Narratives are currently in beta

Key Takeaways

- Strong backlog growth in Power Solutions and offshore projects indicate significant future revenue and profitability potential.

- Addressing Service inefficiencies and ramping up manufacturing could improve margins and meet growing demand, boosting earnings.

- Geopolitical risks, operational inefficiencies, and high service costs threaten Vestas' profitability, with low-margin projects and slow regulatory processes affecting margins and revenue realization.

Catalysts

About Vestas Wind Systems- Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

- Vestas is experiencing a backlog increase in Power Solutions, reaching an all-time high of €28.3 billion, suggesting strong future revenue growth as these orders are fulfilled.

- The company is addressing inefficiencies in its Service business, which, if resolved, could lead to improved net margins through cost reductions and better contract management.

- Vestas is ramping up manufacturing capabilities in the U.S. and Europe, positioning itself to capitalize on domestic demand and potentially increase earnings through higher output capacity.

- Continued investment in offshore manufacturing platforms in Europe, such as projects He Dreiht and Baltic Power, indicates future growth potential in offshore wind, which could enhance revenue and profitability.

- The development pipeline of 28 gigawatts in key markets like Australia, U.S., and Brazil shows promising revenue opportunities and potential earnings gains as projects reach financial close and construction readiness.

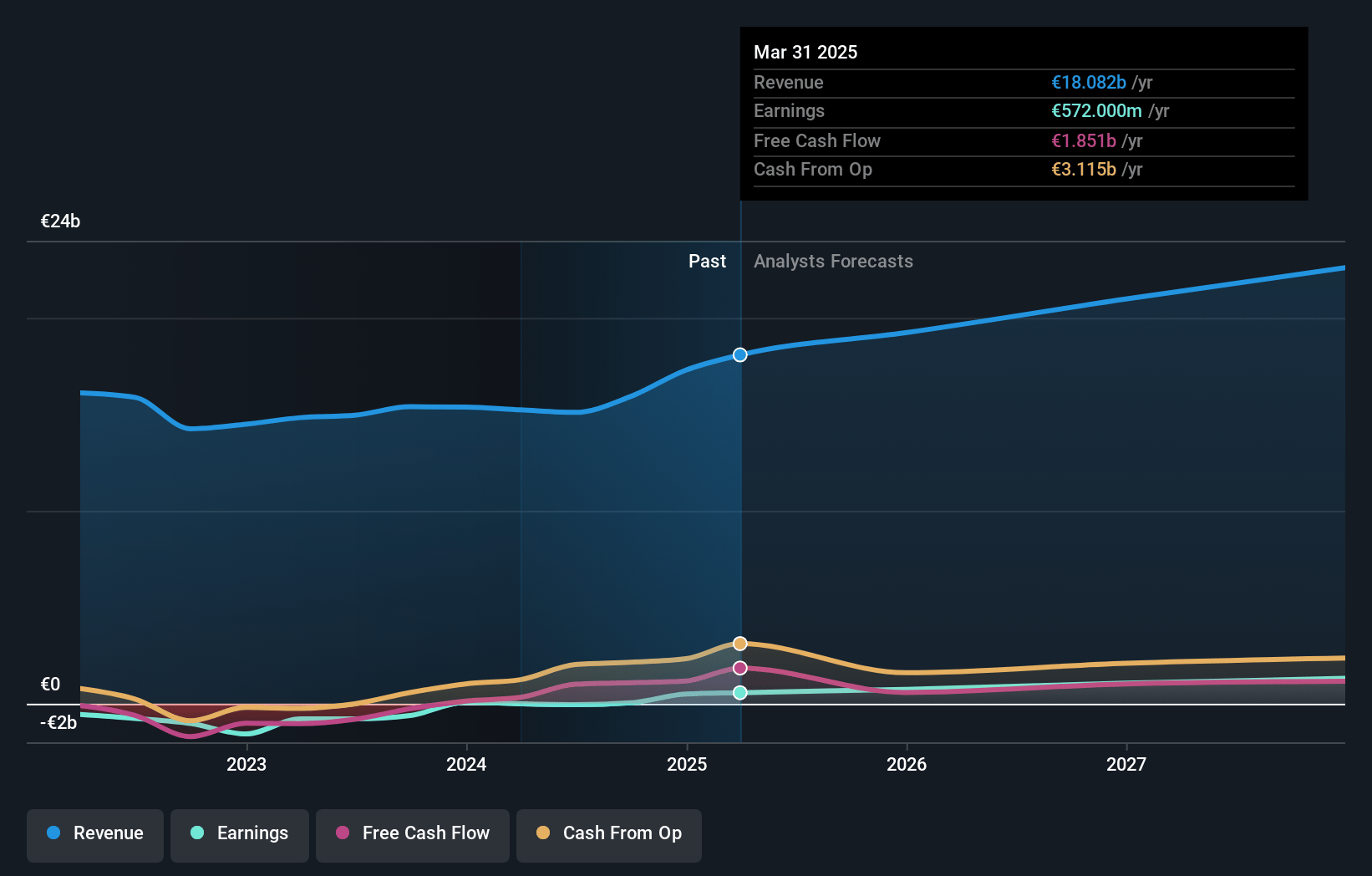

Vestas Wind Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vestas Wind Systems's revenue will grow by 11.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.3% today to 6.4% in 3 years time.

