Last Update10 Sep 25Fair value Decreased 0.23%

Amid virtually unchanged discount rate and consensus revenue growth forecasts, the consensus price target for Netcompany Group was revised marginally down from DKK313.00 to DKK312.29.

What's in the News

- Maintained full-year 2025 earnings guidance, expecting organic revenue growth of 5% to 10%.

- Netcompany Banking Services anticipates nonorganic revenue of DKK 840 million to DKK 870 million for 2025.

- Held an Analyst/Investor Day.

Valuation Changes

Summary of Valuation Changes for Netcompany Group

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from DKK313.00 to DKK312.29.

- The Discount Rate for Netcompany Group remained effectively unchanged, moving only marginally from 7.55% to 7.61%.

- The Consensus Revenue Growth forecasts for Netcompany Group remained effectively unchanged, moving only marginally from 10.0% per annum to 9.9% per annum.

Key Takeaways

- Growth is driven by demand for European digital solutions, selective acquisitions, and success in AI-enhanced platforms across the public and private sectors.

- Regulatory trends and internal tech adoption are increasing pricing power, competitive advantage, and sustainable profitability through margin improvements and expanded market access.

- Margin pressure, talent retention challenges, public sector dependence, integration risks, and AI-driven commoditization threaten long-term growth, profitability, and market differentiation.

Catalysts

About Netcompany Group- Provides business critical IT solutions to private and public customers in Denmark, Norway, the United Kingdom, the Netherlands, Greece, Belgium, Luxembourg, and internationally.

- Ongoing acceleration of digitalization initiatives across European governments, reinforced by EU-backed strategies and explicit client preference for European vendors, is increasing Netcompany's long-term addressable market in the public sector and supporting revenue growth and order visibility.

- Long-term investments and recent wins in AI-driven platforms (such as EASLEY AI, Feniks AI, and PULSE) enable Netcompany to modernize legacy systems across both the public and private sectors, differentiating their offerings and positioning the company to win large, multi-year contracts, improving both revenue growth and margin resilience.

- The successful integration of SDC (now Netcompany Banking Services) expands Netcompany's footprint in the high-growth financial services industry, introduces SaaS banking solutions, and is expected to be accretive to net profit and EPS from 2026 onward, supporting top-line and earnings expansion.

- Netcompany's early adoption and mandatory internal deployment of advanced AI tools drive efficiencies in project delivery, allowing for higher utilization rates and operating leverage; as product development FTE allocation normalizes in H2 2025, this is expected to enhance margins and earnings.

- Increased European regulatory focus on digital sovereignty, cybersecurity, and data residency is shifting vendor selection criteria in favor of Netcompany's European platforms, which should support pricing power, reduce competitive risk from non-European peers, and underpin stable or improved net margins.

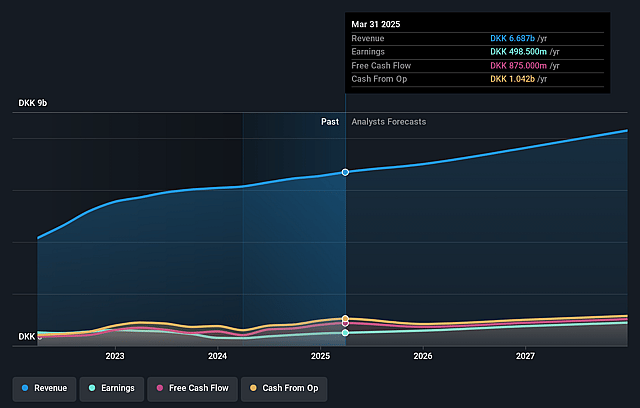

Netcompany Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Netcompany Group's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.4% today to 11.5% in 3 years time.

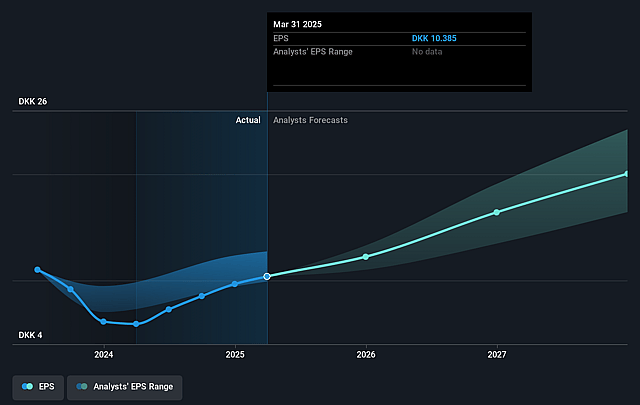

- Analysts expect earnings to reach DKK 1.0 billion (and earnings per share of DKK 20.78) by about September 2028, up from DKK 434.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.6x on those 2028 earnings, down from 26.0x today. This future PE is lower than the current PE for the DK IT industry at 25.0x.

- Analysts expect the number of shares outstanding to decline by 1.7% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.55%, as per the Simply Wall St company report.

Netcompany Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of SDC (Netcompany Banking Services) introduces risk around achieving targeted synergies, with restructuring costs expected to dilute net profit and earnings per share in 2025; if synergy realization is delayed or below expectations, this could structurally reduce long-term earnings growth.

- Margins have weakened year-over-year, notably in Denmark and the UK, due to resource redeployment, heavy upfront product/platform investments, and increased use of subcontractors; if normalization of these costs or effective redeployment of FTEs is slower than expected, persistent margin pressure could compress long-term net margins and profitability.

- Talent attrition increased to 18.2% (up 0.9 percentage points YoY), and reliance on contractors, especially in the UK (now 14% of workforce), suggests ongoing difficulty in attracting and retaining specialized IT talent-a long-term industry trend that could result in higher wage inflation and reduced operational leverage, pressuring margins.

- Revenue growth in the Danish segment declined (-3.9% YoY in Q2), and growth in the private sector was flat group-wide in H1 2025, highlighting ongoing dependence on the public sector; this concentration increases exposure to public budget constraints, stalled or delayed project starts, and policy-driven volatility, putting long-term revenue growth at risk.

- Rapid adoption of AI and automation in the sector brings the risk of pricing pressure and commoditization of services, as generative AI may drive efficiency and replace traditional IT consulting needs; despite Netcompany's internal adoption, this secular trend could structurally reduce the addressable market and compress revenues if offerings do not remain differentiated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK313.0 for Netcompany Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK350.0, and the most bearish reporting a price target of just DKK280.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK9.0 billion, earnings will come to DKK1.0 billion, and it would be trading on a PE ratio of 16.6x, assuming you use a discount rate of 7.6%.

- Given the current share price of DKK240.8, the analyst price target of DKK313.0 is 23.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.