Key Takeaways

- Strategic market expansion and supply chain investments are set to boost Novo Nordisk's revenue growth through increased production and broader geographical reach.

- Diversification through R&D and strategic acquisitions will enhance portfolio breadth, tapping new revenue streams and improving operational efficiencies.

- Heavy reliance on its GLP-1 franchise and challenging product pipeline expansion entail revenue risks, while sustainability concerns and supply constraints pressure margins and growth.

Catalysts

About Novo Nordisk- Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

- Novo Nordisk is undertaking significant investments and resource allocation to expand its supply chain, particularly in response to high demand for its GLP-1 products. These efforts are likely to drive future revenue growth as production capacity increases.

- The company is actively expanding its market presence, including 15 countries for Wegovy, alongside broad formulary access in the U.S. Increasing geographical availability should enhance revenue by capturing a larger share of the global market.

- Continuous investment in Research and Development is aimed at diversifying Novo Nordisk’s portfolio, moving beyond diabetes and obesity into cardiovascular, liver, kidney, and potentially Alzheimer’s disease. This pipeline expansion is expected to bolster future earnings by tapping into new markets and revenue streams.

- Novo Nordisk is demonstrating strong sales growth, particularly with its brands Ozempic and Wegovy, which command a high share of growth. Sustaining or enhancing this trend will contribute positively to revenue and operating profit margins.

- Strategic acquisitions and partnerships, such as the Catalent transaction, aim to enhance production capacity and efficiency. Successful integration of these assets could lead to increased operational efficiencies and improved net margins over time.

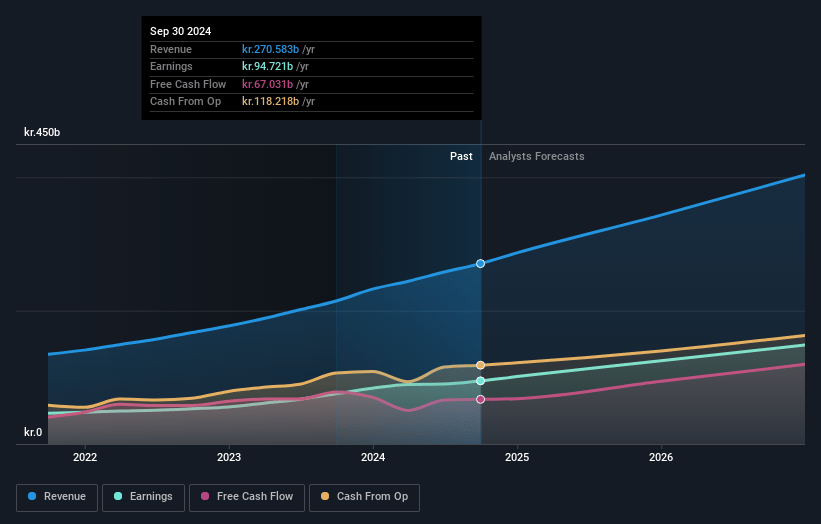

Novo Nordisk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Novo Nordisk's revenue will grow by 17.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 35.0% today to 36.0% in 3 years time.

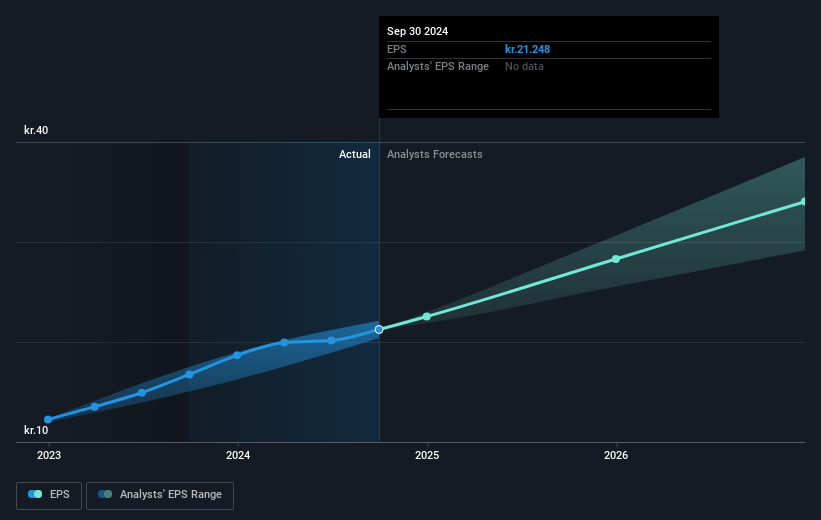

- Analysts expect earnings to reach DKK 155.9 billion (and earnings per share of DKK 35.44) by about January 2028, up from DKK 94.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting DKK172.1 billion in earnings, and the most bearish expecting DKK131.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.5x on those 2028 earnings, down from 28.5x today. This future PE is lower than the current PE for the US Pharmaceuticals industry at 28.6x.

- Analysts expect the number of shares outstanding to decline by 0.3% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.46%, as per the Simply Wall St company report.

Novo Nordisk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Novo Nordisk's significant growth involves substantial investments, leading to a 34% increase in CO2 emissions, which might raise sustainability concerns and impact operating costs and profit margins.

- The company's heavy reliance on its GLP-1 franchise, particularly Ozempic and Wegovy, for growth means any issues, such as increased competition or regulatory changes affecting these products, could significantly impact future revenues.

- The ambitious expansion of the product pipeline into new areas (e.g., cardiovascular and Alzheimer's) is associated with high R&D costs and execution risks, potentially affecting net margins if new products do not meet expectations or face delays in approvals.

- Potential supply constraints, exacerbated by the necessity for technology transfers and existing production commitments at acquired facilities like Catalent, could limit the company's ability to meet rising demand, impacting revenue growth.

- Fluctuations in the pricing structures due to competitive pressures and evolving market dynamics, particularly in the U.S., could affect net margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK824.65 for Novo Nordisk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK1150.0, and the most bearish reporting a price target of just DKK515.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK433.3 billion, earnings will come to DKK155.9 billion, and it would be trading on a PE ratio of 26.5x, assuming you use a discount rate of 4.5%.

- Given the current share price of DKK607.7, the analyst's price target of DKK824.65 is 26.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

UN

Unike

Community Contributor

Novo Nordisk will dominate with GLP-1 products boosting an 8% revenue spike

Catalysts Are there any products or services that could move sales or earnings meaningfully? Most Immediate Catalyst (1–2 Years): Established GLP-1 Products: Ozempic & Rybelsus: driving robust sales and market penetration.

View narrativeDKK 1.10k

FV

42.9% undervalued intrinsic discount8.00%

Revenue growth p.a.

10users have liked this narrative

0users have commented on this narrative

10users have followed this narrative

9 days ago author updated this narrative