Key Takeaways

- Strong growth and strategic partnerships in Personal Lines are boosting market share and future revenue prospects.

- Repricing strategies and operational efficiencies are expected to enhance profitability, improve net margins, and boost earnings.

- Alm. Brand's high payout ratio, intense competition, and tax burdens could limit growth, impact financial flexibility, and pose risks to future profitability.

Catalysts

About Alm. Brand- Provides non-life insurance products and services in Denmark.

- Alm. Brand is experiencing strong growth in Personal Lines, with a 7.7% increase in 2024, driven by strong partnerships with banks. This is likely to boost future revenue by expanding market share.

- The company is implementing repricing strategies, particularly in motor insurance, which are expected to enhance profitability as these effects kick in and frequency moderates. This is likely to improve net margins.

- Successful synergy initiatives have already exceeded targets in 2024, with expectations to reach DKK 600 million in 2025. This operational efficiency is likely to boost earnings and improve cost structures.

- Planned divestments, such as the Energy & Marine division, are expected to yield substantial buybacks, distributing capital to shareholders and potentially enhancing earnings per share.

- The company is maintaining a high payout ratio and committing to further buybacks and dividends, which may support the stock price and improve investor returns.

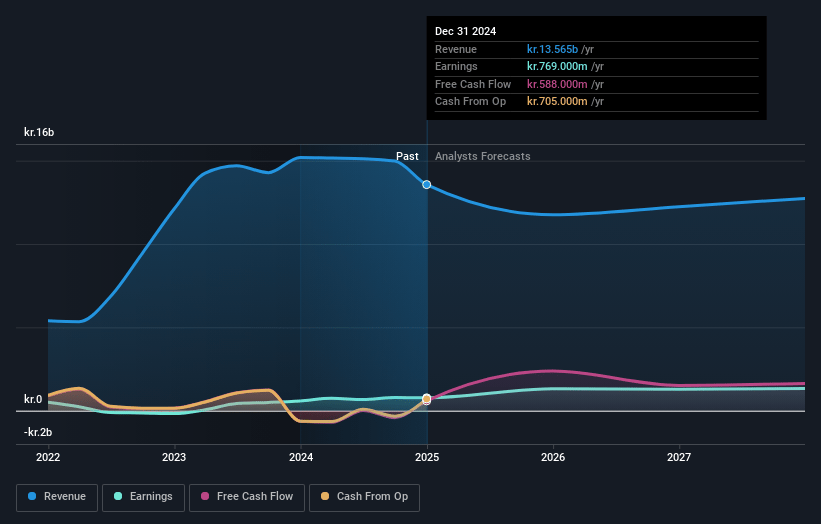

Alm. Brand Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alm. Brand's revenue will decrease by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.7% today to 10.6% in 3 years time.

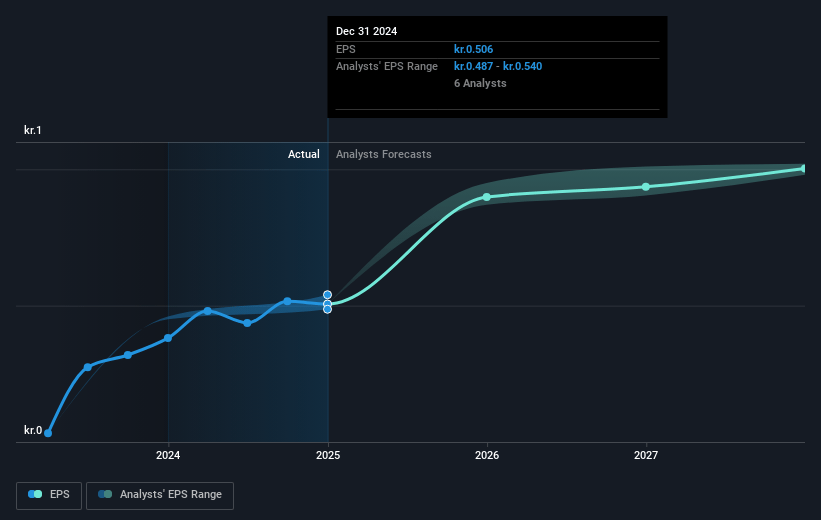

- Analysts expect earnings to reach DKK 1.3 billion (and earnings per share of DKK 1.01) by about May 2028, up from DKK 769.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.5x on those 2028 earnings, down from 30.3x today. This future PE is lower than the current PE for the GB Insurance industry at 24.1x.

- Analysts expect the number of shares outstanding to decline by 1.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.74%, as per the Simply Wall St company report.

Alm. Brand Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has a high payout ratio of close to 100%, which may limit Alm. Brand’s capacity for reinvestment and growth, potentially impacting future earnings and financial flexibility.

- The recent improvement seen in motor claims frequency might not be structural, which presents a risk if the repricing effects anticipated for 2025 do not materialize as expected, influencing future revenue and profitability.

- There is intense competition in personal and commercial insurance lines, and while current retention rates are stable, any future increase in churn could affect revenue and profitability negatively.

- The company's tax rate is notably higher than the statutory rate due to certain deductions, which might lead to higher tax expenses impacting net earnings.

- The transition to a partial internal model (PIM) for capital does not yet have a clear timeline for completion, and regulatory risks may impact future capital adequacy and solvency ratios, influencing Alm. Brand’s ability to distribute capital or reinvest.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK17.625 for Alm. Brand based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK12.7 billion, earnings will come to DKK1.3 billion, and it would be trading on a PE ratio of 21.5x, assuming you use a discount rate of 4.7%.

- Given the current share price of DKK15.62, the analyst price target of DKK17.62 is 11.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.