expected to unlock revenue and profitability improvements in underperforming segments like Denmark and Latvia, especially as market conditions and weather normalize, fueling net margin recovery and improved earnings visibility.

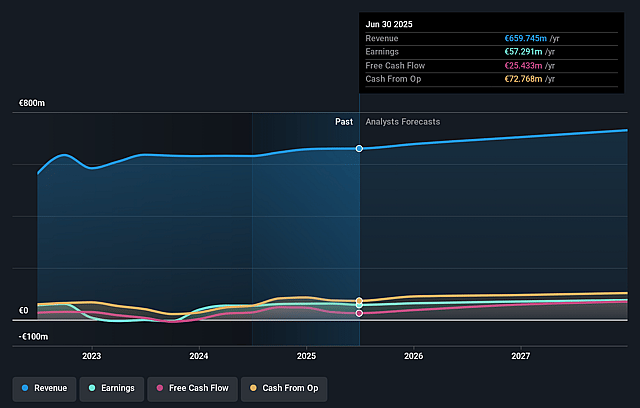

Olvi Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Olvi Oyj's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.7% today to 10.9% in 3 years time.

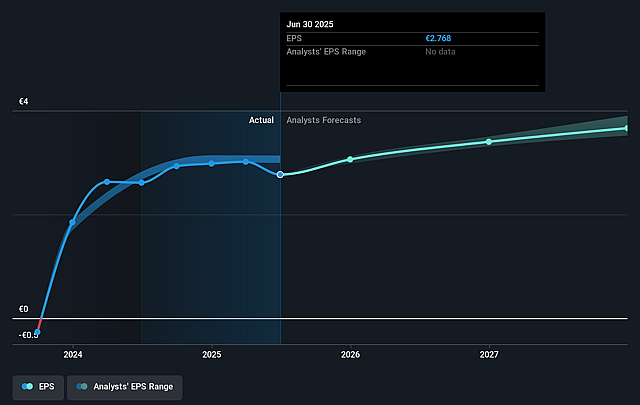

- Analysts expect earnings to reach €81.0 million (and earnings per share of €3.66) by about September 2028, up from €57.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2028 earnings, down from 10.8x today. This future PE is lower than the current PE for the GB Beverage industry at 20.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.49%, as per the Simply Wall St company report.

Olvi Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged weak consumer demand and increased economic uncertainty across Olvi's core Nordic and Baltic markets could continue to suppress beverage consumption, directly impacting revenue growth and potentially leading to sustained margin pressure if recovery remains slow.

- Intensifying price competition, especially in beer (the core product for Olvi), coupled with market contraction in key regions like Latvia, risks both volume declines and net margin compression due to elevated marketing spend and promotional activities necessary to maintain market share.

- Regulatory developments, including stricter alcohol legislation (excise duties) and potentially costly EU packaging and waste requirements, pose a structural risk of higher compliance and operational expenses, which may weigh on long-term earnings and net margins.

- Olvi's limited geographic diversification, with strong reliance on Finland and the Baltics, makes it vulnerable to regional economic stagnation and demographic shifts, potentially resulting in revenue instability and challenging the viability of long-term earnings growth.

- Sustained inflation in logistics and input costs, evident in higher expenses particularly in Belarus and across the group, combined with limited room for further price increases and portfolio optimization, could erode operating margins and dampen future profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €36.667 for Olvi Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €40.0, and the most bearish reporting a price target of just €33.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €745.8 million, earnings will come to €81.0 million, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 5.5%.

- Given the current share price of €30.0, the analyst price target of €36.67 is 18.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.