Key Takeaways

- Strategic advances in decarbonization, modular power solutions, and digital services are set to strengthen margins and recurring revenues across expanding end markets.

- Growing demand from data centers and renewable energy integration gives Wärtsilä a competitive edge, positioning it for substantial long-term growth and market leadership.

- Reliance on fossil-fuel engines, slow digital innovation, pricing pressure, order lumpiness, and emerging market exposure heighten risks to future profitability and earnings stability.

Catalysts

About Wärtsilä Oyj Abp- Offers technologies and lifecycle solutions for the marine and energy markets worldwide.

- While analysts broadly agree that Wärtsilä's record 8.8 billion euro order book will support future revenue growth, current lead times and rising capacity utilization suggest a developing scarcity premium that could significantly accelerate both equipment price realization and forward revenue growth, with scope for orders to be pulled forward as customers seek to secure slots.

- The analyst consensus views the strategic focus on decarbonization and new engine technologies as margin-accretive, but the commercial launch of Wärtsilä's full-scale marine carbon capture solution is likely to trigger a step-change in both equipment and long-term service revenues, progressively positioning Wärtsilä as the de facto supplier to owners facing tightened IMO 2030 and 2050 emissions mandates, supporting sustained expansion in net margins.

- Rapid growth in global data centers is catalyzing new demand for modular, engine-based power plants-where Wärtsilä holds key competitive advantages in efficiency, emissions, and modularity-potentially opening a multi-billion euro equipment and high-margin service market that is only just beginning to manifest in the company's order intake and backlog.

- Ongoing digitalization trends-such as smart lifecycle services, predictive maintenance, and remote monitoring-are poised to transform Wärtsilä's services segment into a high-margin, recurring revenue engine, driving significant operating leverage and upward pressure on group-wide net margins and free cash flow over the medium to long term.

- As global grid modernization and investment in flexible power ramp up to integrate rising shares of intermittent renewables, Wärtsilä's leadership in balancing and hybrid power solutions positions it to capture an outsized share of grid stability and distributed energy investment, which could unlock a step-change in top-line growth and profitability that is not fully reflected in current market valuations.

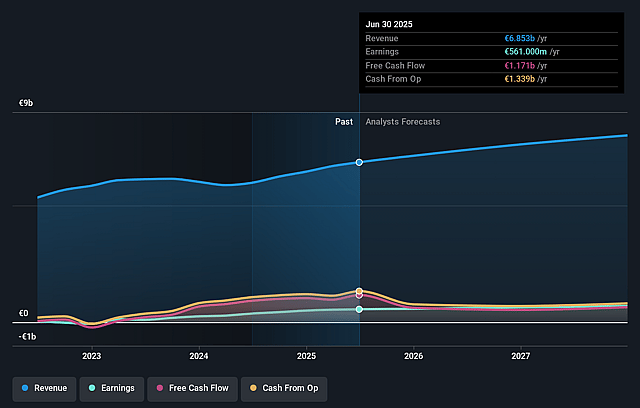

Wärtsilä Oyj Abp Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wärtsilä Oyj Abp compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wärtsilä Oyj Abp's revenue will grow by 9.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 8.2% today to 9.4% in 3 years time.

- The bullish analysts expect earnings to reach €853.4 million (and earnings per share of €1.44) by about September 2028, up from €561.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.7x on those 2028 earnings, down from 27.0x today. This future PE is greater than the current PE for the GB Machinery industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.71%, as per the Simply Wall St company report.

Wärtsilä Oyj Abp Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Acceleration of decarbonization policies and global carbon pricing could undermine demand for Wärtsilä's traditional engine and propulsion technologies that rely on fossil fuels, potentially stranding assets and putting long-term revenues and profit margins at risk.

- Intensifying price competition from Asian manufacturers and increasing global supply chain instability may put sustained downward pressure on both equipment pricing and margins, eroding profitability over time.

- Wärtsilä's slow pace of innovation in digitalization and automation relative to competitors, coupled with industry-wide shifts to electrification and alternative energy sources such as batteries and hydrogen, threatens to diminish market share and compress both future revenues and operating margins.

- The company's high exposure to project-based (lumpy) orders, particularly in energy and marine infrastructure, makes it vulnerable to delays or cancellations in customer investment cycles, especially if rising interest rates or macroeconomic/geopolitical uncertainties reduce capital expenditure, impacting order flow and future earnings.

- Heavy dependence on emerging markets, where currency volatility and geopolitical risks are pronounced, increases the likelihood of long-term earnings volatility and the potential for unexpected write-downs impacting net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wärtsilä Oyj Abp is €26.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wärtsilä Oyj Abp's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €26.0, and the most bearish reporting a price target of just €13.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €9.1 billion, earnings will come to €853.4 million, and it would be trading on a PE ratio of 21.7x, assuming you use a discount rate of 6.7%.

- Given the current share price of €25.7, the bullish analyst price target of €26.0 is 1.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.