Key Takeaways

- Expansion in public preparedness and successful vaccine launches could significantly enhance revenue streams through government contracts and new territories.

- Advancements in new vaccine candidates indicate promising pipeline potential, supporting future revenue growth and market expansion.

- Reliance on public health emergencies, competitive pressures, and regulatory hurdles represent significant risks to Bavarian Nordic's market share, revenue, and future earnings.

Catalysts

About Bavarian Nordic- Develops, manufactures, and supplies life-saving vaccines.

- The successful completion of the tech transfer for rabies and TBE vaccines is expected to improve gross margins by 15% to 20% by 2026, enhancing earnings and profitability.

- Bavarian Nordic's growing Travel Health vaccine franchise, with a 22% growth rate and projections between 10% to 12% growth through 2027, indicates a robust revenue trajectory.

- Expansion in public preparedness, fueled by government contracts and a growing customer base, could lead to revising and possibly increasing the projected base business revenue of DKK 1.5 billion to DKK 2 billion, positively affecting total revenue.

- The launch of VIMKUNYA (chikungunya vaccine) in the EU and gearing up for new territories could offer additional revenue streams, and the company plans to sell a priority review voucher at an optimal time, which can bolster one-time earnings.

- The progression of new vaccine candidates for Lyme and Epstein-Barr Virus into clinical trials by 2026 suggests a pipeline with high potential, promising future revenue growth and market expansion.

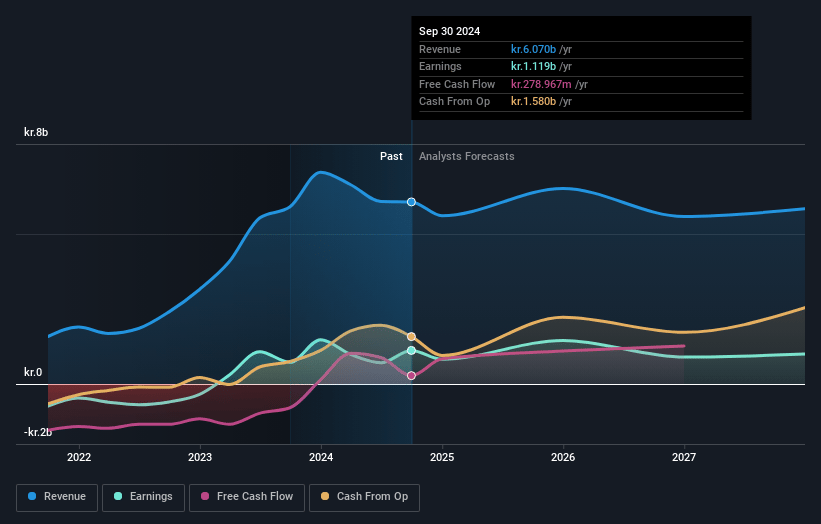

Bavarian Nordic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bavarian Nordic's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts are assuming Bavarian Nordic's profit margins will remain the same at 17.3% over the next 3 years.

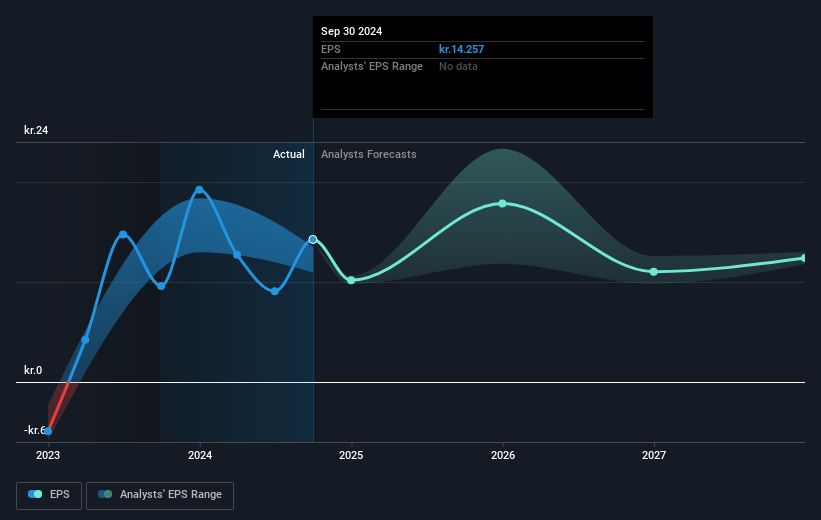

- Analysts expect earnings to reach DKK 1.0 billion (and earnings per share of DKK 12.43) by about May 2028, up from DKK 988.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.0x on those 2028 earnings, up from 12.3x today. This future PE is greater than the current PE for the GB Biotechs industry at 11.6x.

- Analysts expect the number of shares outstanding to grow by 2.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.96%, as per the Simply Wall St company report.

Bavarian Nordic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on securing additional orders for public preparedness amidst unpredictable outbreaks poses a risk to projected revenues and stability, especially since 2025 baselines include assumptions about public health emergencies.

- Revenue from newly launched assets like Vaxchora and Vivotif is not fully rebounded post-COVID, indicating potential challenges in market penetration and sustained sales growth, impacting overall revenue targets.

- The risk associated with the approval and timing of key endorsements like ACIP recommendations in the U.S. for the chikungunya vaccine could delay market adoption or reduce projected revenues in the launch phase.

- Bavarian Nordic still faces competitive pressure from other companies developing similar vaccines for diseases like chikungunya and Lyme, which can potentially affect market share and future revenue streams.

- The significant R&D investments and potential for regulatory hurdles associated with developing new vaccine candidates for Lyme and Epstein-Barr Virus could strain resources and delay returns, impacting future earnings and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK270.5 for Bavarian Nordic based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of DKK310.0, and the most bearish reporting a price target of just DKK231.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK5.9 billion, earnings will come to DKK1.0 billion, and it would be trading on a PE ratio of 26.0x, assuming you use a discount rate of 5.0%.

- Given the current share price of DKK156.35, the analyst price target of DKK270.5 is 42.2% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.