Key Takeaways

- Slower-than-expected market growth and customer caution may limit revenue expansion and increase margin volatility amid ongoing global and industry uncertainties.

- High market expectations for electrification and premium pricing could be challenged by regulatory costs, competitive pressure, and slower adoption, dampening future earnings potential.

- Robust order growth, expanding eco-friendly offerings, and services profitability, supported by strong financials and global diversification, position Kalmar for resilient, long-term revenue and margin growth.

Catalysts

About Kalmar Oyj- Provides heavy material handling equipment and services for ports, terminals, distribution centres, manufacturing, and heavy logistics industries in the Americas, Europe, Asia, the Middle East, and Africa.

- Current investor optimism may overstate the pace and sustainability of container traffic growth, as recent global container throughput estimates project a 1% decrease this year versus GDP/industrial growth-implying future revenue growth might underperform expectations amid deglobalization and shifting supply chains, negatively impacting top-line potential.

- Elevated valuation may reflect expectations for rapid adoption of Kalmar's electrified/economical portfolio, but near-term uncertainty (tariffs, price sensitivity, battery tariffs in the U.S.) and slower customer transitions could temper order growth and limit margin expansion in key markets, putting downward pressure on earnings and net margins.

- Uncertainty from tariffs, geopolitical tensions, and macro risks is leading key customers to delay capex decisions, with U.S. customers demonstrating a pronounced wait-and-see approach-this could result in equipment revenue volatility and underutilization of fixed cost absorption, compressing net margins if volumes stay subdued.

- Although services profitability is currently strong, a broader industry shift to asset-light, shared, and digital logistics models may structurally limit the growth rate of traditional service revenues, which could eventually dampen recurring cash flow growth and erode long-term margin resilience.

- Current high multiples may assume ongoing premium pricing power and sustained R&D-driven competitive advantage, yet the risk of rising compliance costs from environmental regulation, combined with intensifying low-cost competition, could erode gross and net margins faster than expected, restraining future earnings growth.

Kalmar Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kalmar Oyj's revenue will grow by 4.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 10.5% in 3 years time.

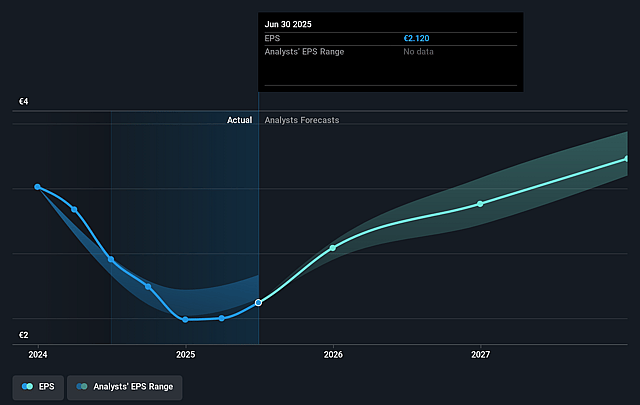

- Analysts expect earnings to reach €199.2 million (and earnings per share of €3.1) by about July 2028, up from €128.6 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, down from 20.0x today. This future PE is lower than the current PE for the FI Machinery industry at 22.5x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

Kalmar Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong growth in equipment orders (+20% YoY and two consecutive strong quarters), combined with a rising order book and book-to-bill above 1.0, points to future sales recovery and improved fixed cost absorption, supporting revenue and margin growth.

- The services segment, now 36% of sales, continues to post high profitability (19% in Q1) and provides stable, recurring revenues and cash flows even during economic uncertainty, buttressing overall earnings resilience.

- Significant customer interest in eco, hybrid, and fully electric solutions (eco portfolio share of sales/order intake >40%, electric machine orders rising) aligns Kalmar with long-term decarbonization and automation trends, supporting premium pricing and future revenue streams.

- A strong financial position-order book at all-time high, leverage at 0.1x EBITDA, gearing at 4%, high cash conversion (97%), and robust ROCE (18.4% headline, ~22% adjusted)-enables continued R&D, capacity investment, and navigation of macro challenges without margin sacrifice.

- Kalmar's diversified geographic (operations in 120+ countries, factories in four continents), customer, and product base, combined with proactive price management and a €50 million efficiency program, mitigates regional demand swings-supporting stable long-term earnings and revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €35.0 for Kalmar Oyj based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €40.0, and the most bearish reporting a price target of just €27.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.9 billion, earnings will come to €199.2 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 7.1%.

- Given the current share price of €40.04, the analyst price target of €35.0 is 14.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.