Key Takeaways

- Investment in digitalization, automation, and analytics is enhancing efficiency, underwriting profitability, and expense control, supporting margin expansion and sustained growth.

- Diversification into new insurance products and effective customer acquisition reduce reliance on motor insurance, creating new revenue streams and growth opportunities.

- Heavy dependence on the Spanish motor insurance market and limited diversification heighten vulnerability to sector downturns, rising costs, and macroeconomic or regulatory shocks in Spain.

Catalysts

About Línea Directa Aseguradora Compañía de Seguros y Reaseguros- Engages in insurance and reinsurance business in Spain and Portugal.

- Strong acceleration in customer acquisition, particularly in motor (+11% premiums, >100,000 net new clients in H1), supported by Spain's ongoing shift to digital direct insurance and increasing new car sales, indicates Línea Directa is well placed to benefit from expansion of its addressable market and sustain double-digit revenue growth.

- Ongoing investment in digitalization, process automation, and expense control (highlighted as core strengths, with expense ratios cited as a key competitive advantage) points to continued improvement in combined ratio and net margin expansion.

- Recent product innovation and launches in new insurance verticals (anti-occupancy, pet, retail), combined with a more comprehensive health product mix, create new, higher-margin revenue streams that should smooth earnings and reduce reliance on motor insurance.

- Enhanced capabilities in individualized pricing and rapid rate adjustment (faster than traditional incumbents), leverages big data and analytics to improve risk selection and maintain underwriting profitability (as seen in combined ratio improvement), supporting both earnings and loss ratios.

- The underpenetration of insurance and increasing consumer awareness of financial protection in Southern Europe, along with Línea Directa's strong brand and customer retention, signal untapped growth potential for both premium and fee income, supporting sustainable top-line and bottom-line growth.

Línea Directa Aseguradora Compañía de Seguros y Reaseguros Future Earnings and Revenue Growth

Assumptions

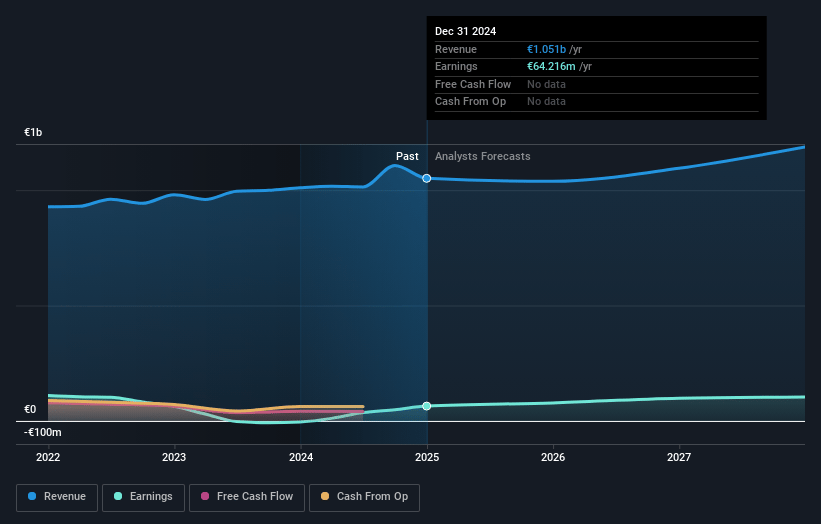

How have these above catalysts been quantified?- Analysts are assuming Línea Directa Aseguradora Compañía de Seguros y Reaseguros's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.0% today to 8.9% in 3 years time.

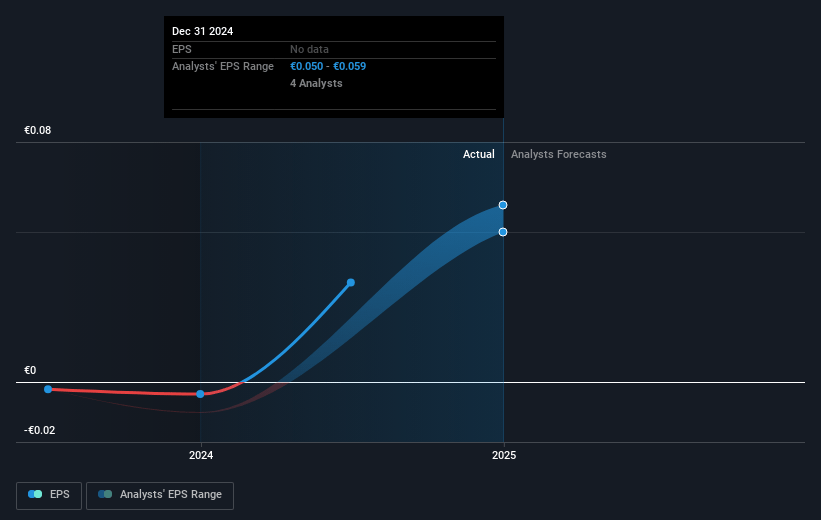

- Analysts expect earnings to reach €109.0 million (and earnings per share of €0.1) by about July 2028, up from €74.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, down from 20.0x today. This future PE is greater than the current PE for the ES Insurance industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.29%, as per the Simply Wall St company report.

Línea Directa Aseguradora Compañía de Seguros y Reaseguros Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on the Spanish motor insurance market remains a notable risk, exposing Línea Directa to high cyclicality and potential market saturation; this concentration could limit revenue growth and lead to increased earnings volatility if motor insurance faces structural decline or economic downturn in Spain.

- Slower cross-selling and policy growth in Home and Health insurance segments compared to Motor indicate limited diversification of revenue streams; if these lines do not accelerate meaningfully, future net margin and earnings growth may be constrained by over-exposure to a single business line.

- Increasing acquisition costs, particularly with marketing spend on new products and launches, could pressure net margins if policy growth or technical breakeven is slower than anticipated, weakening profitability in the medium-term.

- Continued strong returns from the investment portfolio are partly reliant on current bond yields and mark-to-market gains; a shift to a low or volatile interest rate environment could reduce portfolio returns, impacting earnings and bottom-line growth.

- Lack of significant geographic diversification means any macroeconomic shocks, adverse regulatory changes, or negative secular trends in Spain-such as tougher competition from digital-first insurance rivals or changes in vehicle ownership trends-could disproportionately and negatively impact both revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €1.293 for Línea Directa Aseguradora Compañía de Seguros y Reaseguros based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €1.4, and the most bearish reporting a price target of just €1.15.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €1.2 billion, earnings will come to €109.0 million, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 7.3%.

- Given the current share price of €1.37, the analyst price target of €1.29 is 6.2% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.