Last Update 11 Dec 25

Fair value Increased 0.53%IBE: Key Market Power Demand Will Support Operations Amid Mixed Ratings Narrative

Analysts have nudged their fair value estimate for Iberdrola slightly higher to EUR 17.15 from EUR 17.06, citing a stronger multiyear revenue growth outlook and supportive recent rating and target price revisions despite some dissenting views.

Analyst Commentary

Street research remains divided on Iberdrola, with recent rating changes and target price revisions underscoring a debate around how much of the multiyear growth story is already reflected in the share price.

While bullish analysts point to accelerating demand and improved earnings visibility in key geographies, more cautious voices highlight valuation constraints versus near term regulatory and macro uncertainties.

Bullish Takeaways

- Bullish analysts argue that structurally higher electricity demand, particularly in the U.S. and UK, underpins a more robust top line trajectory and supports the recent upward drift in fair value estimates.

- Upgrades to positive ratings are framed around Iberdrola's execution in regulated and quasi regulated networks, which is seen as de risking cash flows and justifying a premium versus traditional utilities peers.

- Upward revisions to price targets, even if incremental, are interpreted as confirmation that consensus had been too conservative on medium term growth and capex returns.

- Some analysts highlight that the growing visibility on renewables and grid investment plans could catalyze further multiple expansion, provided project delivery continues to track or beat guidance.

Bearish Takeaways

- Bearish analysts see limited upside from current levels. At least one has set a target price below the latest fair value estimate, implying downside risk if execution stumbles or macro conditions soften.

- Concerns center on valuation compression risk, as the shares already trade at a premium to many European utilities. This leaves less margin of safety if regulatory frameworks or power prices turn less supportive.

- More cautious views also flag potential delays or cost inflation in large scale network and renewables projects, which could pressure returns on invested capital and weigh on earnings momentum.

- There is also some unease around currency and political risk in non domestic markets, which could introduce volatility to cash flows and challenge the current growth driven narrative embedded in the valuation.

What's in the News

- Storm damage at Iberdrola's Flyers Creek wind farm in Australia caused a GE Vernova turbine blade to bend in half. The company removed the unit from service, established an exclusion zone, and ordered a replacement blade while working on a safe return-to-operation plan (Recharge News).

- Iberdrola signed a 10 year renewable hydrogen energy agreement with IFF to power a new nature based hydrogen production facility at IFF's Benicarló fragrance ingredients plant in Spain, enabling annual production of 100 tons of green hydrogen.

- The green hydrogen supplied under the Iberdrola IFF agreement will be used in hydrogenation reactions for more than 50 key fragrance ingredients, supporting IFF's goal to eliminate 2,000 tons of CO2 emissions per year and advance toward its 2030 emissions reduction targets.

Valuation Changes

- Fair Value Estimate has risen slightly to €17.15 from €17.06, reflecting a modest upward adjustment in long term fundamentals.

- Discount Rate is unchanged at 7.65 percent, indicating no shift in perceived risk profile or cost of capital assumptions.

- Revenue Growth has increased meaningfully to approximately 4.67 percent from 4.07 percent, signaling stronger expectations for top line expansion.

- Net Profit Margin has edged down slightly to about 13.88 percent from 14.19 percent, suggesting a modestly more conservative view on profitability.

- Future P/E has risen moderately to roughly 25.6 times from 23.8 times, implying a higher valuation multiple applied to forward earnings.

Key Takeaways

- Expansion of regulated network assets and clean energy projects, backed by supportive policies, drives predictable revenue growth and higher margins.

- Strong financing and operational cash flow support ambitious investments, maintaining reliable dividends and reducing the need for new equity.

- Heavy reliance on regulated markets, partnership funding, and favorable regulation exposes Iberdrola to political, financial, and execution risks that threaten profitability and growth targets.

Catalysts

About Iberdrola- Engages in the generation, production, transmission, distribution, and supply of electricity in Spain, the United Kingdom, the United States, Mexico, Brazil, Germany, France, and Australia.

- Major expansion of regulated network investments in the US and UK, supported by stable and attractive policy frameworks and recently approved regulatory determinations, is expected to nearly triple Iberdrola's regulated asset base to €90bn by 2031. This should drive sustained, predictable growth in revenues and a structural increase in regulated net margins.

- Ongoing acceleration of grid modernization and digitalization-driven by enhanced incentives in the new regulatory regimes-will improve operational efficiency, reduce network losses, and boost EBITDA margins over time as these investments scale across core regions.

- A multi-year pipeline of large offshore wind and renewable projects in the US, UK, and continental Europe, backed by supportive government policies and long-term power purchase agreements, underpins forward-looking growth in clean generation capacity and future revenues.

- The electrification of transport, heating, and industrial sectors in both Europe and the US is expected to steadily raise electricity demand over the next decade, expanding Iberdrola's addressable market and enhancing long-term top-line and EBITDA growth prospects.

- Growing access to green finance, along with robust operational cash flow and a successful equity raise, ensures Iberdrola can fund its ambitious expansion with comfortable leverage and no need for additional equity until at least 2030, supporting sustained investment, future earnings growth, and reliability of dividend policies.

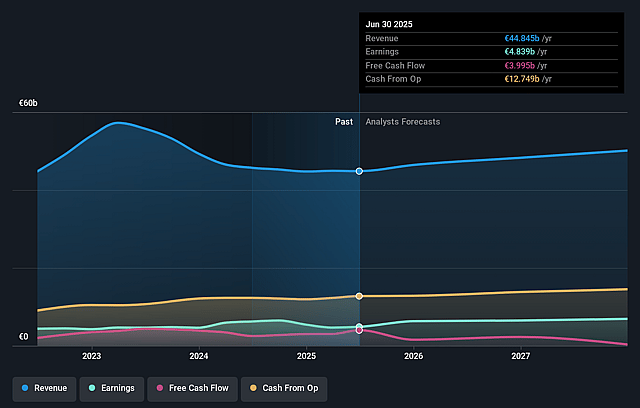

Iberdrola Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Iberdrola's revenue will grow by 3.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.8% today to 14.0% in 3 years time.

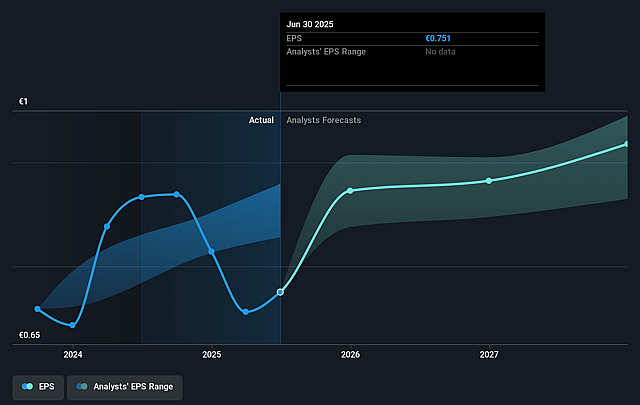

- Analysts expect earnings to reach €7.0 billion (and earnings per share of €1.06) by about September 2028, up from €4.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €6.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, down from 21.8x today. This future PE is greater than the current PE for the GB Electric Utilities industry at 15.1x.

- Analysts expect the number of shares outstanding to grow by 1.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.49%, as per the Simply Wall St company report.

Iberdrola Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Iberdrola's significant reliance on regulated markets-particularly in the U.K. and the U.S., which will account for approximately 75% of the regulated asset base by 2031-increases exposure to potential adverse changes in regulatory frameworks or political intervention, which could negatively impact allowed returns, pricing power, and future net margins.

- The company is undertaking a large €5 billion equity raise to fund an unprecedented acceleration in network investments, indicating heavy dependence on favorable capital market conditions and access to green financing; should macroeconomic conditions shift (e.g., rising interest rates or tighter credit), Iberdrola may face higher financing costs, pressuring future profitability and earnings growth.

- While Iberdrola's focus shifts to networks, growth in renewables investment is largely being maintained only through asset rotation and co-investment strategies; heavy reliance on these partnership and asset sale mechanisms to fund growth could expose the company to execution risk, dilution of returns, or subdued revenue growth if market appetite weakens or partners become scarce.

- Spanish regulatory uncertainty, as highlighted by ongoing concerns regarding investment caps, slow recognition of investment, and unfavorable draft proposals for network remuneration, suggests downside risks for Iberdrola's domestic regulated business, with potential impacts on revenue growth, cost recovery, and regional net margins.

- The group's rapidly expanding asset base and leverage (despite improved ratios post-asset rotation) could become a long-term financial risk if regulatory returns fail to keep pace with cost inflation, future rate hikes, or if investments face delays and overruns-collectively jeopardizing targets for EBITDA growth, net profit, and dividend sustainability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €15.944 for Iberdrola based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.5, and the most bearish reporting a price target of just €9.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €50.1 billion, earnings will come to €7.0 billion, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 7.5%.

- Given the current share price of €15.8, the analyst price target of €15.94 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.