Key Takeaways

- Strategic acquisitions and expansion in the Environment and Water sectors boost market presence and potential revenue growth.

- Effective cash management allows increased investment activities without raising debt, enhancing future growth and earnings potential.

- Divestitures and project completions, along with currency impacts and increased debt, may challenge revenue stability and profit margins.

Catalysts

About Fomento de Construcciones y Contratas- Engages in the environmental services, water management, infrastructure development, and real estate businesses in Europe and internationally.

- The carved-out operations, primarily in Real Estate and Cement, had a lower contribution to the profit in 2024 compared to 2023, creating a misleading base effect so the continuing operations are actually performing better than the headline figures show, which could help revenue and net margins in the future.

- Significant growth was observed in the Environment and Water sectors, largely due to organic growth and strategic acquisitions like the U.K. Urbaser and MDS in Texas, which positions FCC for increased revenues and EBITDA margins.

- The completion of significant waste treatment plant projects in Spain and the acquisition of GEL Recycling in Florida expands FCC's market presence and offers opportunities for higher revenues and margins in the Environment sector.

- Increased investment activities possible due to the efficient cash management that led to higher operating cash flow, allowing FCC to fund future growth without significantly increasing net debt, potentially driving earnings growth.

- The expansion of operations in key international markets (e.g., Waste collection in the U.K. and integrated water cycles in the U.S.) suggests potential for increased revenue streams and operational efficiencies in foreign segments, positively impacting future earnings.

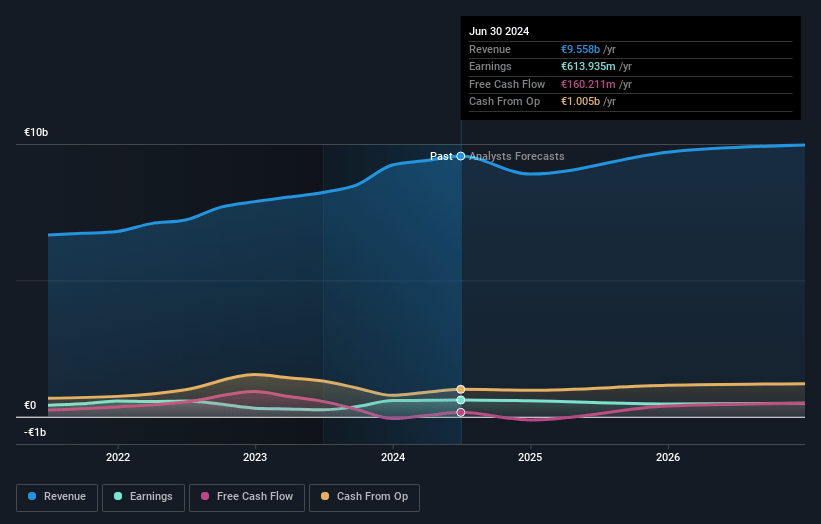

Fomento de Construcciones y Contratas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Fomento de Construcciones y Contratas's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 4.9% in 3 years time.

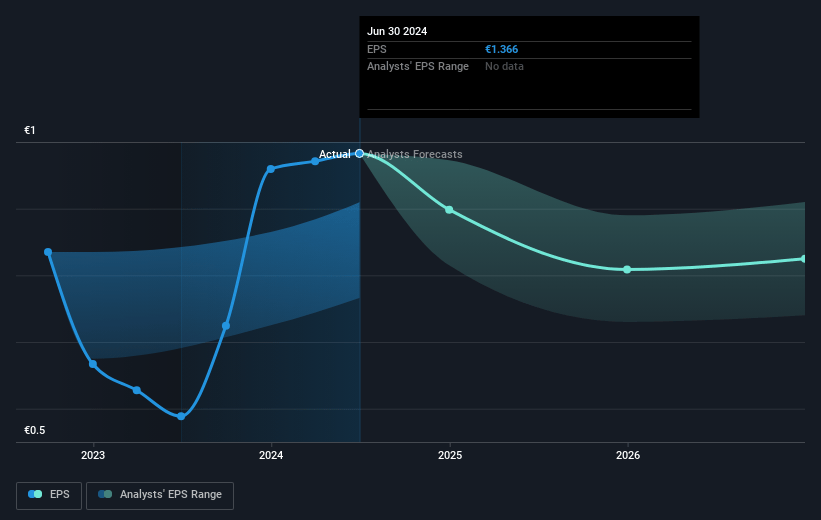

- Analysts expect earnings to reach €483.7 million (and earnings per share of €1.37) by about April 2028, up from €293.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €534 million in earnings, and the most bearish expecting €386 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.8x on those 2028 earnings, up from 16.3x today. This future PE is greater than the current PE for the GB Commercial Services industry at 13.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.58%, as per the Simply Wall St company report.

Fomento de Construcciones y Contratas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The carve-out and division into separate entities, including Real Estate and Cement activities, might lead to decreased revenue and net profit contributions, affecting overall earnings stability.

- The attributable net profit of the group decreased by 27% due to discontinued activities, indicating potential challenges in maintaining net margins and bottom-line profitability.

- Increased financial debt and interest payments, particularly a rise in debt due to investments, could pressure net earnings and cash flow if not offset by proportional revenue growth.

- Exchange rate differences, especially a 4% negative impact from Georgian and Czech currencies, highlight exposure to currency fluctuations, which can affect revenue and net margins.

- A decrease in revenues in key markets, like the Americas, due to completed projects like the Maya Train, poses a risk to revenue stability and future growth potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.229 for Fomento de Construcciones y Contratas based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.4, and the most bearish reporting a price target of just €11.7.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €9.9 billion, earnings will come to €483.7 million, and it would be trading on a PE ratio of 16.8x, assuming you use a discount rate of 10.6%.

- Given the current share price of €10.56, the analyst price target of €13.23 is 20.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.