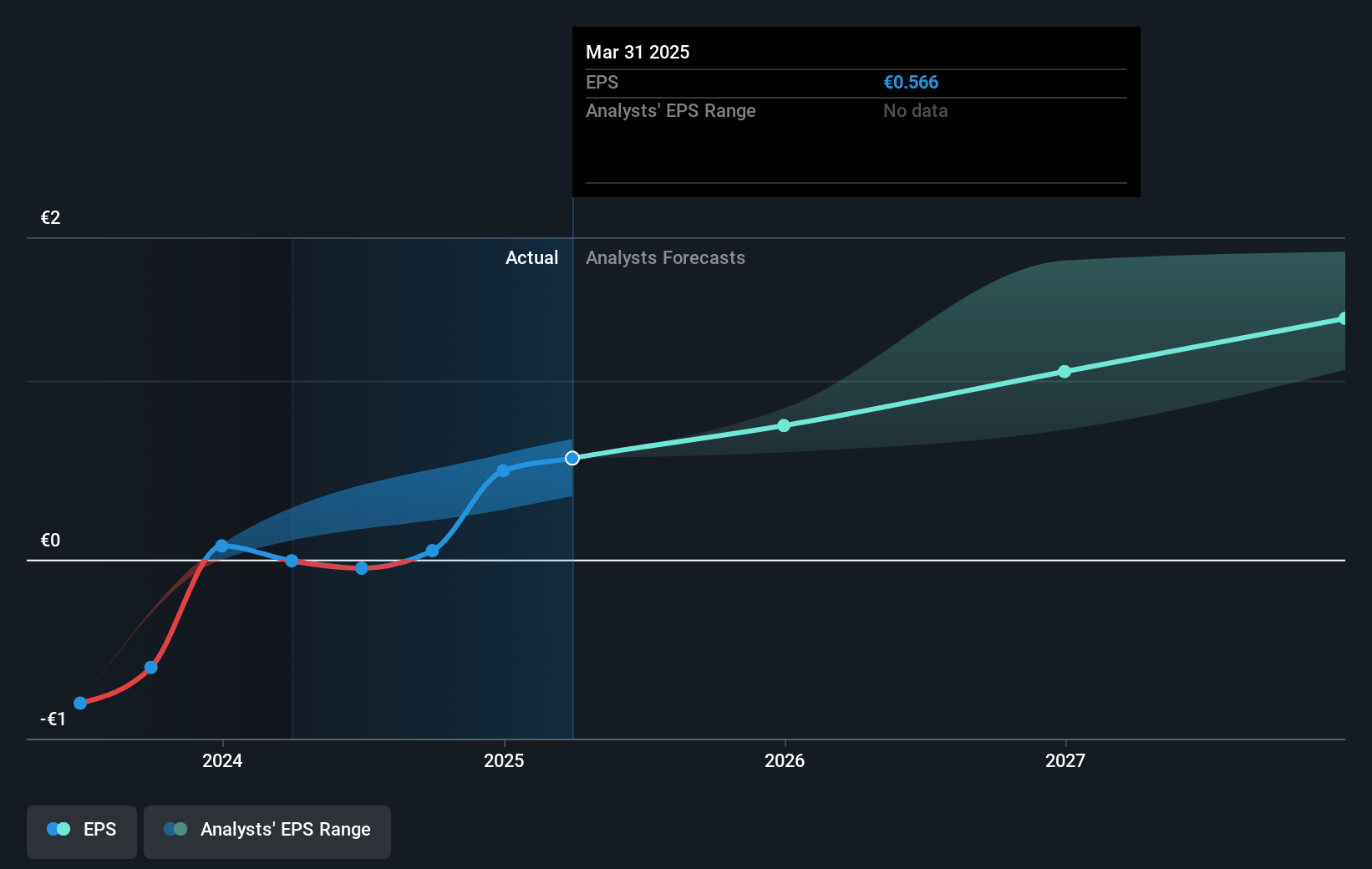

- Analysts expect earnings to reach €1.4 billion (and earnings per share of €1.41) by about January 2028, up from €49.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €1.9 billion in earnings, and the most bearish expecting €895.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 139.4x on those 2028 earnings, down from 270.8x today. This future PE is greater than the current PE for the GB Electrical industry at 22.9x.

- Analysts expect the number of shares outstanding to decline by 0.05% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.3%, as per the Simply Wall St company report.

Vestas Wind Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geopolitical and trade volatility, including potential increases in tariffs, could disrupt the supply chain and increase costs, impacting Vestas' revenue and net margins.

- Ongoing ramp-up challenges in manufacturing in the U.S. and Europe may result in higher operational costs and inefficiencies, affecting earnings.

- Persistent high service costs, particularly in the EMEA and Americas regions, threaten the profitability of the Service business, impacting its net margins.

- Slow improvement in project permitting and grid investments, despite being critical in key markets, might limit Vestas' ability to realize revenue from its order backlog.

- Completion of low-margin projects, coupled with specific offshore-related warranty provisions, continues to hamper EBIT margins despite improvements, affecting near-term profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €163.72 for Vestas Wind Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €280.08, and the most bearish reporting a price target of just €80.04.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €22.2 billion, earnings will come to €1.4 billion, and it would be trading on a PE ratio of 139.4x, assuming you use a discount rate of 6.3%.

- Given the current share price of €98.08, the analyst's price target of €163.72 is 40.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives