Narratives are currently in beta

Key Takeaways

- Successful M&A strategy and acquisition plans drive revenue growth as a sector-focused consolidator in the fragmented vehicle aftermarket.

- Geographic and product expansion into new platforms and electric vehicle parts promises long-term revenue enhancement and earnings growth.

- Reliance on acquisition-driven growth faces integration risks, while limited financial flexibility hampers expansion, risking earnings and revenue stability amidst industry-specific and operational challenges.

Catalysts

About Relais Group Oyj- Operates as a consolidator and acquisition platform for vehicle aftermarket in the Nordic and Baltic countries.

- The company is actively pursuing a strategy as a sector-focused consolidator in the fragmented vehicle aftermarket, with a track record of successful M&A and a robust pipeline of acquisition targets, which should drive future revenue growth.

- There is significant potential for geographic and product expansion, including new platforms such as agriculture, forestry, or mining vehicles, and increased focus on electric vehicle parts, promising long-term revenue enhancement.

- The business model, which emphasizes cash generation and decentralized governance, supports lean operations and local entrepreneurship, aiming to increase net margins over time through operational efficiencies.

- The company's scalable platform and focus on commercial vehicles, especially in the already large and resilient Nordic market, are expected to deliver organic growth rates above the market average, positively impacting earnings.

- With improved capacity utilization in repair and maintenance services and the potential for margin expansion in the wholesale segment through better procurement and pricing strategies, earnings per share are anticipated to grow.

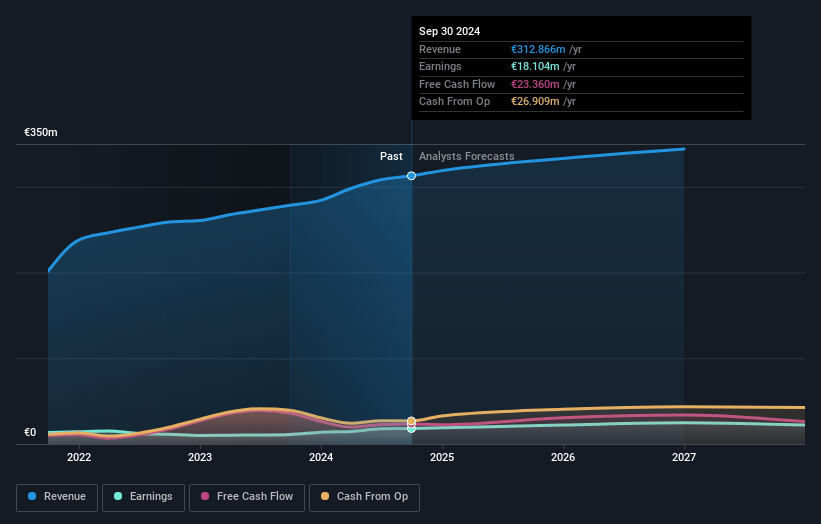

Relais Group Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Relais Group Oyj's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.8% today to 6.4% in 3 years time.

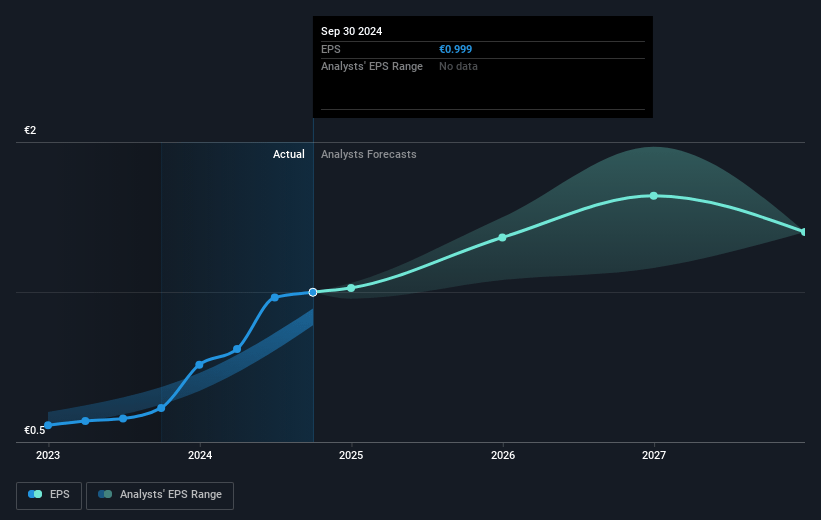

- Analysts expect earnings to reach €22.7 million (and earnings per share of €1.23) by about January 2028, up from €18.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €27.5 million in earnings, and the most bearish expecting €19.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.7x on those 2028 earnings, up from 12.8x today. This future PE is greater than the current PE for the FI Trade Distributors industry at 12.8x.

- Analysts expect the number of shares outstanding to grow by 0.8% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.88%, as per the Simply Wall St company report.

Relais Group Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth strategy heavily relies on acquisitions in a fragmented market, which carries integration risks and could lead to issues in maintaining profitability or synergy realization, potentially impacting earnings.

- The focus on the commercial vehicle sector, though less cyclical, may limit diversification and expose the company to industry-specific downturns, affecting revenue stability.

- Profitability improvements are linked to margins in the Repair and Maintenance segment, which may face pressures from labor costs due to collective bargaining agreements, impacting net margins.

- The company’s current financial flexibility for larger acquisitions is limited, which could restrict opportunities for significant expansion or transformational deals, affecting future growth in revenue and earnings.

- Cash flow improvements depend significantly on net working capital efficiency, which can be highly sensitive to demand fluctuations or inventory challenges, potentially affecting liquidity and the ability to sustain operations without external financing.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €16.85 for Relais Group Oyj based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €355.7 million, earnings will come to €22.7 million, and it would be trading on a PE ratio of 16.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of €12.8, the analyst's price target of €16.85 is 24.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives