Key Takeaways

- Strategic focus on prime assets in key European cities boosts rental growth and pricing power, enhancing revenue and earnings.

- Efficient capital management and strong macroeconomic conditions in core markets enhance future growth and financial performance.

- Rising interest rates, execution risks in property transformation, and high payout ratios could strain financial resources and impact future earnings growth.

Catalysts

About Inmobiliaria Colonial SOCIMI- Colonial is a Spanish listed REIT company (SOCIMI), leader in the European Prime office market with presence in the main business areas of Barcelona, Madrid, and Paris with a prime office portfolio of more than 1 million sqm of GLA and assets under management with a value of more than €11bn.

- The company's strategic focus on prime asset class positioning in key European cities like Paris, Madrid, and Barcelona is expected to continue driving superior rental growth and strong pricing power, positively impacting revenue and earnings growth.

- The ongoing urban transformation projects and new urban planning initiatives, particularly in cities like Paris, are creating supply constraints, which could lead to increased demand and rental rates, thereby enhancing future revenue growth.

- The delivery of new urban campus projects, such as Madnum and other Alpha X projects, is anticipated to significantly contribute to rental income and earnings growth, offering a potential increase in EPRA EPS by 3%.

- Strong macroeconomic fundamentals in home markets, particularly Spain's leading GDP growth in Europe, are expected to create favorable conditions for the office sector, potentially boosting occupancy rates and revenue growth.

- Efficient capital management, including the issuance of green bonds and maintaining a solid capital structure, positions the company well for future investment and growth, potentially benefiting net margins and EPS.

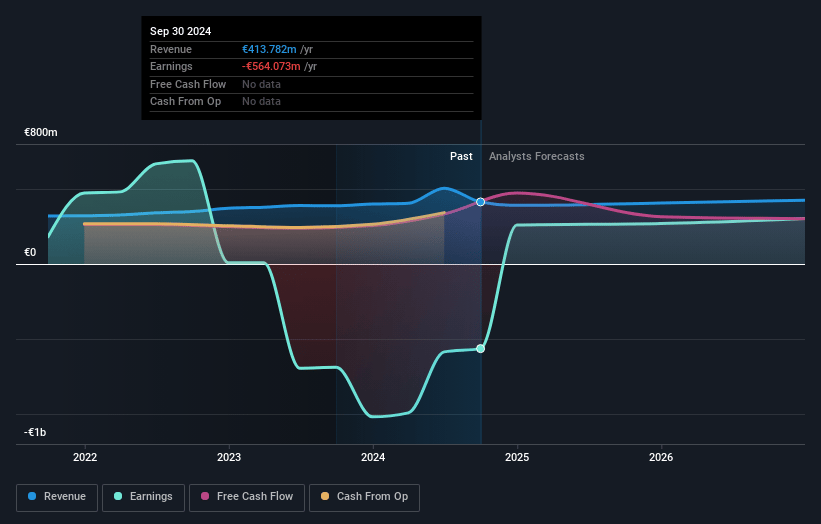

Inmobiliaria Colonial SOCIMI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Inmobiliaria Colonial SOCIMI's revenue will decrease by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 60.0% today to 90.3% in 3 years time.

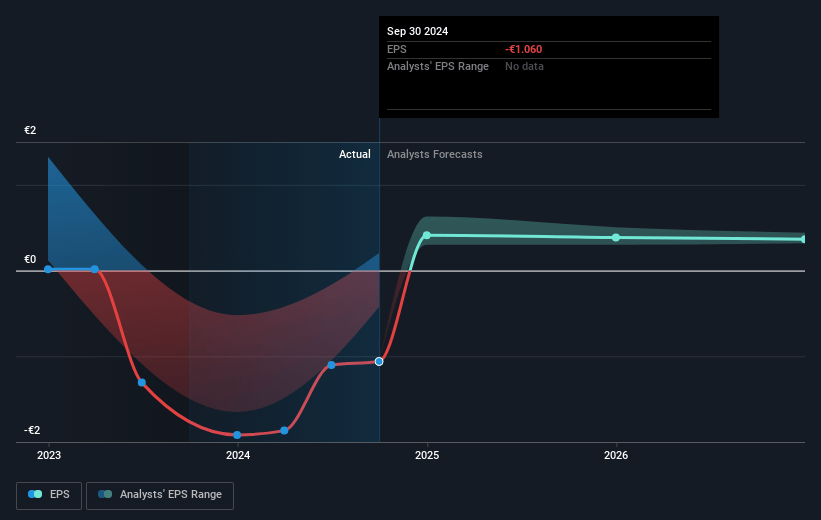

- Analysts expect earnings to reach €411.8 million (and earnings per share of €0.58) by about May 2028, up from €307.4 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €710 million in earnings, and the most bearish expecting €227 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.1x on those 2028 earnings, up from 11.5x today. This future PE is lower than the current PE for the GB Office REITs industry at 22.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.4%, as per the Simply Wall St company report.

Inmobiliaria Colonial SOCIMI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising interest rates pose a potential risk to asset valuations, resulting in increased yields and reduced asset values, which could negatively impact net tangible assets and overall earnings growth.

- The company's strategy of transforming office spaces into residential properties introduces execution risks and potential disruptions in rental income, particularly if such projects do not meet the expected returns or face regulatory challenges, impacting overall revenue.

- Limited transactional volume in the prime office market could indicate a lack of buyer liquidity or willingness to transact, which may affect the perceived value of Colonial’s assets and impede capital recycling efforts, potentially decreasing asset value growth.

- High payout ratios, such as the proposed dividend payout exceeding earnings per share, may strain financial resources and limit the company's ability to reinvest or adapt to market changes, affecting future earnings growth.

- Relying heavily on macroeconomic conditions in Spain and France introduces vulnerability to local economic fluctuations or growth slowdowns, which could adversely affect rental demand and rental income, impacting revenue and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €6.67 for Inmobiliaria Colonial SOCIMI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €8.5, and the most bearish reporting a price target of just €4.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €456.0 million, earnings will come to €411.8 million, and it would be trading on a PE ratio of 16.1x, assuming you use a discount rate of 9.4%.

- Given the current share price of €5.7, the analyst price target of €6.67 is 14.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.